Month: October 2007

Luxury water bus service takes to the waves on Dubai Creek

Luxury water bus service takes to the waves on Dubai Creek By Ashfaq Ahmed, Staff Reporter GULF NEWS Published: October 02, 2007, 23:09

Dubai: Residents can beat the traffic to reach shopping malls, offices, hotels and banks along Dubai Creek by using the new water bus service, said a top official.

“There is a massive concentration of government offices, banks, shopping areas, and tourist sites along Dubai Creek and the water bus is the answer to avoiding traffic congestion in the area,” Eisa Abdul Rahman Al Dossari, Chief Executive Officer of the Marine Agency at the Dubai Roads and Transport Authority (RTA) told Gulf News at the launch of the Dubai Creek water bus routes.

“People can beat traffic congestion, save time, money and hassle in finding parking by simply using the water bus to commute in the area,” he added.

Integrated plan

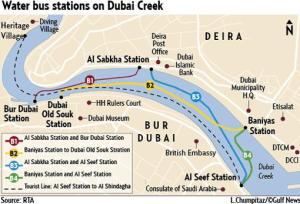

The new water transport is part of an integrated public transport plan to curb traffic congestion. It will serve the congested central business districts of Deira and Bur Dubai.

All five routes of the luxury water bus service are now operational as part of the first phase of a strategic plan for marine transport.

“By introducing air-conditioned water buses, we are targeting new types of commuters and encouraging them to park their cars and use water transport to commute along the creek,” said Al Dossari.

He said the water buses were not in competition with the abra service (traditional boats that traverse the Creek) but would complement it.

Around 20 million passengers use the abra service every year.

“We hope at least 2 million people will use the water bus every year,” he added.

Regarding the price difference between the abra fare (Dh1) and the new water bus fare (Dh4) he said passengers would be travelling in luxury on the water bus as it has proper seating, air-conditioning and facilities for the disabled.

The RTA has also introduced a smart card for the water bus service. Those, who use Dh40 worth will also get a 10 per cent discount. Passengers can also purchase tickets from the machine installed at abra stations.

Al Dossari said the water bus service is part of the first phase of the marine public transport project launched by the RTA’ s Marine Agency which has earmarked Dh1.5 billion to have integrated water transport services to implement its marine transport strategic plan 2020. Initially, eight out of a total of 10 water buses with the capacity to take 36 passengers each will be used while two water buses will be reserved for tourists. The operation will be seven days a week for 17 hours every day, from 6am to 11pm.

Abras: No new licences

With the launch of the service the RTA has stopped issuing licences for abras to cross the creek.

“No new abra licences will be issued because we understand the present 149 are more than enough to handle the current demands of passenger traffic,” Eisa Abdul Rahman Al Dossari, CEO, told Gulf News.

Dark chocolate helps fight fatigue

Dark chocolate helps fight fatigue

2 Oct 2007, 0032 hrs IST,Kounteya Sinha,TNN

They are delicious. And now, they also seem to be beneficial for your health. A daily dose of yummy dark chocolate may help patients suffering from the chronic fatigue syndrome (CFS).

According to scientists from Hull York Medical School, dark chocolates have been found to lower levels of serotonin, a brain chemical related to CFS. Serotonin is also believed to play an important role in the regulation of anger, aggression, body temperature, mood, sleep, vomiting and appetite.

The team said patients with CFS found that their symptoms were alleviated when they consumed dark chocolate, much more so than when they consumed milk chocolate that had brown dye added to it. The scientists, however, stressed that the quantity of dark chocolate consumed should be moderate.

Endocrinologist Steve Atkin said, “Although it was a small study, two patients went back to work after being off for six months. Dark chocolate is high in polyphenols, which have been associated with health benefits such as reduction in blood pressure. Also, high polyphenols appear to improve levels of serotonin in the brain, which has been linked with CFS.”

According to nutritionist Dr Shikha Sharma, consuming two cubes of dark chocolate is good enough. “Dark chocolates better preserve the benefits of cocoa as they have less sugar in it. Cocoa is rich in antioxidant properties. It’s even better when added with resins or nuts. But it has to be consumed in moderation. Consuming bars of dark chocolate can overstimulate the nervous system,” Sharma said.

Atkin and his team then carried out a trial on 10 patients to check whether dark chocolate benefited them also. As part of the experiment, the patients received a daily dose – 45g – of dark chocolate or white chocolate dyed to look like dark chocolate for two months.

This was followed by a month in which they were not given any chocolate, before being given the other type of chocolate for two months.

