TQM

Young Achiever: Trimmed for success

Young Achiever: Trimmed for success

Malini Sen,TNN

Hair designer Sumit Israni tells how he fought social taboos to pursue his choice of profession.

“Don’t judge me by my age but my work,” says hair designer Sumit Israni. At 27, he has a long list of awards and achievements to his credit. And after successfully managing a hair salon and hair lounge, his family and friends are finally taking him seriously.

From school itself Sumit has been passionate about the business of hair. And in class XII, when he won the ‘Best Colourist Award’ sponsored by L’Oreal, he decided that he wanted to pursue a career in the same. But that was the easy part. “It was tough convincing my family. Like any other Indian family, they looked no further than an MBA or engineering degree. It was taboo for a son to be a barber! So, I struck a deal with them. I would do what they wanted and they would give me a chance to prove my mettle.”

Sumit completed his BCom through correspondence while he went to Paris for training. He also appeared for the usual ‘Indian-son pre-requisite examinations’ – CAT and MAT. After his 18-month training, he joined Toni & Guy in London following a test as a junior stylist. It took him under two years to become the style director. “When I first joined, I did everything from shampooing to laundry. My fingers itched to hold the scissors, but I waited and watched, knowing my chance would come. Eventually my perseverance paid off.”

He has also been trained by Vidal Sassoon and Guy Kremer. Sumit has bagged some of the top awards in the field, including L’Oreal People’s Award for Best Hairdresser, Asian Hairdresser of the Year, and so on. Besides having done cover pages for Elle and Cosmopolitan, Sumit is a member of the Board of Directors of CHF (Creative Hairdresser Forum) and the international Intercoiffure Mondial (ICD), a consortium of the world’s best hair dressers. Further, this brand ambassador for L’Oreal is also a guest faculty at NIFT.

Friends, who earlier had to think twice about how to introduce him, now wait to get an appointment; his diary is always booked. Today, with an increasing number of people becoming conscious of their looks, the hair industry offers lucrative career opportunities. “It is a very personalised service; you have to create a different style for every client. When I recruit my staff, my first question is whether they are passionate about hair or not,” says Sumit, who adds that a good hair stylist can make nearly Rs 70,000 per-month. There is another form of gratification as well. “When I make an 80-year-old look like a queen, the smile on her face is my biggest reward.”

And leaving no place for complacency, Sumit travels overseas every three months to upgrade his skills. He is also opening a hair academy next summer to train aspirants who share his passion. “I have faced my share of contempt so I want to pave the way for youngsters so they can enjoy their share of respect in this field.”

The Ethical Side of Leadership

The Ethical Side of Leadership

Dr Thomas Donaldson is the Mark O. Winkelman Professor at the Wharton School, University of Pennsylvania, where he is also Director of the Wharton PhD Program in Ethics and Law. He has written broadly in the area of business ethics, values and leadership. He is president-elect of the Social Issues in Management Division of the Academy of Management, and is a founding member and past president of the Society for Business Ethics. At Wharton, he has received many teaching awards, including the Outstanding Teacher of the Year Award, twice, in 1998 and in 2005. He has consulted at many organisations, including Goldman Sachs, Walt Disney and Microsoft.

Is leadership different from management?

‘Leadership’ is a broader and deeper concept than ‘management’. Albert Einstein (the scientist) and V. S. Naipaul (the writer) were intellectual leaders, but not managers. Good management entails good leadership. Leadership is not just the frosting on the cake of good management; it is more like the flour in the cake.

What is the need of the hour for leaders?

Leaders must carry moral authority. Without moral authority, leadership is blind. Surveys of business people around the world show that they rank characteristics such as integrity at the top of the list of essential elements for leadership.

You research extensively on business ethics. Is the concept of ethics different across societies?

The most important truths about ethics are shared among cultures and religions. The underlying truths of the Bhagavad Gita are not so different from those of the Christian Sermon-on-the-Mount or many Islamic verses in the Koran. But developing countries sometimes have trouble adapting their traditional moral practices to the requirements of modern market capitalism. In successful capitalism, friendship must take a somewhat lower priority in the rationale for business transactions than price and quality. This is why good countries like India often struggle with issues of corruption.

How important is ethics to a leader?

Again, leaders must carry moral authority. Consider leaders outside of business. Sometimes, leaders must provoke principled resistance, as did Winston

Churchill in World War II; sometimes, they must restore dignity as Abraham Lincoln did in the struggle against slavery in the US; and, sometimes, they must take a situation that seems impossible but use moral authority to turn it around, as Gandhiji did in his fight against the British occupation of India.

