UAE

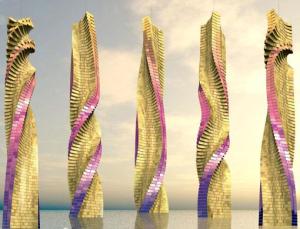

World’s First Moving Tower To Be Built In Dubai

World’s First Moving Tower To Be Built In Dubai

Wednesday, Jun 25, 2008

DUBAI (Zawya Dow Jones)–The world’s first rotating building, an 80-storey tower with revolving floors, will be built in Dubai, New York-based architect David Fisher’s Dynamic Group, the mastermind behind the development, said Wednesday.

The Dynamic Tower will be made up of 80 prefabricated apartments which will spin independently of one another to give the impression that the 420 meter building is constantly changing shape, Dynamic said in a statement.

Work on the tower is due to be completed by 2010, according to Dynamic’s Web site.

The building will have 79 giant power-generating wind turbines located between each floor so that it will be energy self-sufficient.

“The Dynamic Tower is environmentally friendly and the first building designed to be self-powered, with the ability to generate its own electricity, as well as for other nearby buildings,” Fisher said in the statement.

Apartments will range in size from 124 square meters to villas of 1,200 square meters complete with a parking space inside the apartment, the statement said.

Dubai is at the center of the Gulf region’s construction boom spurred by record high oil earnings. It is currently building Burj Dubai, the world’s tallest tower, due for completion in 2009.

The Dynamic Tower will also be the first skyscraper to be built entirely from prefabricated parts that are custom made in a workshop, known as the Fisher Method,

Fisher said just 600 people on an assembly site and 80 technicians on the construction site would be needed to build the tower – compared with around 2,000 workers for a traditional project of a comparable scale.

“Each floor of the building can be completed in only seven days. From now on, buildings will be made in a factory,” he said.

A second, 70-storey skyscraper is planned for Moscow by 2010. Mirax Group will develop the tower, headed by international developer Sergei Polonsky, Dynamic said.

“Our intention is to build the third rotating skyscraper in New York,” Fisher said.

There are also plans to build similar Dynamic Towers in Canada, Germany, Italy, Korea and Switzerland “following an expression of interest from developers, governments, and public officials,” Dynamic said.

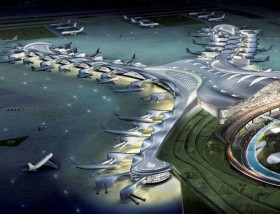

Abu Dhabi airports get new brand identity

Abu Dhabi airports get new brand identity

Staff Report GULF NEWS Published: June 16, 2008, 20:51

Dubai: As part of an ongoing branding initiative to promote Abu Dhabi to millions of airport users, Abu Dhabi Airports Company (ADAC) has launched a new identity for its international airports in Abu Dhabi and Al Ain that connects it to the brand of Abu Dhabi, a statement said.

The move is part of ADAC’s dedicated efforts to align the identity of its two airports, considered to be the major gateways to the emirate, with that of the city.

Abu Dhabi International Airport recently unveiled a new look to its Terminal One with a range of artwork promoting a “Travellers’ Welcome” message to millions of airport users, many of whom are transit passengers.

Based on the artwork developed by the Office of the Brand of Abu Dhabi (OBAD), the installations reflect the core values Abu Dhabi wishes to project to visitors, transit passengers and residents alike – the value of respect.

They also reflect the hospitality Abu Dhabi wants to portray. The move is in line with ADAC and OBAD’s efforts to help promote tourism and the city to the seven million plus users of Abu Dhabi airport.

Abu Dhabi Airports Company will replace its Abu Dhabi airports identity with a new graphic, which embodies the spirit of the Abu Dhabi brand in line with the tourism authority, which promotes the emirate around the world.

The airports have been given a distinctive sky blue colour to use in the logo.

Khalifa Mohammad Al Mazroui, chairman of ADAC, Abu Dhabi Airport owner and operator, said: “Many airports lack a distinctive look and could be anywhere. We want Abu Dhabi’s airports to be distinctive and recognisable to the millions of passengers who are visiting the UAE or transiting through the airport.