To their surprise, the researchers noted that patients taking dark chocolate reported significantly less fatigue when they started eating the sweet. They also reported more fatigue when they stopped eating it.

kounteya.sinha@timesgroup.com

Health benefits of watermelon

Health benefits of watermelon

4 Oct 2007, 0000 hrs IST,TNN

Watermelon is not only delicious, but extremely healthy, as well.

In fact, most melons are rich in potassium, a nutrient that may help control blood pressure, regulate heart beat, and possibly prevent strokes.

Another arm that’s well represented is beta-carotene. Researchers believe that beta-carotene and vitamin C are capable of preventing heart disease, cancer, and other chronic conditions. No matter which way you cut them, when it comes to nutrition, melons are number one.

Watermelon is a valuable source of lycopene, one of the carotenoids that have actually been studied in humans. Research indicates that lycopene is helpful in reducing the risk of prostate, breast, and endometrial cancers, as well as lung and colon cancer.

Whether you choose watermelons for their health benefits or simply for their good flavour, they can be an excellent snack, summer dish.

Shaikha Maitha bint Mohammed bin Rashid Al Maktoum sees hope for Sudanese children

Maitha sees hope for Sudanese children

By a staff reporter KHALEEJ TIMES 3 October 2007

DUBAI — The enormous challenges being faced by children in Sudan can be overcome only through humanitarian initiatives such as the ‘Dubai Cares’ campaign, according to Shaikha Maitha bint Mohammed bin Rashid Al Maktoum.

During her first-ever visit to Sudan as part of the Dubai Cares initiative, Shaikha Maitha toured the country to personally understand the children’s struggle to obtain basic education.

Senior government officials in Khartoum briefed her on the educational needs of the country, decimated by over 20 years of civil war. In Juba, Unicef officials Peter Crowley, Director, and Douglas Higgins, Deputy Representative, Southern Sudan, highlighted the country’s situation in the south.

Isa Abdullah Al Bashah Al Nu’aimi, UAE Ambassador to Sudan, was present during the briefings and Shaikha Maitha’s visits to the schools.

Shaikha Maitha said: “Dubai Cares believes in every child’s right to education and is committed to ensuring that no child is denied education. I wanted to tell the children we are here to help them and to, ultimately, help their country.”

Shaikha Maitha and her delegation visited Kuku-A Primary School and Juba 1 Girl’s Primary School, where the children welcomed her with songs and dances.

Recalling the experience of visiting the 4×3-metre classroom shared by nearly 60 students, she said: “I am touched by the warmth and strength of these children — a testament to their will to live and learn. We owe it to them to keep their hopes alive.”

In Khartoum, Shaikha Maitha visited the Mustapha Hamad School for Girls. She said: “Having seen the situation and the conditions children endure to obtain education, I am overwhelmed with their capacity to cope with the unbelievable. My heart goes out to them. Through campaigns such as Dubai Cares, we will empower them, their families and the community.”

Five burnt to death as speeding car overturns

Five burnt to death as speeding car overturns

By Alia Al Theeb, Staff Reporter GULF NEWS Published: October 02, 2007, 23:09

Dubai: Five people were burnt to death in a horrific traffic accident early on Tuesday, police said.

According to preliminary investigations, speeding was the cause of the accident that took place near the entrance of Al Karama tunnel connecting Shaikh Rashid Road to Shaikh Zayed Road. A police official said the bodies have not been identified yet.

This was the second major traffic accident in four days. Early Friday, seven people were killed on Emirates Road when the tyre of the minibus they were travelling in burst and the minibus turned over. Police also blamed speeding for the accident.

In yesterday’s accident, the driver of the car was speeding and as a result he hit the side pavement of the tunnel. The car turned over and caught fire. None of the passengers was able to escape from the car and were burnt to death.

In another incident, a fire broke out in the cabin of a ship loaded with cars in Al Hamriya Port. However, the fire did not reach the cars and no injuries were reported.

Flexible hours for office workers aim to ease traffic

Flexible hours for office workers aim to ease traffic

By Ashfaq Ahmed, Staff Reporter GULF NEWS Published: October 02, 2007, 23:09

Dubai: Government departments have been asked by the Dubai Executive Council to adopt flexible working hours to improve their performance.

The system would not only benefit government departments but would also dramatically alleviate traffic congestion on the roads, the Council says.

“We expect up to a 30 per cent decrease in traffic congestion, especially during peak hours if flexible working hours are adopted by both the private and public sectors,” an RTA official told Gulf News.