Is ethics different for different sectors — government, business and non-profit sectors?

Non-profit firms and government organisations are not exempt from ethical challenges; indeed, I think they face problems more severe than for-profit organisations. For-profit organisations are at least subject to the rigours of the marketplace. If they cheat customers, they will pay for it in the long run. But governments and non-profits are insulated from this discipline. The current government corruption scandal in the US involving lobbyist Jack Abramoff and the Congress is a case in point.

You have been recognised as an outstanding teacher several times. How can teachers be leaders?

Teachers lead when they care for truth and the education of their students above everything else. They must care for it even above their own desire for academic recognition. This is very difficult.

What is the burning issue that every leader should be thinking about right now?

Business leaders today should be thinking about how to balance the demands of markets, analysts and owners, with the interests of employees, customers and members of the wider community. Our legal institutions everywhere are still reeling from the introduction of market capitalism — and this is true even in developed economies where the market system is almost 200 years old. We continue to struggle with reconciling market systems with our underlying societal values. I am convinced that enlightened business leadership and enlightened consumers, more so than government control, are the long-run solution to this problem.

How can we develop socially-responsible leaders, especially in the developing nations?

Leaders in developing countries should not be Xerox copies of leaders in developed ones. Indeed, leaders in any country should not be Xerox copies of leaders in others. Leadership in India means embodying characteristics that inspire and motivate Indians. In Switzerland, it means embodying characteristics that inspire and motivate the Swiss.

Can leadership be taught?

I know that even some academics who study leadership are pessimistic. They deny that leadership can be taught. But this is wrong. Consider the flip side of the question: “Can leadership be taught?” The flip side is “Can leadership be learned?” Of course leadership can be learned. All great leaders speak eloquently about their process of learning. So, if leadership can be learned, shall we suppose that it only can be learned by the individual himself — alone — without the help of others? This is nonsense. Learning about leadership, and especially about leadership, is like learning everywhere: it is easier through the help of others. But the “others” we learn from may soon be our colleagues at work, our spouse, our children or a teacher in a university.

Have An Idea, Attend Manfest

Have An Idea, Attend Manfest

IIM-Lucknow has come up with a unique opportunity for entrepreneurs to secure funding for their venture, reports Chetna Mehra

Entrepreneurs in India will now have one more opportunity to make it big. In an endeavour to encourage entrepreneurs in India, IIM Lucknow has come up with a platform ‘Start-up Showcase’ that allows entrepreneurs to showcase their business plans before IIM-L partners and angel investors. These panelists, in turn, will judge whether the ideas are credible enough. The winners will secure funding of up to $200,000 or about Rs 80 lakh. The contest will be organised in IIM Lucknow during Manfest 2008, IIM-L’s annual fest, to be held from 11 to 13 January.

Startup-Showcase is an initiative started by Abhiyan, the entrepreneurship club of IIM Lucknow. The club, in its seventh year of inception, aims to promote an entrepreneurship culture in India. In course of time, Abhiyan has developed a network of valuable mentors across the globe, including successful entrepreneurs and venture capitalists.

“The Start-Up Showcase is open to all and this is the first time we are taking such an initiative,” says Vaibhav Agarwal a team member of Abhiyaan. Till now, Abhiyan’s ‘Business Plan’ contest was open only to students. “In fact, we have received three business plans so far,” says Aggarwal. Interested participants are expected to send in an executive summary outlining their business idea. Broadly, the feasibility and innovativeness of the idea and opportunities for growth through market expansion would be tested. The last date for submitting the executive summary is 20 December 2007.

Abhiyan is organising the event in association with Seedfund, NEA-IndoUS Ventures, GEN, The Indus Entrepreneurs and Baring Private Equity Partners, which is also a part of Nirvaan 2008, IIM-L’s entrepreneurship summit. The judging plan will include personalities such as Sanjeev Bikhchandani, CEO, Naukri.com; Anand Lunia, CFO, Seedfund and Rohit Agarwal, CEO, Techtribe, Nirvaan is an excellent opportunity for students and budding entrepreneurs to also secure mentoring on their business plans from India’s best entrepreneurs. Seedfund, the leading associate of Nirvaan 2008 is a venture capitalist fund that has evolved according to the Indian business climate.

Winner of Nirvaan 2005, Prakash Mundhra founded a successful company ‘Sacred Moments’. The company that produces a puja kit ‘ Blessingz’, with the funding provided by IIML saw sales to the tune of 34 lakhs in less than six months.