“Branding the airports in this way will help us convert the millions of people who transit through Abu Dhabi into business and tourist visitors to our city.”

Phase I, which focused on creating awareness for the new identity, was implemented by ADAC in March and consisted of a series of artwork installations and signage around Abu Dhabi airport. In the coming months, Phase II will see the signage and landscaping renewed.

According to Al Mazroui, the objective was to provide a strong and recognisable identity that will signal to all airport users that they have arrived in Abu Dhabi.

Now you don’t need water for carwash!

Now you don’t need water for carwash!

By Zoe Sinclair (Our staff reporter)GULF NEWS 11 June 2008

DUBAI — Residents can now clean their cars without using a single drop of water after a waterless car-cleaning product was launched in the country.

The UAE franchise of the product, Go Green, developed and approved in Australia, launched it here on June 1 with plans to make the service available across the city within the next two months.

Go Green managing director Ali Fadlallah said the service had attracted a lot of attention when it was displayed and demonstrated at the Facilities Management Expo at the Dubai International Exhibition Centre which concluded yesterday.

Fadlallah explained that the all-organic water-free service, provided by Able Facilities Management, cleaned, polished and waxed, preventing damage from pollution elements, salty air and tar.

Saad El Zein, Managing Director of Able Facilities Management, said the product was of environmental importance.

“Research shows that 200 litres of water is used to wash one car, water that should be saved for more important things,” said El Zein.

“Here in the UAE, cars need more care and cleaning due to the dust and extreme heat, meaning they are washed more frequently than in other countries.

“As more and more cars join the UAE’s roads, it becomes increasingly important to preserve water as it is a precious resource and our ‘Go Green’ product doesn’t use any water or chemicals that harm the environment,” El Zein continued.

Able FM hopes to attract property developers by offering a cleaning service within their garages, an option that is currently not available due to the restrictions of water-based maintenance, such as limited drainage areas.

Fadlallah said the product was not available on the shelf but the service would cost about the same price as a car wash at a service station.

“We will have it available at service stations across Dubai and there’s also been interest from cleaning stations and mall stations,” he said.

‘By the end of July there’ll be at least one facility in each suburb and we’ll be mobile too.

“We intend to go not only here but regional.”

The Dubai Municipality is in the process of approving the product while support is being sought from the Dubai Electricity and Water Authority in line with its message of water conservation.

An EPPCO official confirmed Go Green was planned for the service station at The Gardens this month and then a roll-out of the service at selected centres across Dubai and the Northern Emirates.

Able FM was nominated in the innovation category of the FM awards at the Facilities Management Expo for Go Green.

Adnoc finds elixir for its oil fields

Adnoc finds elixir for its oil fields

Tamsin Carlisle, THE NATIONAL

Last Updated: May 08. 2008 10:11PM UAE / May 8. 2008 6:11PM GMT

Abu Dhabi’s quest to become a global hub for energy technology took a step forward yesterday when Linde Group, the German technology company, announced an US$800 million (Dh2.9 billion) joint venture with Abu Dhabi National Oil Company (Adnoc) to extract nitrogen from air and pump it into ageing oil fields.

The initial project of the companies’ “Elixier” joint venture would be among the largest in the world to use nitrogen on an industrial scale to boost oil production.

It calls for the construction of a US$65 million air-separation plant at the Ruwais industrial complex on Abu Dhabi’s coast, which would produce nearly 600,000 cubic feet of nitrogen gas a day for injection into oil fields from late 2009. The plant would also supply liquefied nitrogen and oxygen to industrial customers at Ruwais.

Nitrogen, an inert gas, is the major constituent of air, comprising nearly 80 per cent of the earth’s atmosphere. It is also one of several gases that oil producers around the world are increasingly employing to coax more crude from big deposits with falling production.

Nitrogen’s big advantage for enhanced oil recovery (EOR) projects is its ready availability: air is everywhere. That means the gas can be produced close to big oil fields, avoiding high transportation costs.

The drawback is the cost of the technology used to separate air into its constituent parts, a complex engineering process that involves passing gases through “molecular sieves” as they are cooled, reheated and compressed.

