Month: May 2008

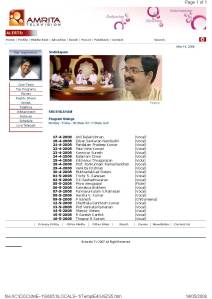

Raga Ratnam Junior – Jugal Bandhi Round – Mahathi

Raga Ratnam Junior – Jugal Bandhi Round – Mahathi

Sruthilayam – programmes for this week

Sruthilayam – programmes for this week

Sruthilayam is an excellent programme presented in Amritha TV from Monday to Friday at 08:30 am IST. The programme presented by Sri Krishna Chandran covers every day one carnatic artist, either vocal or instrumental and presents in detail about the singer, the accompanying artists, details on the keerthanam he/she is going to sing etc. For Carnatic music enthusiasts this is a good venue to learn more about carnatic music and it’s different ways and varieties of presentation.

Sri Neyyattinkara Vasudevan

Neyyattinkara Vasudevan (1940-2008) was a leading Carnatic vocalist from Kerala. He belongs to Neyyattinkara , a township south of Thiruvananthapuram.

Vasudevan born in humble surroundings and after finishing his high school studies, his ardent love towards Carnatic music prompted him to join the Swathi Thirunal Music College at Thiruvananthapuram. He passed Ganabhushanam in 1960 and Sangeetha Vidwan in 1962 with colours. His skills were honed in the College by a bunch of reputed musicians under the leadership of the illustrious Semmangudi Sreenivasa Iyer. Later Vasudevan imbibed the esoteric subtleties from a rigorous training meted out by Ramnad Krishnan in Chennai. Vasudevan’s career graph soared upwards with his arrival to Tripunithura to serve as Assistant Professor in RLV College of music there. This hoary royal town has ever provided a fecund soil for any aspiring musician to bloom and Vasudevan was no exception. With his charming disposition and a positive approach to his chosen vocation, he became immensely popular. In 1974, he joined the All India Radio, Trivandrum as ‘A Grade’ Staff artist in Vocal Music from where he retired in 2000. The AIR honoured him with ‘A Top Rank’ – the highest rank in Carnatic Classical Music. He has been to American countries and Canada in 1983, 1984 and 1994 respectively for giving public performances and for imparting music to music lovers. He has also given public performances in Abudhabi, Dubai, and Muscat during his tour in 1992.

Sri Vasudevan died on May 13, 2008.

Albums and Recordings

The A.V.M Studios has released a cassette of Swathi Thirunal Krithis sung by Vasudevan. The C.B.S has produced two cassette volumes, sung by him, containing Krithis of different composers. The HMV & Manorama Music have also produced a volume of krithis rendered by him. For the film “Swathi Thirunal”, Sri.Vasudevan served as consultant for music aspects. He has also sung in films (Classical Music only) such as “ENIPADIKAL (1968)”, “SWATHI THIRUNAL (1987)”, “CHITHRAM (1988)”, “VACHANAM (1990)” & “MAZHA (2000)”.

He has recorded a music album Classical Encounters with his diciple Sreevalsan J Menon

Rendition Style

His strict adherence to tradition and yet innovating within it, unique style of raga elaboration, inimitable style of rendering rakthi ragas, rendering of compositions in appropriate tempo, compact swaraprasthara and above all his capacity to build up a rapport with the accompanying artists as well as his listeners brought him encomiums even in a place like Chennai where the audiences are fastidious by nature. When he secured the prize for the best sub-junior vocalist in 1971, at the Music Academy, roaring reviews had appeared in the leading newspapers. Vasudevan’s gift for voice modulations and flourishes are always enviable. He comes out always with a clean diction and his format during a concert is evenly distributed among our Sahajavaggeyakaras. He has taken a lot of pains in popularising, Swathi Thirunal compositions throughout the country and abroad.