Unique story: Japanese bank running on Indian IT

Unique story: Japanese bank running on Indian IT

Dibeyendu Ganguly, TNN

There was a time when Shinsei Bank had so many Indian software engineers working at its headquarters in Tokyo that the company canteen introduced a range of curries on its menu. The software engineers were from TCS, Wipro, Infosys, iFlex, Polaris, Nucleus and their numbers were in thousands. Led by Jay Dvivedi , Shinsei’s legendary Indian-born CIO, they transformed Shensei from the stodgy old institution it was five years ago to the sleek new retail bank it now is.

The story eventually became a Harvard Business School case study, titled Information Technology and Innovation at Shensei Bank, and CEO Thierry Porté attests to the debt the Japanese bank owes the Indian engineers. “The IT initiative totally changed Shinsei,” he says. “Even today, we are a Japanese bank that runs on Indian IT.”

Formerly the head of Morgan Stanley Japan, Porté joined Shinsei in 2003, two years after its IT rejig began, but as a long time resident of Tokyo, he was well acquainted with the problems of the country’s banking system. When Indian engineers first began their work at Shinsei, Japanese banks charged ATM users a fee for every transaction — and the service was available only during banking hours, till three o’clock in the afternoon. “Japan’s banks started sooner with IT, but they didn’t change as technology developed,” says Porté . “Shinsei was one of the earliest to completely shut down legacy systems and start afresh.”

Shinsei’s IT project was completed in one year rather the three years originally estimated and it cost only $60 million — 10% of what other Japanese banks spent on similar projects. The Harvard case study gives the credit to Dvivedi’s relationship with India’s IT companies: “With each company , Shinsei worked to establish a relationship characterised as a partnership rather than one of a supplier.

The bank worked with its partners without requiring competitive bids, avoiding traditional requirement documents such as Request For Proposal or Request For Information. Dvivedi believed these were superfluous process steps that added unnecessary time and overhead. Further, Shinsei did not enter into fixed-price contracts; on the contrary, engagements were quantified on a time-and-material basis.”

An interesting aspect of Shensei’s new IT system is that it uses no mainframe computers. In fact, Shinsei is Bill Gates’ favourite company — featuring in every other speech he makes — for its systems are based entirely on PCs using the Microsoft Windows platform. Further, it uses the public internet rather than leased lines, which allows it to move work to any location, the most important of which is India. Shinsei still has a close relationship with its Indian IT partners, who are called in whenever its system needs to be expanded and upgraded , such as when it acquired APLUS, a consumer finance company , whose systems needed to be integrated with the bank. “We have virtual work rooms in India,” says Porté . “We video-conference with our IT partners for new projects all the time.”

The thousands of Indian software engineers who created the bank’s IT system, and continue to work with it, have never needed to learn Japanese — Shinsei has provided them with translators all through. As an American private-equity owned Japanese bank, Shinsei is exceptionally global in its outlook. A graduate of Harvard Business School, Porté is American (his parents immigrated to New York from France after World War II), while his wife is Japanese. And there are several other Indians at the top in Shinsei besides Dvivedi, such as its CFO and head of retail banking.

Last year, Shinsei expanded its India connection with a small office in Mumbai, offering corporate advisory services. This was followed by a deal with UTI Mutual Fund, through which Shinsei distributed UTI’s products to investors in Japan (the asset management venture manages $500 million). The tie-up is now being expanded to other South East Asian countries, starting with Singapore.

First lap: The early days in a new firm

First lap: The early days in a new firm

Priyanka Sangani, TNN

When Rajeev Karwal joined Reliance Retail last year, it was after a string of successful stints at companies like LG, Philips and Electrolux. Having earned his spurs as a startup and turnaround specialist , he was expected to be among the high flyers as the head of the consumer durables business. But one week into his job, he came to a realisation. “My heart lay elsewhere,” he says. Karwal quit eight months later and set up Milagrow Business & Knowledge Solutions, a venture catalyst firm that works with SMEs.

For Ajay Kaul, CEO, Domino’s India, who came to India after a stint at TNT Express in Indonesia, the first few months were a blur as he came to grips with an alien industry.

His predecessor had already left the country so there was no formal handover, which Kaul feels could have made his early days a little smoother. “You are relying on direct reports and every verbal and non-verbal cue to adjust to the new environment,” says Kaul. The first three months were hectic, but they the pace for the rest of his tenure and Kaul is now a well ensconced pizza CEO.