But Adnoc hopes to recoup that cost by pumping more of the natural gas found in oil reservoirs. Without the injection of another gas, such as nitrogen, the natural gas would have to be left underground to maintain the pressure required to push oil into producing wells.

The commercial use of nitrogen for EOR is not new, and in the US dates back to the 1980s.

Still, the economics of such projects were often shaky. Now, soaring oil prices accompanied by rising natural gas prices on international markets are making the technology more economically viable, and much more in demand.

For Linde, the Abu Dhabi project could open the possibility of supplying other customers in the Middle East, said Stefan Metz, a company spokesman.

Indeed, Linde is already building eight air-separation plants at Ras Laffen in Qatar to supply oxygen to the Pearl project, a joint venture between Qatar Petroleum and the Anglo-Dutch energy company Royal Dutch Shell to make petroleum fuel products from natural gas.

In that project, scheduled for completion in 2010, nitrogen from the air-separation process is considered a by-product.

That is not the case with the world’s biggest air-separation plant, located in Mexico. At the end of the last millennium, output from Mexico’s Cantarell oilfield complex, site of one of the planet’s biggest crude deposits, had begun to falter.

In 2000, the country’s national oil company, Petroleos Mexicanos (Pemex), built an air-separation plant to pump out 1.2 billion cubic feet a day of high-pressure nitrogen for injection into the big offshore fields.

Oil production from Cantarell shot up 75 per cent over the next four years, peaking at 2.1 million barrels a day in 2004, when it accounted for nearly half of Pemex’s total output.

Although Cantarell crude production is again declining, billions of barrels of oil were pumped from the fields that otherwise would have stayed trapped below the seabed. Mexico, which had been slow to develop its large gas reserves as it expanded its industrial base, also reaped substantial economic benefits from producing Cantarell’s gas. The parallels between the UAE’s current circumstances and Mexico’s a few years back are striking: both countries are among the biggest oil producers in their respective hemispheres and, indeed, in the world.

The UAE today, like Mexico earlier this decade, is in the midst of an unforeseen industrial and population boom that has increased domestic gas demand faster than supply.

Other GCC countries have similar problems. Mr Metz said Linde was in negotiations to supply nitrogen to several potential new customers in the region, either from the Abu Dhabi plant or from additional air-separation plants that the firm hopes to build.

The German company’s clients already include Borouge, an Adnoc petrochemicals venture with the Austrian chemicals producer Borealis. In 2006, Linde was awarded a contract to build a large ethylene plant at Ruwais. Borouge may soon begin using oxygen supplied by Elixier.

tcarlisle@thenational.ae

UAE may buy Pakistan farms

UAE may buy Pakistan farms

Sarmad Khan and Vivian Salama

ABU DHABI // Inflation and the spectre of long-term food shortages have prompted the Government to consider a new strategic investment – the purchase of large-scale farms in Pakistan and other countries.

The aim is to protect the country from the turmoil of soaring wheat and rice prices and export bans by producing countries that could lead to food shortages.

The Government is holding exploratory talks with Pakistan on the proposal, according to a senior Pakistan government official and the Emirates Society of Consumer Protection, a division of the Economy Ministry.

The Government was looking to acquire large land holdings and import food at 20 to 25 per cent less cost, a senior Pakistani government official said.

There are six parties in the chain between the farmer and the time the product reaches retailers including the farmer, broker, exporter, importer here, wholesaler and retailer.

According to a Pakistani official each party retains a 5 per cent margin on each transaction, and by eliminating several steps the government can bring the cost of food down by 20 to 25 cent, according to a senior Pakistani government official.

“The talks have been going on between Pakistan’s government and the UAE’s Ministry of Economy for some four months, however no concrete decision is made yet,” he said. The ministry was seeking support and guarantees from Pakistani counterparts before getting into large-scale corporate farming, he added.

Rising inflation is one of the driving forces behind the Economy Ministry’s decision to consider alternative food sources that would secure supplies for the country while cutting costs.

“We believe that, if we get products directly from the farms, it will encourage market competition,” an official at the Emirates Society of Consumer Protection said, adding that the government was studying similar options in other countries.

Pakistani officials say their government will facilitate negotiations between farmers and UAE representatives but it is not involved in growing food and cannot help the UAE set up government-supported farms.