Disciples

Vasudevan is blessed with a number of disciples in South India and U.S.A. Some of the performing musicians who are his disciples include M.G.Sreekumar, Sreevalsan J.Menon, Late Thripunithura Lalitha, Mukhathala Sivaji, Alleppey Sreekumar, Suresh.K.Nair, Vellayani Ashok Kumar, Narayanan Nair etc.

Honours and Awards

Vasudevan has been given the Indian President’s Award in the A.I.R. Music competition in 1960. He has been given music concerts regularly in Madras Music Academy ever since 1972. He has been given awards for Best Vocalist in the years 1972, 1978, 1982 and 1988 by the same institution. In 1993 he was given award for Best Musician in Raga rendering.

He has been giving public performances throughout India and abroad. Almost all top ranking violinists and mridangists have accompanied him in his concerts. He has also been featured in the National Programme of Music and Radio Sangeetha Sammelan concerts. The Kerala Sangeetha Nataka Academy Award was given to him in the year 1982 and the prestigious Sangeetha Nataka Academy Fellowship in 1989. He received the Tulasivanam Award of Kerala in 1992. The title “Asthana Vidwan” was conferred on him in 1984 by the Sri. Venkateswara Temple Trust, Pittsburgh, U.S.A. The Govt. of India’s Sangeeth Natak Academy, National Academy of Music, Dance and Drama honoured him with the Academy award for Carnatic Music in 2000. The prestigious Padmasree came in search of him in 2004 and the Swathi Puraskaram in 2006/7 by Kerala State Government.

More news on late Sri Neyyattinkara Vasudevan

He studied at the Swathi Thirunal Music collage and served as a professor of music there. His music is a combination of tradition and innovation. He has contributed in a big way to popularize Swathi compositions both as a teacher and a performer.

Hailing from Neyyattinkara, to the south of Thiruvananthapuram district, he studied in the Swati Tirunal College of Music here. The Carnatic music world realised his immense potential during his initial days of performance itself. Here was a singer in the truly classical mould who was not afraid of innovations. This twin quality made him acceptable to both the traditionalists and the innovators. To the delight of both, he soon took the Carnatic music world by storm. His concerts were eagerly awaited in the music circuits of Kerala. The sheer brilliance of his rendering made him acceptable to even the most exclusive institutions engaged in the promotion of exquisite music and brilliant singers.

He has succeeded in grooming up a group of talented young singers who are expected to do him proud in the coming days.

A jury headed by Sangeetha Nataka Akademi chairman Murali selected Mr. Vasudevan for the Swathipurasakaram award.

Musicians Remesh Narayanan and B. Arundhati and Sree Swathi Tirunal College of Music Principal Rajalakshmi were the members of the jury.

Semmangudi Sreenivasa Iyer, Ustad Bismilla Khan, D.K. Pattammal, K.V. Narayanswami, T.N. Krishnan, Pandit Bhimsen Joshi, Kalamandalam Sankaran Embranthiri, Mavelikara R. Prabhakara Varma and Umayalpuram Sivaraman are the past winners of the award.

He was 68 and is survived by wife and two sons, according to his family sources. Contributing in a big way to popularise Swathi compositions, his music is a combination of tradition and innovation. Neyyattinkara Vasudevan was so popular for his charming disposition.

Vasudevan was born in 1940 in humble surroundings at Neyyattinkara near here. After finishing his high school studies, he joined the Swathi Thirunal Music College at Thiruvananthapuram because of his ardent love for Carnatic music.

He was recognised as ”Ganabhushanam” in 1960 and ”Sangeetha Vidwan” in 1962. Vasudevan had served as Assistant Professor in RLV College of music at Tripunithura. In 1974, he joined All India Radio (AIR), Thiruvananthapuram as an ‘A Grade’ artist. He retired in the year 2000.

Vasudevan was honoured with many awards, including the Padmasree in 2004 and the Swathi Puraskaram in 2007.

He was also awarded the Sangeeth Natak Academy for Carnatic Music in 2000 and the Kerala Sangeetha Nataka Academy Award in 1982. He was also awarded the Sangeetha Nataka Academy Fellowship in 1989.