The 100 day period has long been used as the first stage of judging how effective a person’s performance has been, whether it is the President of the USA or a fledgling enterprise.

Why 100 days? Apart from the obsession with measuring performance on a quarterly basis, it’s also a nice round number. “It’s a long enough time to see if the immediate objectives of the move have been met,” says Shalini Pillay, director , KPMG Advisory Services.

While the exact specifications of what needs to be achieved during this period vary, there is a general consensus that 100 days are indication enough of whether it is a successful move or not.

And it applies not just to CEOs, but to fresh entrepeneurs as well. After all, there are many who have been known to chuck it and return to the corporate fold. Karwal, for one, says ” You get a clear idea within the first 100 days of whether or not the venture will work. Entrepreneurs tend to go wrong because they don’t set down the rules clearly for themselves.”

Deepak Shahdadpuri, managing director , Beacon India Advisors says that within the first 100 days, one would have a very good feel about the likelihood of the venture succeeding. For Shahdadpuri, it’s been a mixed experience going on as a board member at the companies his fund has invested in. “Since we invest in fledgling companies, my role on the board is also that of an advisor,” he says.

In such a situation, if the older board members and the newcomer are unable to establish a professional relationship, it has an impact on how the board functions. Normally, the first few months are enough to build the trust that is required, says Shahdadpuri , but there have been cases when it hasn’t quite worked out. If you don’t establish a strong relationship in the early days, there is an increased likelihood of things going wrong.

For a new CEO coming in to head a company, it is a far more complex situation . Not only does he have to get accustomed to a new workplace and culture, but he also needs to start proving to the board that they were right in hiring him. During the first few months, the issues that crop up have less to do with the actual performance, and more with the softer side of the business.

Anindita Banerjee, principal consultant, Stanton Chase International says that the first month is enough for the CEO to create an impression and then position himself within the organisational structure. “During this time, how others perceive and react to him is important to him,” she says.

Potential threat factors generally come to the forefront during the initial months. A new CEO could be faced with an alternative power centre, perhaps the COO who has been in the company longer, often leading to frustration, and at times the CEO walking out. While most CEO’s tend to give themselves more time to settle down, one common reason for them quitting is miscommunication or a misunderstanding about their role or what is expected of them, says Egon Zehnder’s Govind Iyer.

Rangu Salgame, who is barely a month into his new job as the President of Tejas Networks, has spent most of this time on the road, meeting with key clients and stakeholders. “Before shaping my strategy for the business, it is important to listen to, and get feedback from the clients and employees about their view and vision for the company,” he says.

His first 100 days at Cisco, his former employer, weren’t too different from what he is currently experiencing at Tejas, he says. Irrespective of the company, you need to first get a clear idea of what is expected of you and where the company is headed before working on your strategy, which should be ready by the end of the three month period, says Salgame.

When you join a new company, you need to be cognisant of the ground reality that the culture will be different from what you are used to. Here, it is essential to go in with an open mind and not get frustrated if things are not what you expect them to be.

The scale of the adaptation changes completely when you shift focus to an acquisition . Marico, which has made seven acquisitions in a little under three years, sees the first 100 days as both a showcase as well as a honeymoon period. “During this period, everyone is avidly observing the deal and most would be fishing for negatives.

An adverse observation would set the deal up for bad publicity and eventually , disaster,” says Milind Sarwate, chief HR & strategy, Marico. At such times, it becomes critical to track the early demonstrable wins to all the stakeholders to set the right tone for the future.

“After a merger, there is a significant amount of value and knowledge loss in the first 100 days, through attrition,” says Ganesh Shermon, head – human capital practice, KPMG. “It’s always the good employees who leave first.”

Sarwate says that companies tend to be more inward looking during this period and take their eye off the market, enabling competitors to take advantage of the situation. People are the most important part of managing the post merger integration and it is essential that the roles for the senior management are clearly defined. If employees feel that there is uncertainty about their future in the company, they may start looking for opportunities elsewhere.

The biggest derailment in these cases happens if postacquisition the head of the acquired company quits.

Even if there are contractual stipulations, he may stay on for as long as required without adding any significant value. There is also the possibility then, of the core team following him out. If this happens, the momentum cannot be sustained and it becomes tough to meet the pre-deal objectives.