Last week Pakistan announced the introduction of tax exemptions, duty free import of equipment and 100 per cent land ownership in specialised free zones in its agriculture, livestock and dairy sectors to lure potential investors.

It is expected to announce more concessions to entice investments.

“Agricultural free zones will be set up within the next four to five months, which will open up doors for the nations to own sources of food supply,” the Pakistani official said. “It is a good opportunity, especially for GCC countries which are dependent on food imports.”

GCC countries rely heavily on imported food and the UAE imports nearly 85 per cent of its supplies for an estimated Dh11 billion (US$3bn) annually.

The GCC is the largest importer of food from Pakistan, according to Pakistani officials. A number of GCC-based companies have already turned to Pakistan for alternative resources. Qatar Livestock Company is to invest $1bn in corporate farms in Pakistan, according to Huma Fakhar, an adviser to the Bahraini government. Some Saudi Arabian groups, particularly Al Rabie Group, a dairy company, have expressed interest in buying land in Pakistan.

“There is a global crisis right now,” said Miss Fakhar. “If you do not prepare these reserves now, then three to four years down the line it will turn extremely critical.”

Several UAE-based retailers including Baniyas Co-operative Society, Carrefour, Union Co-operative Society and Lulu hypermarkets have agreed to help the government to curtail inflation by putting price caps on basic commodities.

Last week the Economy Ministry urged retailers to start stockpiling basic food items to prevent shortages resulting from export bans by countries like India, Egypt and Brazil.

The UAE government has also urged retailers to consider eliminating middlemen when importing commodities to cut costs. While executives like José Luis Durán, the chief executive of Carrefour, encourages supermarkets to work directly with farms, others are concerned that this carries a hidden catch.

“If you want to make money as a farmer, go to a place where the farmers are making money, not a place where the land is cheap,” said Jannie Holtzhausen, chief executive of Spinneys in Dubai. “What has now suddenly changed in the world that the economic model drives governments to become farmers?”

Concerned about what the initiative means to their businesses, local importers are speaking out against it.

“Eliminating traders from this process would be a mistake,” said Burhan Turkmani, the general manager of Dubai-based Al Rabiah Trading Company.

“Farmers are not exporters and governments are not importers,” added Riaz Hussein Bhojani, the general manager of Rashwell Company, another trading company.

Taweelah to host chemical city

Taweelah to host chemical city

Chris Stanton The National

ABU DHABI // The capital’s Kalifa Industrial Zone, which already includes plans for a deep-water port and the world’s largest aluminium smelter, will also play host to the biggest integrated plastics and chemicals complex on the planet, officials said yesterday.

The multi-billion dirham Chemicals Industrial City, which will produce basic plastics and chemicals, is part of the emirate’s drive to build a viable petrochemicals industry and diversify its economy away from simple crude oil exports.

“The location of this large-scale petrochemical complex is a major milestone for the development of the industrial cluster at the Khalifa Industrial Zone,” Ahmed al Calily, the chief executive and managing director of the Abu Dhabi Ports Company said in a statement.

The backers of the new complex, the International Petroleum Investment Company (Ipic), a Government investment fund, and Borealis, a chemical company based in Austria that is majority-owned by Ipic, chose the Khalifa port over Abu Dhabi’s existing petrochemical centre in Ruwais, in the Western Region, to take advantage of easy access to global markets.

The first stage of the complex, to be called Chemaweyaat Complex 1, is scheduled to be completed by 2013.

“It provides us not only with the physical space for major development, but also helps us to export our future production efficiently,” said Mohamed al Azdi, the chairman of the Chemaweyaat development committee.

Chemical Industrial City will produce seven million tonnes of chemicals by 2013, which Ipic has said would make it the largest plant of its kind in the world. At the moment, the biggest chemical complex is BASF’s Lunwigshafen site in southwestern Germany.

Before yesterday’s announcement, the site for Chemicals Industrial City was undisclosed but recent media reports suggested that Borealis, Ipic, and the Abu Dhabi Investment Council, a third backer of the complex, were leaning toward the Taweelah site over Ruwais, where the Abu Dhabi National Oil Company’s oil terminal, major refinery and plastics plants are all located.