From The Hindu when he was selected for the Swati Puraskaram

Extraordinary musician and teacher: Neyyattinkara Vasudevan.

Neyyattinkara Vasudevan, who has been selected for the Swati Puraskaram, has renewed, refined and enriched the musical tradition he inherited from the great masters of Carnatic music.

His unlimited generosity as a guru has enhanced the lives of his disciples.

Ask mridangam maestro Umayalpuram Sivaraman about his favourite Carnatic musician from Kerala, and he would reply quickly: “Neyyattinkara Vasudevan.”

The master percussionist once told the audience at a concert in Mumbai: “If you want to be treated to the music of Semmangudi Srinivasa Iyer, Ramnad Krishnan and M. D. Ramanathan simultaneously, listen to Neyyattinkara Vasudevan.”

The maestro from Neyyattinkara, near Thiruvananthapuram, has renewed, refined and enriched the musical tradition he inherited from the great masters of Carnatic music. He has spiritedly preserved this tradition through his concerts and lessons to two or three generations of students, becoming its most important icon in post-Independence Kerala.

He likens a brilliant concert to a dynamic painting by an artist who has a definite idea about how to set out the elements, choose a light source and what to include or exclude in the composition.

Early 1990s. Being his disciple, I was with him as he proceeded to present a concert at the Ramaseva Mandali in Bangalore. Sometime ago, he had taught me ‘Sukhiyavaro’ in raga Kanada. When he was freshening up before the concert, I practised the raga with different swara combinations.

He stepped out of the shower, and said: “The sangathis (phrases) are good, but too many of them will make the presentation stale. Brevity is the soul of wit.”

Economy of expression

Economy of expression is the hallmark of his concert. He has proved that brevity in raga delineation, in swara prasthara and neraval is a worthy counterpoint to elaboration.

Nevertheless, each time you listen to him singing a raga, it would sound different. Concert to concert, he would change the manner of elaboration, pushing the boundaries of creativity. Sometimes, the raga presentation is guided by ‘lakshya.’ Here, the singer himself does not know which phrase comes next. There is a flow of spontaneous ideas.

On other occasions, he is guided by lakshana, where the plan is premeditated. In his concerts, there is a fine and majestic balance between the magical and the planned. He builds his musical edifice upon the foundations of brevity and balance.

Musicians of the younger generation have much to imbibe from the manner in which he interacts with fellow-beings. His simplicity, humility and, above all, unconditional love for others are exemplary. His unlimited generosity as a guru has enhanced the lives of his disciples. He would spend long hours teaching, making his disciples listen to stalwarts and discussing music.

If things went above their heads, he would say: “You will grasp this over time.”

He loves all forms of music, though he practises only the Carnatic style. He has made me listen to Pakistani brothers as much as G. N. Balasubramanian or M. D. Ramnathan. While we were travelling once, the background score of the film, ‘Salam Bombay’, composed by L. Subramaniam, was played in the car stereo. He exulted: “This is brilliant.”

He worked as assistant professor in the RLV College of Music, Thripunithura, for nearly a decade before joining All India Radio as an A-grade staff vocalist in 1974. He retired in 2000 and was later ranked A Top, the highest honour given by AIR to classical musicians. He never chased awards, but they came his way. He is a recipient of the Madras Music Academy Award, Kerala Sangeeta Nataka Akademi Award (1982), Kerala Sangeeta Nataka Akademi Fellowship (1989), Kendra Sangeet Natak Akademi Award (1999-2000) and Padma Sri (2004).

Apt award

The conferment of the Swati Puraskaram on him is apt as he has been one of the greatest ambassadors of the compositions of Swati Tirunals. The core of his music is embedded in the Semmangudi-Ramnad bani. He generally employs a madhyamakala tempo. His style of rendition is deceptively simple. He draws from D. K. Jayaraman’s adherence to kriti structure, M. D. Ramanathan’s brevity of presentation and G. N. Balasubramaniam’s raga elaboration. He pays close attention to diction.