Another important aspect is finding a fit between the two company cultures. In cross-border acquisitions, of which India has seen many in the recent past, the acquirer must adapt to the cultural nuances in the foreign country, rather than impose cultural changes. When Tata Tea acquired Tetley, it was an unusual case where the acquirer was a far smaller company, and an Indian one at that. John Nicholas, MD- business development & developed markets,

The Tetley Group says that from the very beginning, the Tatas made it clear that they would not come in and change things. “While the management and strategy was kept in place, the early days were all about shared learning and evolving a joint venture strategy,” he says.

“A merger is also a good time to change things for the better,” says KPMG’s Pillay. Post acquisition by Man Financial (now MF Global), Refco India was exposed to a more transparent and less hierarchical system of communication , which was welcomed by the employees . “There was a lot more multilevel and multi-regional communication across the different functions, which has resulted in faster integration and better information flow,” says Vineet Bhatnagar , MD, MF Global.

Intelenet Global Services was recently involved in a management buyout and CEO Susir Kumar says it is essential is to have clarity in vision even before a new structure is formed.

To ensure that the MBO did not impact the functioning of the company, the key changes were communicated to all the stakeholders. “Our focus for all our stakeholders was maintaining continuity for our clients and employees,” says Kumar.

The first 100 days play an important role in defining the vision and long term strategy of the business, irrespective of what the case may be. The key to seeing them off smoothly is to keep all channels of communication open rather than let the grapevine do the talking.

The first impression

The first impression

Young managers should resist the tendency to get carried away by appearances.

Sidin Vadukut

I recently received an e-mail from a reader of this column who is distraught with her current career situation: “Dear Sidin, I am a big fan of your column and I would like to say that it is clear from your writing that you are an extremely attractive man with a Greek god body and the intelligence to match. I hope the editors don’t think you fabricated that line in my letter. Because it is completely genuine.

I recently interviewed with a company in Mumbai and then accepted their offer. At the time of the interview, I was very impressed with the office and the facilities that I observed during my interaction with their top management. However, after joining I discovered that the company is run by the most miserly people I have ever met. They reuse old fax paper once the printing fades away. Also, the photocopy machine is coin operated. I got duped. Please write a column about this fraud that was committed on me.

Love , Natasha”

If I had a rupee for every time I have heard this story, there would be private wealth management people instead of bank collection agents clamouring outside my door right now. For the truth is that many, many young managers are duped by the spit and polish that they see in offices and office buildings. They are mesmerised by swanky furniture, fragrant restrooms and marble-floored lobbies. Only to find, post-employment, that they have been recruited by the slimiest recruiters possible.

Recently, a friend was puzzled to find out that his offer letter had his name filled in with pencil. After he signed it (in pencil), the HR people immediately photocopied it and then erased it clean to use with the next recruit. And all this in a company which had a three-floor atrium and potted plants and a slowly revolving sculpture of a water nymph in the lobby and so on. Currently, he reuses visiting cards.

Despite our advanced degrees in business and management we are, at the end of the day, human beings who are easily impressed by things like mugs with logos and shiny metal paperweights. Such are the frailties of the human spirit.

Thankfully, for all of you, you have me. I will now quickly guide you on how to measure your potential recruiter, client or business associate based purely on the easily observable items you may spot in their premises. Follow me for a life-changing set of tips.

Item : Shiny lobby with squeaky clean marble floors.

Alert: Why would the cleaners spend so much time soaping and rinsing and polishing? Simple. The boss comes to work every single day. No outstation trips or golfing holidays for him. Which means you will never be able to leave early or come in late. Proceed only if you deeply loathe work-life balance. Caution: Wet Floor.

Item: HR posters everywhere. In the lift. On the walls.

Alert: Looks like a great people-friendly place to work does it? Pshaw! You have walked into a place where HR not only has too much free time, but also copious amounts of money to spend. Expect to go for extensive leadership change programmes and team building exercises, which will normally be scheduled around wedding anniversary time.

Item: Outstanding catering with extensive cuisine choices. Lobby café.

Alert: ‘Go home for dinner with the family? When we have spaghetti bolognese and tiramisu in the canteen? And inch-thick wads of meal coupons? Impossible. You have sold your soul to us. Guahahaha…’

Item: State-of-the-art laptops for everyone along with features-rich Blackberries.

Alert: Wow! They invest so much on infrastructure for the employees, no? No! Instead you will soon begin to loathe both devices and will find yourself leaving them around unattended at cafes and airports hoping that someone would steal them. Also, changing the ringtone (set on Barbie Girl by the cheeky fellows in IT) is against company policy.