The site in Taweelah will be near Abu Dhabi’s main power stations, the new Khalifa deepwater port and the world’s largest aluminium smelter, which is being built by Emirates Aluminium.

The statement suggested that Abu Dhabi’s planners see the complex as a catalyst for the development of other chemical plants that will use Chemicals Industrial City’s products as feedstock for their own operations.

“We also look forward to attracting further downstream industries to Taweelah through the broad range of chemical and petrochemical products to be produced there,” Mr Azdi said.

Officials said the chemical plant would attract spin-off industries to Taweelah.

“Chemaweyaat, as an anchor tenant will attract additional investments from all parts of the supply chain and will create a viable chemical and petrochemical cluster,” Mr Calily said.

The Chemicals City complex will include facilities for producing plastics from propylene and ethylene, a reformer to make gasoline, and sophisticated machinery to make xylene, benzene, cumene, phenol and their derivatives. All are basic ingredients used in the modern chemical industry.

The complex will also have a large naphtha cracker, which will provide the plant with feedstock derived from a component of crude oil.

The naphtha cracker is crucial because it means the plant will differ substantially from existing plastic plants in Ruwais since it will be fed by crude oil instead of natural gas. The country is facing a shortage of gas due to booming demand for electricity but has ample supplies of naphtha.

The plants in Ruwais are owned by Borouge, which was launched seven years ago as a joint venture between Adnoc and Borealis. Borouge and Borealis both produce plastics but avoid competing against each other by dividing the world into two distinct markets. Borealis sells to Europe while Borouge concentrates on the Middle East and Asia.

Abu Dhabi to set up world’s largest chemicals complex

Abu Dhabi to set up world’s largest chemicals complex

By Haseeb Haider KHALEEJ TIMES 5 May 2008

ABU DHABI – Abu Dhabi, which is setting up Chemicals Industrial City in Taweelah’s Khalifa Industrial Zone, has finalised its plan to establish the world’s largest chemicals complex.

The multi-billion dollar project, due to complete in 2013, will manufacture olefins, aromatics, oxide and ammonia derivatives.

The Chemaweyaat Complex-1 will be the first project to be completed at the Chemicals Industrial City. It is expected to be the world’s largest grassroots fully chemical integrated complex with a total production of around seven million tonnes per annum of olefins, aromatics, oxide and ammonia derivatives.

Abu Dhabi Ports Company (ADPC), which owns Khalifa Industrial Zone, has signed an MoU with Chemaweyaat, an initiative launched by ADIC and the International Petroleum Company (IPIC) to develop the mega project in Chemicals Industrial City.

“The location of this large scale petrochemical complex is a major milestone for the development of the industrial cluster at the Khalifa Industrial Zone,” said Ahmed Al Calily, CEO and MD of ADPC.

“Chemaweyaat, as an anchor tenant, will attract additional investments from all parts of the supply chain and will create a viable chemical and petrochemical cluster. This will deliver valuable collective benefits to the port and the industrial zone,” he added.

Mohamed Al Azdi, Chairman of the Chemaweyaat Development Committee, said the new Chemicals Industrial City will not only provide the physical space for major development, but also help export future production efficiently.

He said that Chemaweyaat will look forward to attracting further downstream industries to Taweelah through the broad range of chemical and petrochemical products to be produced there.

KPIZ is a multi-purpose facility strategically located in Taweelah between Abu Dhabi and Dubai. It includes the construction of a world-scale container and industrial port, and the development of over 100 square kilometres of industrial, logistics, commercial, educational and residential special economic and free zones.

UAE to sign $10bn gas deal

UAE to sign $10bn gas deal

Tamsin Carlisle, THE NATIONAL

Last Updated: April 30. 2008 3:51AM UAE / April 29. 2008 11:51PM GMT

Conoco was among the four bidders on the Shah project. Tim Johnson / Bloomberg News

ConocoPhillips rumored to be partner

A long delayed contract to develop big new natural gas reserves will be signed within a week, according to a senior official from the Abu Dhabi National Oil Company (Adnoc).