I remember him having demonstrating the pronunciation of ‘Ra’ in ‘Rama Nannu Brova Ra.’ ‘Ra’ in ‘Rama’ is different from ‘Ra’ in Ratish or ‘Ra’ in ‘Rava.’ “Rama’s ‘Ra’ is somewhere in between,” he explained.

His ability to feel the pulse of the audience is much talked-about. Be it a Sangeetha Sabha in Chennai packed with connoisseurs or a cutcheri in a Kerala temple with lay listeners, he relates instantly to the audience and takes them to heights of aesthetic pleasure.

As mridangam maestro Mavelikkara Velukutty Nair says: “Neyyattinkara Vasudevan is an extraordinary musician and teacher – absolutely one of a kind.”

Links of songs sung by Sri Neyyattinkara Vasudevan

http://www.devaragam.com/vbscript/MusicNew.aspx?ArtistID=206

http://www.raaga.com/channels/malayalam/artist/Neyyattinkara_Vasudevan.html

http://www.hummaa.com/albumpage.php?pg=ja&lg=&lc=&md=27334&ps=

http://www.devaragam.com/vbscript/MusicNew.aspx?MovieId=57

http://www.thehindu.com/fr/2007/08/24/stories/2007082450320200.htm

Hope this collection of information on late Sri Neyyattinkara Vasudevan was useful to all of you and let us all join together collectively offering our regards and pranams to the departed soul of this musical maestro and offer our condolences to his family members. Music is immortal and he will continue to remain with us forever through his songs.

Adnoc finds elixir for its oil fields

Adnoc finds elixir for its oil fields

Tamsin Carlisle, THE NATIONAL

Last Updated: May 08. 2008 10:11PM UAE / May 8. 2008 6:11PM GMT

Abu Dhabi’s quest to become a global hub for energy technology took a step forward yesterday when Linde Group, the German technology company, announced an US$800 million (Dh2.9 billion) joint venture with Abu Dhabi National Oil Company (Adnoc) to extract nitrogen from air and pump it into ageing oil fields.

The initial project of the companies’ “Elixier” joint venture would be among the largest in the world to use nitrogen on an industrial scale to boost oil production.

It calls for the construction of a US$65 million air-separation plant at the Ruwais industrial complex on Abu Dhabi’s coast, which would produce nearly 600,000 cubic feet of nitrogen gas a day for injection into oil fields from late 2009. The plant would also supply liquefied nitrogen and oxygen to industrial customers at Ruwais.

Nitrogen, an inert gas, is the major constituent of air, comprising nearly 80 per cent of the earth’s atmosphere. It is also one of several gases that oil producers around the world are increasingly employing to coax more crude from big deposits with falling production.

Nitrogen’s big advantage for enhanced oil recovery (EOR) projects is its ready availability: air is everywhere. That means the gas can be produced close to big oil fields, avoiding high transportation costs.

The drawback is the cost of the technology used to separate air into its constituent parts, a complex engineering process that involves passing gases through “molecular sieves” as they are cooled, reheated and compressed.

But Adnoc hopes to recoup that cost by pumping more of the natural gas found in oil reservoirs. Without the injection of another gas, such as nitrogen, the natural gas would have to be left underground to maintain the pressure required to push oil into producing wells.

The commercial use of nitrogen for EOR is not new, and in the US dates back to the 1980s.

Still, the economics of such projects were often shaky. Now, soaring oil prices accompanied by rising natural gas prices on international markets are making the technology more economically viable, and much more in demand.

For Linde, the Abu Dhabi project could open the possibility of supplying other customers in the Middle East, said Stefan Metz, a company spokesman.

Indeed, Linde is already building eight air-separation plants at Ras Laffen in Qatar to supply oxygen to the Pearl project, a joint venture between Qatar Petroleum and the Anglo-Dutch energy company Royal Dutch Shell to make petroleum fuel products from natural gas.

In that project, scheduled for completion in 2010, nitrogen from the air-separation process is considered a by-product.

That is not the case with the world’s biggest air-separation plant, located in Mexico. At the end of the last millennium, output from Mexico’s Cantarell oilfield complex, site of one of the planet’s biggest crude deposits, had begun to falter.