The General Secretariat of the Dubai Executive Council has sent a letter to all government departments urging them to apply flexible working hours.

The system is in line with Dubai’s strategic plan 2015 launched by His Highness Shaikh Mohammad Bin Rashid Al Maktoum, Vice-President and Prime Minister of the UAE and Ruler of Dubai, calling for the creation of an ideal work environment

Positive environment

Flexible working hours would ensure a positive work environment ideal for government employees to serve customer needs, a DEC statement said.

A Roads and Transport Authority (RTA) official told Gulf News the RTA has also proposed a change in the private sector’s working pattern to ease traffic and it has been having talks with major companies.

“Based on our studies, we have categorised three sectors for flexible working hours. They are public and private sectors and schools. In addition to having flexible workings hours within the private and public sectors, we want to have a “window” between the timings of these categories,” the official said.

Municipality already working on system

Dubai Municipality has already started working on applying a flexible working hours system for its employees, said an official.

“The system aims to improve the performance of staff and extract the maximum out of official working hours. One of the purported objectives is also to help solve the traffic woes of office-goers, especially during rush hour,” he said.

He said the system neither proposes to cut the total working hours nor staff attendance.

The Municipality, on an experimental basis, is considering implementing three timings for checking in and checking out of staff. They are 6.30am to 1.30pm, 7.30am to 2.30pm, and 8.30am to 3.30pm.

Oil prices fall as investors cash in on profits

Oil prices fall as investors cash in on profits

Reuters Published: October 02, 2007, 00:12

London: Oil fell below $81 a barrel yesterdayas investors took profits from near-record highs of last week. But a weak dollar helped check losses sparked by worries of an economic slowdown in top consumer the US.

US crude fell 83 cents to $80.83 by 1441 GMT, having sunk more than $1 to $80.59 in earlier trade. London Brent crude dropped $1.10 to $78.07.

Oil has surged more than 30 per cent this year to an all-time high of $83.90 in late September on expectations of a supply shortfall in the fourth quarter as heating demand peaks.

A weaker dollar has also propped up oil and other commodities as they become cheaper for holders of other currencies. Gold hit a 28-year high on Monday, while platinum neared a record peak.

“The weaker dollar, for now, is the most consistent bullish theme that explains the incredible bullish momentum we are seeing in a variety of commodity complexes,” said Edward Meir at broker MF Global.

The dollar sank to a new low against the euro and a basket of currencies early yesterday, then rebounded as investors cashed in.

An Iranian oil official said on Sunday the price of US crude could gain $10 from current levels by December if the dollar continued to weaken.

Apart from a weak dollar, analysts said expectations of tightening fuel supplies heading into winter and the threat of supply disruptions due to hurricanes would also support prices in the near term.

The Organisation of the Petroleum Exporting Countries agreed last month to boost production by 500,000 bpd to soothe consumer concerns over high prices and tight supplies.

No need for Opec to boost output – Qatar

No need for Opec to boost output – Qatar

Reuters Published: October 02, 2007, 00:12

Dubai: More crude supply from Opec would do little to ease $80 oil as speculative investment flowing into the market from other assets is boosting the price, Qatar’s oil minister said yesterday.

US crude was trading at $81.43 a barrel yesterday. The price has been above $80 for much of the last three weeks, despite Opec’s agreement on September 11 to boost output by 500,000 barrels per day from November 1.

“I am confident that the price is not related to supply,” Qatar’s Oil Minister Abdullah Al Attiyah told Reuters by telephone.

“We increased at the last Opec meeting and were confident that it would help the market, but unfortunately the market is moving in a different direction. More oil won’t help at all.”

Members of the Organisation of Petroleum Exporting Countries (Opec) were not in consultations at the moment about boosting oil supply, he said.

Two weeks ago, an Opec source told Reuters the producer group would hold talks about a further supply boost if the price stayed above $80 for several weeks.

Al Attiyah said he did not know if Opec would consult on output before the heads of state of its 12 members gather at a summit in Riyadh in November. Oil ministers were due to meet ahead of the summit.

The global credit crunch had encouraged investors to switch to oil from other assets, Al Attiyah said.

“Our increase in output could not overcome the investment flow switch,” he said. “Investors believe oil is safer than some others [assets].”

The weak dollar was not making Opec more resistant to an output change, Al Attiyah said. The higher price has helped insulate oil producers from the erosion of their spending power due to dollar weakness. The US greenback hit a new record low against the euro yesterday.