The US$10bn (Dh37bn) Shah gas project, which is key to providing new fuel needed for power plants to meet soaring domestic electricity demand, has been in limbo for eight months.

“There are no delays, no problems,” said Omair Suwaina, a senior Adnoc official, who was speaking yesterday while attending an industry conference in Abu Dhabi. “We expect to sign within a week,” he told the Reuters news agency.

Mr Suwaina declined to confirm the identity of the contract winner, widely expected to be ConocoPhillips, the US energy company.

Once under way, the project will produce up to one billion cubic feet a day of gas at the Shah field near Abu Dhabi’s southern border with Saudi Arabia. This will be the first of a series of similar projects that the Government wants to undertake.

The Shah project is scheduled to start in 2012. It was first tendered in April 2007 as part of a larger project, but no winning bidder was selected. Adnoc invited four foreign companies including ConocoPhillips to bid again on the Shah development in July of that year. It has since been evaluating the bids.

Deborah Algosaibi, a ConocoPhillips external affairs co-ordinator said Adnoc’s long delay in formally announcing the development could be related to smoothing out contract details. “Perhaps they are dotting an ‘i’,” she said.

Craig McMahon, an analyst with Wood Mackenzie, a British research and consulting company, suggested the delay could be related to the size and complexity of the project, which could involve the parties crafting a detailed commercial agreement. “The devil is always in the details,” he said.

The Shah project is the largest Abu Dhabi upstream development in the past year open to bids by international companies. The gas involved is known as “sour gas” because it contains high levels of acidic and toxic hydrogen sulphide, which makes the project costly and dangerous. Cost projections by analysts have doubled within a year in line with global inflation in the industry. Last April, when Adnoc was proposing the simultaneous development of Shah and Bab, another sour gas field, they pegged the cost for both developments at US$10bn.

Mr Suwaina, who declined to disclose Adnoc’s cost projection for Shah, told the conference that rising costs for energy development worldwide had pushed up the investment required for sour gas projects. He said the UAE would go ahead with plans to develop several sour gas fields to supply its power needs.

“There will be more developments. It is necessary and we have to do it,” he said.

However, sensitivities surround the proposed Bab field and are more pronounced than that of Shah because the toxic gas deposit is close to residential settlements. Bab, and the offshore Hail sour gas field, are next in line for development.

While costs for Abu Dhabi’s technically challenging sour gas projects could be four or five times higher than the emirate has traditionally paid for gas, the rising price of sulphur could sweeten the deal. Hydrogen sulphide stripped out of the gas stream can either be pumped back into the ground for storage or, with favourable economics, processed to yield sulphur. This month, the price of sulphur exported from Abu Dhabi surpassed US$600 a tonne, a stunning increase from about US$20 a tonne just a few years ago. Mr Suwaina said estimates for sulphur contracts were based on spot prices of $700 to $800 a tonne.

The UAE holds the world’s fifth-largest gas reserves at nearly 214 trillion cubic feet., much of it “ultra-sour” with a hydrogen sulphide content of 30 per cent or higher. Although deposits with a similar composition have been developed in other countries, safety concerns, technical challenges and rising costs have held back exploitation here.

tcarlisle@thenational.ae

Hydrocarbon sector’s share in Abu Dhabi GDP diminishing

Hydrocarbon sector’s share in Abu Dhabi GDP diminishing

By Haseeb Haider KHALEEJ TIMES 27 April 2008

ABU DHABI — With the diversification of Abu Dhabi’s economy, the dominant role of oil and gas sector is being diminished as in 2007 it contributed 65 per cent to the GDP from 66.3 per cent in 2006 and 66 per cent in 2005.

According to an Abu Dhabi Planning and Economy Department weekly status report on the emirate’s economy, share of the government sector to the GDP was estimated at 18.5, 16.7 and 16.1 per cent in 2005, 2006 and 2007 respectively.

Restructuring: The government is currently undertaking a wide-ranging restructuring programme to arrive at the best formula of governance which envisages sustainable constructive public-private partnership.

The restructuring programme has produced new public entities like the Abu Dhabi Tourism Authority and Abu Dhabi Council for Economic Development that have specific and clear-cut targets and in which the private sector has a major role to play.