In 2000, the country’s national oil company, Petroleos Mexicanos (Pemex), built an air-separation plant to pump out 1.2 billion cubic feet a day of high-pressure nitrogen for injection into the big offshore fields.

Oil production from Cantarell shot up 75 per cent over the next four years, peaking at 2.1 million barrels a day in 2004, when it accounted for nearly half of Pemex’s total output.

Although Cantarell crude production is again declining, billions of barrels of oil were pumped from the fields that otherwise would have stayed trapped below the seabed. Mexico, which had been slow to develop its large gas reserves as it expanded its industrial base, also reaped substantial economic benefits from producing Cantarell’s gas. The parallels between the UAE’s current circumstances and Mexico’s a few years back are striking: both countries are among the biggest oil producers in their respective hemispheres and, indeed, in the world.

The UAE today, like Mexico earlier this decade, is in the midst of an unforeseen industrial and population boom that has increased domestic gas demand faster than supply.

Other GCC countries have similar problems. Mr Metz said Linde was in negotiations to supply nitrogen to several potential new customers in the region, either from the Abu Dhabi plant or from additional air-separation plants that the firm hopes to build.

The German company’s clients already include Borouge, an Adnoc petrochemicals venture with the Austrian chemicals producer Borealis. In 2006, Linde was awarded a contract to build a large ethylene plant at Ruwais. Borouge may soon begin using oxygen supplied by Elixier.

tcarlisle@thenational.ae

Plastic fantastic

Plastic fantastic

Last Updated: May 10. 2008 9:48PM UAE / May 10. 2008 5:48PM GMT

The process by which Abu Dhabi’s natural gas is transformed into a Chinese car bumper more than 6,000km away is an unknown method to most people.

But governments in the Gulf are betting that by the end of the next decade, many consumers around the world will drive cars made, in part, from plastics manufactured in the region. The UAE and Saudi Arabia, in particular, are hoping that massive investments in chemical infrastructure and technology will diversify the revenue base for their oil-dependent treasuries.

Abu Dhabi’s plans to produce plastics for the Chinese car market illustrates how complex that wager will be.

First, natural gas must be harvested from wells in the Western Region and piped to Ruwais, where ethane is separated from the mix of compounds that occurs in natural gas.

The ethane gas is “cracked” with blasts of steam at high temperatures for short periods, producing ethylene. That is converted to propylene, then a catalyst is introduced to create polypropylene.

The little pellets of tough plastic that emerge will eventually be shipped to a planned compounding plant in Shanghai, where reinforcements, other modifiers and colouring will be added. Next, they are trucked to a factory, where they will be moulded into the bumpers and interior panelling of a Chinese-made car.

Car bumpers are but one piece of a strategy to develop a sophisticated, multi-step chemicals industry.

Last month, Borouge, the Abu Dhabi-based plastics maker, announced it would consider building a third plant at Ruwais that would more than double the company’s annual output of plastics. With its new plant in Shanghai and hefty stakes in two European chemical companies, Borouge wants to go global and grab a piece of the huge profits that come with selling more sophisticated products that require a highly skilled workforce.

The company’s expansion is one small piece of a global shift in the petrochemical industry from established bases in North America and Europe to the Middle East and Asia, where they gain a cost advantage in hydrocarbon feedstock at a time of rising energy prices.

Jean-François Seznec, a professor at Georgetown University in Washington DC and an expert on Gulf chemicals, said governments had realised they could employ more people and make more money by selling sophisticated products derived from crude oil and natural gas. So-called “downstream” operations enable producers to sell each part of their precious resource at a premium.

“Everybody in the region realises – at least the leadership in the region realises – they cannot just keep producing oil or just gas in Qatar,” Dr Seznec said. “Sooner or later, it’s going to run out.”

Abdulaziz Alhajri, the chief executive of Borouge, said regional petrochemicals producers were bringing advanced stages of plastics and chemicals production to the Gulf that were traditionally undertaken overseas.