Item: Expensive champagne and Cuban cigars adorn the CEO’s lavish office.

Alert: What a sophisticated man! Must be enriching to work under him. Or so you think. In reality, you will soon be reporting to a semi-conscious gentleman who is on a slightly high all day:

You: “So from your perspective, as CEO, I really think that this is an acquisition that will add value to our overall product portfolio, long-term strategy and international expansion plans…”

CEO: “… I am the CEO? Hic!”

So as you can see, first impressions can be pretty risky things to go by. First impressions can be a minefield of career maladies for the gullible young manager. Thankfully, by using these tips you should be able to tiptoe past many of them.

Now, before we close the topic I know there is a burning question in your mind. What sort of recruiter is ideal? How do you know when a job is perfect? When do you know you’ve found the recruiter who will satisfy you for years and years?

Ideally, the interview takes place at a swanky restaurant over dinner. That way, you can knock back a few drinks too. (If the guy offers booze during lunch ask for the offer letter right away. Start work next morning.) You should be able to work from home. This omits the need for an office altogether. It also means that the dress code is a lungi and white banian. Lunch break is as and when you wish. Also, your remuneration should have nothing at all to do with the actual effort you put in. And whenever you need to send in reports to the office, they could send the receptionist to pick it up.

When you come to think of it, that’s a lot like freelance writing. Except for the receptionist. And the money.

Sigh.

See you all next fortnight. Till then you taking the care, wokay?

(The writer, an alumnus of IIM-A, was a management consultant before quitting to work as a freelance writer, author and general handyman. He blogs at http://www.whatay.com)

Reckless motorists ‘will be forced to clean roads’

Reckless motorists ‘will be forced to clean roads’

WAM Published: December 09, 2007, 23:20

Abu Dhabi: Stunt drivers and motorists who violate road manners in Abu Dhabi will be punished by being forced to clean the roads and school for 48 hours in addition to one week behind the bars, an Interior Ministry official said yesterday.

Brigadier Nasser Al Nuaimi, Director General of the Interior Minister’s office, revealed Abu Dhabi Police would crackdown on violators who abuse the roads and obligate them to work for two days in cleaning up the schools and roads.

The decision, which took effect on Sunday, aims to intensify punitive measures against offenders who drive dangerously and recklessly with no respect to safety.

“Although we appreciate the public celebrations of national and religious holidays, that does not mean people can take this as a chance to break the law, endanger their lives and those of others, breech the privacy of road users and tarnish the image of the UAE,” Brigadier Al Nuaimi said.

He warned against negligence of public safety, which will be monitored by a team of security men, who will be assigned to cover all parts of the city including roads and public places, to put an end to this menace.

Awareness

Al Nuaimi said an awareness campaign would shortly be launched to raise awareness among the public about the security, health and cultural dangers of such practices and their negative impacts on the nation.

The decision came in the wake of violations committed during the National Day celebrations, as some drivers were caught driving recklessly, making loud noises and using firecrackers.

Top Asian business leaders honoured

Top Asian business leaders honoured

Staff Report GULF NEWS Published: December 09, 2007, 23:20

Dubai: A number of businessmen were honoured at the first Asian Business Awards Middle East (ABA ME) held at the Emirates Palace Hotel in Abu Dhabi on Saturday evening.

The ABA ME has been instituted to recognise and award business excellence within the Asian community and nurture economic relations between Middle East and the sub-continent.

The public had a clear and definite participatory role in the ABA ME awards process. The debut award year had 200,000 registrations. While the grand jury finalised the three nominees in each of the six categories, the public were once again imperative in the choice of winners.

The awards process this year had some of the prominent business personalities of the region on the grand jury panel. These include Michael J. Stevenson, senior partner Middle East region, PricewaterhouseCoopers; Abdul Aziz Sager, chairman, Gulf Research Centre, and president of Sager Group Holding in Saudi Arabia; Alex-ander John Andrakis, executive director, sales & marketing, Emaar Properties; Sultan Saoud Al Qasimi, managing director of the Al Qasimi group of companies and chairman of Barjeel Securities and Dr. Fatima Saeed Al Shamsi, secretary general, UAE University, Al Ain.

List: The winners

Lifetime Achievement Award: N.R. Narayana Murthy, chairman of the board and chief mentor, Infosys Technologies.

Global Asian of the Year: Lakshmi N. Mittal, president of the board of directors and chief executive officer, Arcelor Mittal.

Outstanding Asian Businesswoman of the Year: Renuka Jagtiani, chief executive officer, Landmark International.