Other entities like Abu Dhabi Education Council and Abu Dhabi Health Authority were also created to upgrade health and educational services.

Private sector: The private sector’s contribution to GDP rose from 15.5 per cent in 2005 to 17 per cent in 2006 and 18.2 per cent in 2007.

The situation needs restructuring of the sector and creating a favourable working environment and removing obstacles hindering its progress and the development of its potential.

The public and private sectors should come together to adopt private-sector oriented economic policies given the strategic operational options under the economic openness adopted by the government.

Other goals include optimum utilisation of competitive edges of the private sector and forging strategic alliances based on mutual interests.

The future of economic development in Abu Dhabi hangs to a large extent on the nature of partnership between the public and private sectors.

Broadening the scope of this partnership and boosting its ability to act as the key driver in the emirate’s economy is the only option to address and tackle the economic challenge ahead, the report said.

However, the private sector is still suffering from drastic deficiencies and defects which invite formulation of proactive, effective restructuring policies from its foundation and motivate it to develop its own capabilities so as to compete in regional and international markets.

Policies seeking to enhance the efficiency of the private sector should based on the following factors :

* Giving the private sector a greater role in carrying out development projects and achieve socio-economic development which is based on diversification of income and economic base.

* Outsourcing more public utilities

* Stimulating research and development of competitive national products

Motivating economic cooperation to merge and create major private sector firms that focus on high value added capital-oriented sectors.

* Providing favourable business and regulatory environment conducive to increasing of productivity.

* Building more modern infrastructure and introducing incentive regimes.

* Offering financial and moral support and incentives to spur national plans to recruit Emiratis and transfer technology to the emirate.

* Facilitating adoption of modern efficient administrative systems at bar with those adopted in advanced economic nations.

* Streamlining issuance of commercial, industrial and professional licences as per economic feasibility studies and actual needs,

* Drawing industrial investment plan to encourage the private sector to play its role in industrial development.

UAE and US sign agreement on peaceful uses of nuclear energy

UAE and US sign agreement on peaceful uses of nuclear energy

By Samir Salama, Associate Editor, and Abbas Al Lawati, Staff Reporter

Published: April 21, 2008, 12:33

Manama/Abu Dhabi: The United States became the second country with which the UAE signed an agreement on peaceful nuclear energy cooperation yesterday, as the top US diplomat praised the UAE as a “responsible power”.

Foreign Minister Shaikh Abdullah Bin Zayed Al Nahyan and Condoleezza Rice, US Secretary of State, met on the sidelines of the GCC summit in Manama, where a memorandum of understanding on cooperation in the peaceful use of nuclear energy was signed. A similar agreement was signed with France in January.

“The UAE-US MoU represents an excellent example of cooperation the UAE hopes to forge with responsible nuclear supplier states. There are potential mutual benefits to both parties from deepening cooperation in the development of the UAE’s domestic nuclear energy sector,” said Shaikh Abdullah.

The Foreign Minister welcomed the prospect of negotiating a more extensive bilateral agreement with the US, which would establish the necessary legal basis for trade in significant nuclear commodities between the two countries.

“We are very supportive of what you are trying to do. As you know we think access to nuclear energy is very important. The UAE is a responsible partner and a responsible power,” Rice said at the signing ceremony.

Hamad Al Ka’abi, the Special Representative of the Ministry of Foreign Affairs for International Nuclear Cooperation, told Gulf News the agreement entails cooperation in developing nuclear infrastructure, training human resources and safeguarding of nuclear materials and facilities.

Al Ka’abi said the MoU does not provide for commercial contracts for American companies to build or operate nuclear plants.

Global initiative

He said the UAE will seek nuclear know-how from all responsible suppliers worldwide.

The government has also said it plans to establish a $100 million agency to look into developing nuclear energy to satisfy rising electricity demand.

GCC countries, the US, Egypt and Jordan said that they supported “the responsible and transparent development of civilian nuclear energy” in a statement.

Shaikh Abdullah also presented to his US counterpart a diplomatic note endorsing the Global Initiative to Combat Nuclear Terrorism.

– With additional inputs from Habib Toumi, Bahrain Bureau Chief, WAM and agencies

You must be logged in to post a comment.