“Today, the compounding and the downstream and some of the ingredients that we use in our industry are imported from outside,” he said.

But he noted that the model was steadily changing. “I see the future as very bright for the UAE, the overall Middle East,” he said.

In addition to the Borouge expansion, the International Petroleum Investment Company (Ipic), a Government investment fund, and Borealis, one of Borouge’s parent companies, announced plans earlier this year to build the largest integrated chemicals and plastics complex in the world at Taweelah, near the border between Abu Dhabi and Dubai.

The plant will use naphtha, a derivative of crude oil, as a feedstock and produce plastics, petrol and basic chemicals.

The UAE is not the only one working on such a plan. In Saudi Arabia, the government plans to make the kingdom the largest producer of chemicals in the world in less than five years.

But building a sophisticated chemicals industry takes more than new plants, as companies have to either acquire or develop the catalysts and specialised equipment that allow them to compete in a market that is well established in the West.

Saudi Arabia’s drive to reach the top is being put into action by the twin behemoths Saudi Aramco and Saudi Arabia Basic Industries, or Sabic, which began laying the groundwork for its rise in the 1990s. Aramco has focused its downstream operations on refining and petrochemicals based on crude oil, while Sabic has steadily moved towards higher-end chemical products derived mainly from natural gas.

Sabic’s petrochemicals growth has been driven and sustained by access to cheap ethane feedstock, according to John Vautrain, a senior vice president at the petrochemical research firm Purvin and Gertz. He noted that Sabic pays US$0.75 for a million BTUs of ethane, 15 times cheaper than some competitors. The historic average price for ethane in the United States has hovered just above US$4.50 per million BTUs.

“They have a powerful platform for growth. Cheap ethane gives them an enormous cash flow,” he said. “They have such an enormous advantage, no one else can touch them.”

Sabic’s ambitions are well known. In 2006, the chief executive, Mohamed al Mady, announced that Sabic wanted to “be the preferred world leader in chemicals” by 2020.

Mr Seznec said the company had steadily moved into more and more sophisticated chemicals in the past 10 years, with a two-pronged strategy of signing joint ventures with Western companies and also buying up the companies themselves, along with the patented technology and skilled workers.

The strategy required a large cash reserve and a disciplined company leadership that had been able to set its sights on the long-term horizon, Mr Seznec said.

“This is really due to the vision of people. Money by itself is important, but it is not a sufficient variable to really create this growth,” he said. “I mean, Iran has the money, but they don’t do anything with it.”

The company’s headline-grabbing move came last summer, when it bought GE Plastics, a US-based company, to give itself more exposure to advanced chemicals technology.

Abu Dhabi has made its own moves to acquire sophisticated technology. The Abu Dhabi National Oil Company (Adnoc) created Borouge from a joint venture with the European chemical company Borealis. Ipic then bought a 65 per cent stake in Borealis itself and a 19.6 per cent share in OMV, the largest refiner and petrochemicals company in Austria.

Even with these investments, however, Mr Seznec noted that Saudi Arabia’s technology remained far ahead of the curve.

“I think the Saudi products will be a lot more downstream because, as they go into fine chemicals, they’ll be way beyond the more basic chemicals that are going to be produced by Kuwait, Abu Dhabi and Qatar,” he said.

Mr Vautrain, the Purvin and Gertz analyst, noted the industry was entering a down cycle in terms of profit margins due to a glut of petrochemical products coming on to market, and the low-cost producers in the Middle East would increase their advantage.

“Overseas assets may become cheaper,” he said. “This is the time to do deals.”

Mr Seznec said the drive to develop a chemicals industry was not merely fuelled by a need to diversify the region’s economies, nor simply about making more money. It is also an effective strategy for conserving the region’s vast hydrocarbon reserves.

“At the end of the day, instead of having Saudi Arabia sell US$200 billion [Dh734.6bn] of oil, for instance, they will be selling maybe US$100 billion of oil, but then they’ll start selling US$100 billion worth of petrochemicals,” he said. “In the process, they will need to produce only one-fifth as much oil because there’s so much value into this business.”