Outstanding Asian Businessman of the Year: Sunny Varkey, chairman, GEMS Education and Welcare World.

Asian Rising Star of the Year: Ramesh Prabhakar, managing director, Rivoli Group.

Young Asian Achiever of the Year: Madhu Koneru, managing director, RAK Minerals and Metals Investments.

Outstanding Asian Contribution to the ME Development: Syed M.Salahuddin, managing director, ETA Ascon and Star Group.

Asian Business Leader of the Year: Yousuf Ali, managing director, EMKE Group.

The Arab Honour Awards

ABA ME The Arab Rising Star Award: Salah Salem Al Shamsi, president, Abu Dhabi Chamber of Commerce.

ABA ME The Arab Business Excellence Award: Mohammad Abdul Jalil Al Fahim, honorary chairman, Al Fahim Group.

ABA ME The Arab Lifetime Achievement: Obaid Khalifa Jaber Al Merri, chairman, Al Jaber Group.

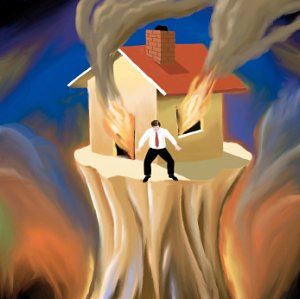

Basics of insuring your home

Basics of insuring your homeBy: Kavita Sriram, TNN

To own a house is every individual’s dream come true. The house could have taken away your life’s savings or you may have to repay the debt for decades.

There is so much at stake when it comes to the safety of your house. Have you considered insuring this precious possession of yours?

What is home insurance?

When it comes to your house, it holds not only economic but also tremendous emotional bonding. The possibility of damage to your house cannot be ruled out. Home insurance tries to preserve the safety of your valued house. It protects it from unforeseen eventualities that can cause damage. A home insurance policy covers the structure and contents of your home from natural to man-made calamities. It also comes with additional features like protection for the family, loss of cash in transit and baggage loss.

Home insurance comes with two-fold protection, one for structure and another for content. Structure cover is a comprehensive cover that envelopes the construction of the house including its walls, roof and the flooring. Content cover protects all the contents and belongings within the house. It provides insurance for all the expensive jewelry and cash at home.

What are the issues covered?

Fire is a major catastrophe damages the structure and its contents. A home insurance policy provides protection from fire and such disasters that are can prove very expensive. The contents of the house should be insured for their market value. The building cost is equated to the cost of reconstruction today.

There are other perils against which this insurance protects your home. It includes explosion or implosion , aircraft damage caused by aircraft, damage/loss due to riot, damage due to impact by rail or road vehicle or animal , bursting/overflowing of water tanks, apparatus and pipes, leakage from automatic sprinkler installations, lightning and bush fire, loss caused by storm, landslide etc.

What are optionally covered?

The home insurance needs can be diverse and can be tailor-made to suit various needs of home owners. On payment of extra premium you can extend the umbrella of cover to include additional benefits. You can include burglary, loss/damage of domestic appliance, personal accident and baggage loss, public or third party liability, plate glass, etc.

Typically, not included under the cover is willful destruction of property; loss, damage or destruction caused by war; wear and tear and atmospheric conditions etc.

How are payments made?

You have the option to either choose a comprehensive cover or separate cover. Under a comprehensive cover, all the sections are to be covered. The more sections you take for additional cover, the more discount you get on the premium.

This policy can be taken for a period of five or ten years. The longer the term of the policy, the more the discount on premium. The premium is usually paid every year.

How do you make claims?

In order to get the claims process rolling, submit to the insurer a completely filled and signed claim form, copy of the policy, copy of FIR, report from police and a copy of all invoices, bills, price listing and estimated copy of repairs.

Intimate the insurer. The insurer then transfers your request to the claims department . And the insurer authenticates and settles your claim within a stipulated time frame.

Some points to bear in mind

Give an accurate value of whatever you want to insure. You may need to pay higher premium, but all your valuables will be amply covered. In the case of appliances, ornaments and items in the house, provide the insurer with list of things including the model number, name of manufacturer, year of purchase, value, and other specifications .

This will ensure that your claim at a later date is not unnecessarily rejected. Verify if your cover makes up for the replacement value of your valuables.

15 financial problems at a glance!

15 financial problems at a glance!

When it comes to psychology and financial behaviour, India does not have too much of research papers. Hence we are forced to turn to the US or UK for such research work.