“The weak dollar and Opec’s supply are not related,” he said. “But it has affected us. A lot of our imports are in euros.”

Qatar had no plans to change its policy to price and receive payment for all of its oil in dollars, Al Attiyah said.

Neighbouring Gulf Arab Opec members Saudi Arabia, the UAE and Kuwait also receive all their oil revenues in dollars.

Iran, locked in a row with Washington over its nuclear work, is aiming to boost oil export earnings in non-dollar currencies to 80 percent by the end of October.

It already receives more than 70 per cent in other currencies.

Qatar is Opec’s smallest oil producer, with output of around 800,000 barrels per day.

Sensex@17000 has 9 new trillion Re members

Sensex@17000 has 9 new trillion Re members

28 Sep, 2007, 1000 hrs IST, TNN

MUMBAI: The surprise bull run has generated so much of wealth that many top-rung companies can now boast of being part of the Rs 1-trillion market cap club.

The list of the biggest wealth creators is expanding with every 1,000-point rise in the Sensex . Nine companies, led by Reliance Industries (RIL), have already entered the hall of fame after their market caps soared beyond Rs 1,00,000 crore (trillion) amid unprecedented rally in their shares in the past few months.

RIL topped the list with Rs 3,23,322 crore as on Thursday when the Sensex soared past the historic 17k-mark to close with a gain of 229 points, or 1.4%, at 17,151. The stock has been on a dream run, jumping 27% to Rs 2,320 in one month. The market is still looking for clues as to what sparked the surge in the scrip.

Public sector oil and gas giant ONGC ranks second, but the company’s market cap at Rs 2,07,826 crore is substantially lower than that of RIL. Apart from RIL and ONGC, Bharti Airtel (Rs 1,82,256 crore), NTPC (Rs 1,59,880 crore) and DLF (Rs 1,26,432 crore) are among the top five wealth creators. Most of them, barring Bharti Airtel, have outperformed the Sensex in the past one month. The stocks have risen between 10% and 27% against a 16% gain in the index.

Two companies — DLF and ICICI Bank (market cap Rs 1,09,222 crore) — have found place in the list of high-fliers during the Sensex’s journey from 15K to 17K in the past two-and-a-half months.

A few more companies are close to touching the Rs 1 trillion-mark. Bhel and SBI, with a market cap of Rs 99,896 crore and Rs 99,260 crore, respectively, may soon achieve the milestone if these stocks continue to rise in the coming days.

5 reasons why market is complacent

5 reasons why market is complacent

28 Sep, 2007, 0310 hrs IST,Pravin Palande, TNN

1. First, the equity earnings yields (the inverse of PE ratio) is at 4.77%. The equity market is attractive when earnings yield is higher than that of bond yield. Today, 10-year bond yield is at 8%. When earnings yield is almost half that of the government bond yield, it indicates a clear complacency. Investors want to look at the next year’s PE of 18.14 which gives an earnings yield of 5.51%. This, according to them, makes the market look very comfortable. Investors expect the equity market to go up irrespective of any events. Again, justifying that the market at a PE of 18.14 may not be a great idea.

2. The implied volatility of Nifty is falling. In other words, investors feel that the market will not be choppy, given that the Sensex has seen an amazing run. The volatility in Nifty is 14%, a level seen two months ago when it was at a lower level. Since, the market has moved up 7% in the past two months, the volatility number should have been higher. This shows that investors are under the impression that there are no bumps ahead.

3. Open interest positions in Nifty futures are rising. Almost 77% of the positions have been rolled over on Thursday to October contracts. Simply put, investors may be taking big bets in derivatives. The October contract of the Nifty is in heavy demand. The market looks optimistic for the coming month, at least going by the Nifty futures positions.

4. Bank stocks are moving up as the market is betting on a rate cut even though there are no such indications from RBI. Over the past two weeks, the Nifty banking index has moved up 15%. Any kind of rate cut is seen as a positive, since it makes money cheaper and leveraging easier. At a time when the Sensex has hit 17K, expecting cheaper money may be wishful thinking.

5. Investors are reading too much into the recent capital outflow liberalisation measures. Many feel that the rupee will turn weaker with more outflow and it’s time to buy IT stocks or cover short-positions in software scrips. The fact is it could be too little, too late. Besides, net FII investments are rising. Since September 20, FIIs have been net buyers of Indian equity. On September 27, net investment was Rs 1,004 crore. These numbers are fuelling in the feel-good sentiment.

You must be logged in to post a comment.