Unfortunately, other GCC states face more challenges in entering the chemicals market. Bahrain, for instance, already has diversified industries, with several large refineries and the largest aluminium smelter in the world, but now has perhaps only eight years of natural gas left.

Dr Seznec said Kuwait half-heartedly moved downstream in a venture with Dow Chemical. But he said it lacked large natural gas reserves and had not moved towards using crude oil as a feedstock. It is now experiencing political infighting that could upend any attempts at large-scale economic reform. And despite recent announcements, Qatar was more concerned with managing lucrative LNG exports than committing to a large-scale petrochemicals expansion, he said.

But in Saudi Arabia and the UAE, Mr Seznec has been following events closely and is hopeful, almost gleeful, about the future.

“What they’re trying to do is go into value-added productions, knowledge-based industries, basically, and that’s going to make them able, first of all to use a lot less of their resources to make a lot more money,” he said. “And in the process create employment for the locals, and in the long term make these countries major industrial producers in the world by 2020.”

@Email:cstanton@thenational.ae

Shell out of Iran gas deal

Shell out of Iran gas deal

Tom Bergin, THE NATIONAL

Last Updated: May 10. 2008 8:50PM UAE / May 10. 2008 4:50PM GMT

Royal Dutch Shell has pulled out of a planned US$10 billion (Dh36.7bn) gas project in Iran, after coming under pressure not to participate from US lawmakers who were concerned about the country’s nuclear programme.

A spokesman said yesterday that the world’s second-largest oil company by market capitalisation was pulling out of Phase 13 of the giant South Pars gas field, but may yet join later stages of the field’s development.

Shell, Spain’s Repsol and the National Iranian Oil Company (NIOC) signed a memorandum of understanding in January 2002 to develop Phase 13 in a project known as Persian LNG.

At the time, Shell said deliveries of liquefied natural gas – gas cooled to liquid under pressure for transportation in special tankers – could begin in 2007.

However, United Nations sanctions on Iran related to its nuclear programme, which it claims is for power generation, but which the US and European states believe is aimed at developing weapons, and criticisms of the deal from US politicians and investors, slowed progress.

Meanwhile, Iran grew impatient and threatened Shell with eviction from the project if it did not commit formally. The spokesman for the Anglo-Dutch company said: “We have agreed the principal of substitution of alternative later phases for the PLNG project so that NIOC can proceed with the immediate development of Phase 13.”

She would not give a reason for the decision. Repsol was not available for comment.

Iran will now need to find new partners for the project. Media reports have suggested Russia’s Gazprom, Indian Oil Corporation and Chinese companies could join, as they were expected to be less susceptible to US political pressure, but the companies have limited experience of LNG.

Shell and Repsol began negotiating with the Iranian government to pull out of the natural gas project at the beginning of this month. The companies wanted Iran to agree to drop their current development plans for block 14 of the South Pars field, but to allow them to bid for other parts of the field in the future if the international political climate improved.

On May 3, a Repsol spokesman declined to comment on the report. Shell and Repsol had planned to export South Pars gas via ship in liquefied form as part of the Persian LNG project. Now, it is more likely the gas will supply the Iranian market or be exported by pipeline.

The US discourages Western companies from investing in Iran, which it accuses of trying to develop nuclear weapons. Iran denies the accusation.

* Reuters

Test run of the Dubai Metro begins

Test run of the Dubai Metro begins

Staff Report Published: May 12, 2008, 10:18

Dubai: Officials from the Dubai Road and Transport Authority (RTA) have tested a five-car Metro train on a stretch of completed track near Jebel Ali on Monday.

Witnesses said the train, which can reach speeds of up to 40km per hour, passed through an uncompleted station a number of times.

The first line of Dubai’s Dh15.5 billion Metro system is expected to be complete by September next year. The second will be ready by March 2010.

The RTA said more Metro trains will be seen travelling up and down the test stretch in the coming months as testing continues.

You must be logged in to post a comment.