US studies have summarised financial problems and have found the following to be the most common of financial problems:

~ Not planning: The single biggest problem for most people is that they just do not plan their finances. It just keeps coming and going. Even if they are not happy about the results of what they have done so far, they do not change the way things are done.

~ Overspending: Many people with not very high incomes have very high ambitions. This is likely to get them to grief. Most of this problem is because the salesmen in most shops do not tell you the price of a product, they only tell you the EMI — so anything from a plasma TV to a luxury home on the outskirts of the city are made to look cheap! After all at Rs 2,899 a month does a plasma TV not look cheap?

~ Not talking finance at home: Children are kept away from the finance topics at the dining table. Finance is perhaps the second most taboo topic at home! So many children grow up without knowing how much of sacrifice their parents have gone through to educate them.

~ Parents spending on education and marriage: There are just too many kids out there who believe that they need to worry about savings, investment and life insurance only at the age of 32 plus. This means your father, father�in-law or a bank loan has funded your education and marriage. Kids should take on financial responsibility at a much younger age than what is happening currently.

~ Marriage between financially incompatible people: Most marriages under stress are actually under financial stress. Either the husband or the wife is from a rich background and the other partner cannot understand or cope with the spending pattern. It is necessary to match people financially before marriage.

~ Delaying saving for retirement: “I am only 27 years old why should I think of retirement” seems to be a very valid refrain for many 32 year olds! Every year that you delay in investing the greater the amount that you will have to save later in your life. Till the age of 32 it might be feasible for you to catch up, but after some time the amount that you need to save for retirement just flies away.

~ Very little life insurance: With all the risks of life styles, travel, etc. illness and premature death are common. We all have classmates who had heart attack at the age of 32 but still pretend that we do not need life or medical insurance. We buy car insurance because it is forced upon us, but we ignore life insurance! Imagine insuring a Rs 10 lakhs car, but not insuring (or under insuring) the person who is using the car — and paying for it, that is, you!

~ Not prepared for medical emergencies: Normally big emergencies — financially speaking — are medical emergencies. Being unprepared for them — by not having an emergency fund is quite common. Emergency fund has now come to mean the credit card — which is good news for the bank, not for the borrower.

~ Lack of asset allocation: Risk is not a new concept. However, it is a difficult concept to understand. For example when the Sensex was 3k there was much less risk in the equity markets than there is today. However at 3k index people were afraid of the market. Now everybody and his aunt wants to be in the equity market — and there are enough advisors who keep saying, “Equity returns are superior to debt returns.” This is true with a rider — in the long run. It is convenient for the relationship manager to forget the rider. So there could be a much larger allocation to equity at higher prices — to make for the time missed out earlier.

~ Falling prey to financial pitches: The quality of pitches has improved! Aggressive young kids are recruited by brokerage houses, banks, mutual funds, life insurance companies, etc. and all these kids are selling mutual funds, life insurance, portfolio management schemes, structured products, et al. Selling to their kith and kin helps these kids keep their jobs, and there is happiness all around! These kids, themselves prey to financial pitches, have now made it an art when they are selling to their own natural ‘circle of friends’ and relatives.

~ Buying financial products from ‘obligated persons’: This is perhaps one of the worst things you can do in your financial life. A friend, relative, neighbor, colleague who has been doing something else suddenly becomes a financial guru because they have become an agent! They, in great enthusiasm, sell you a financial product and promptly in 2 years time give up this ‘business’ because it is too difficult. You are saddled with a dud product for life! What a pity. Charity begins at home, not financial planning.

~ Financial illiteracy: Most people do not wish to know or learn about financial products. They simply ask, “Where do I have to sign” — so buying a mutual fund is easier than buying life insurance! Selecting products based on the ease and simplicity of buying is a shocking but true real life experience in the financial behaviour of the rational human being!

~ Ignoring small numbers for too long: What difference will it make if I save Rs 1,000 a month? Well over a long period it could make you a millionaire! So start early and invest wisely. It will make you rich. That is the power of compounding.

~ Urgent vs important: Most expenses, which look urgent, are perhaps not so important — the shirt or shoe at a sale. That luxury item which was being offered at 30 per cent discount is such an example. These small leakages are all reducing the amount of money you will have for the bigger things like education or retirement.

~ Focusing too much on money: Money is no longer a commodity to buy things. It is a scorecard of one’s life. That will cause stress, and yoga might help. However if you will seek a branded yoga teacher — so that your friends think you have arrived, yoga it self could cause financial stress!

You must be logged in to post a comment.