Information – Money Market

8 guidelines to make money from IPOs

8 guidelines to make money from IPOs

There are basically two ways in which you can buy shares: you can either buy them from the stock market, or you can apply for them in a public issue. The stock market is a secondary market where shares are bought and sold, whereas the primary market is one where companies issue shares for the first time.

When a company raises funds by issuing new shares or debentures for sale to the public, it is called a public issue, or an IPO (initial public offering). Such new shares and debentures are called new issues.

New issues of capital can be made both by existing companies as well as by new companies. Bonus shares and rights shares are also new issues but since they are only issued to existing shareholders of the company, they are not called public issues.

Why IPOs are profitable?

Public issues provide you with an opportunity for picking up shares at relatively low prices. Newly formed companies usually offer their shares for subscription at par values, whereas existing companies price their new issues at levels which are sometimes as much as 20 to 30 per cent lower than the market price of their existing shares.

For example, new issues priced at Rs. 12 to Rs. 15 per share may be quoted as high as Rs. 20 to Rs. 25 per share in the secondary market soon after their listing on the bourses.

Similarly, shares issued at par by new companies also quote at high premiums soon after they get listed on the stock exchange. For example, in early 2004 public issues of Maruti Udyog, Indraprastha Gas and Divi’s Labs listed at high premiums.

Equally, most companies, which went in for IPOs in 2005 and 2006 did well. In most cases, the initial days after listing saw the stock prices moving well above the listing prices before settling down in a price range.

Many companies, which listed during this period gave double digit returns, some companies like Indiabulls, Bharati Shipyard, India Infoline. PTC India Limited, Shoppers Stop, Sun TV Limited, Suzlon Energy and Tulip IT Services even gave triple digit returns.

This is the main reason why public issues are so popular with investors; they offer opportunities for making quick money which few other forms of investment can hope to match, match particularly during the market’s bull phase.

The only snag lies in getting a firm allotment of shares. Since most good public issues are heavily oversubscribed, lots have to be drawn and only a few of the applicants succeed in getting a firm allotment. Sometimes the allotment is done on a proportionate basis.

Therefore, you should consider yourself lucky if you get an allotment of even a small number of shares. It is with this background in mind that you should calculate the pros and cons of applying for IPOs.

How to apply for an IPO?

IPOs are generally given widespread, nation-wide publicity through advertisements in newspapers and magazines well before the date fixed for the opening of their issues. These advertisements, along with the other highlights of the issue, give the names and addresses of brokers and the bankers to the issue from whom you can get copies of the prospectus and application forms. If you write to any one of them, they will send you the prospectus and application forms free of cost.

The prospectus is a document inviting the public to purchase or subscribe to the shares of the company. It contains all relevant information you may need to decide whether a company is worth investing in. It would, therefore, be in your interest to read a company’s prospectus carefully before applying for its shares.

The subscription list is required to be kept open for a minimum of three days and a maximum of ten days. Since most of the IPOs are oversubscribed, the subscription list is usually closed immediately after three to five days.

You have to submit your application form and the stipulated application money to any one of the banks or their branches listed on the reverse of the application form. Applications, whether handed personally or sent by post, should reach the bank within the period during which the subscription list remains open.

If you are lucky and get an allotment, the company will send you an allotment letter which will inform you that shares allotted to you have been credited to your demat account.

Nowadays, for IPOs with an issue size of Rs 10 crore (Rs 100 million) or more, shares are issued only in the demat form. For IPOs with an issue size of Rs 100 crore (Rs 1 billion) or more, shares are issued only through the book building process.

Where the IPO is issued through the book building process, reservations are made for QIBs (qualified institutional buyers), non-institutional buyers (large investors), and retail investors who apply for less than Rs 50,000 worth of shares.

What exactly is book building? Book building is a process whereby the demand for a share is ascertained so that it can be issued at the maximum price. Before the opening of the public issue, the lead manager to the issue announces a price band in which the company plans to allot the shares.

For example, in the case ONGC’s [Get Quote] public issue in March 2004 the price band was Rs. 680 to Rs 750 per share. After the issue, the cut-off price is fixed in such a manner that all the shares are offloaded to the QIBs and the public either at, or above, the cut-off price. In this way the company gets the maximum price for its shares.

Companies cannot allot shares arbitrarily. They do so in consultation with the stock exchange authorities. The principles on which allotment is done are heavily weighted in favour of large applicants.

If you are living in a city where one or more bank branches have been designated for accepting application forms, you should give in your application only on the third, or closing, day of the subscription list.

On the first two days you should visit the concerned banks for making an on-the-spot assessment of the public response to the issue. If the public response is poor, then your chances of getting a firm allotment are brighter.

On the other hand, if the public response is very heavy, then your chances of getting an allotment will obviously be very low and it may not be worthwhile to apply at all. The enthusiasm with which the public responds to a particular issue will also give you an idea of the premium the shares are likely to subsequently command after listing.

The greater the public interest in any share, the higher will be the price at which it is later likely to be quoted in the stock markets.

The gap between the issue price of a share and the price at which it is initially quoted on the stock exchange is in the nature of a windfall gain. Should you get a firm allotment in any issue, don’t miss out on the opportunity to encash these gains unless you want to retain the share as a long-term investment for tax purposes.

If you sell a share at a premium soon after it is allotted to you, your money is freed for recycling in other new issues and you can maximise the returns on your investments in public issues.

Guidelines for investing in new issues

New issues can be divided into two broad groups:

New issues of newly formed companies, and

New issues of existing companies.

New issues of existing companies are, by and large, very good investments. They provide an opportunity for acquiring shares in ongoing profit-making companies at relatively low prices. On the other hand, all new issues of newly formed companies are not good investments.

You have to be careful in selecting a new company to invest in, as the incidence of failure among these is quite high. We give below some guidelines, which should help you select the right new issues for investment:

Don’t invest blindly in a company having unknown and untried promoters. First study the performance of other companies set up by the same promoters. If these have done well, then chances of the new one doing well are also high.

Don’t invest in a company, which is not ready to start business operations. This will help you avoid investing in companies, which may have long gestation periods before business operation can commence.

Invest in companies that have something new to offer. Companies introducing a new product or industrial process for the first time, companies proposing to manufacture a product which is currently being imported, companies introducing a technologically advanced or better quality product, or companies venturing into new areas are likely to be better and more remunerative investments.

Invest in companies that operate in high-growth sectors of the economy. The incidence of failure is likely to be lower for such companies.

Avoid investing in very small companies.

Check the reputation and market standing of the foreign collaborator, if there is one. For example, new issues of Vesuvius India [Get Quote] and Birla Ericsson evoked a very good response from investors because of the excellent international reputation of their parent companies.

Companies where the foreign collaborator has an equity stake are often good investments. Foreign collaborators do not readily opt for an equity stake in any company unless they are confident of its bright future prospects.

Do apply for the mega issues of well-known profit-earning companies. The sheer size of such issues ensures better chances of getting a firm allotment. This is what happened in the public issue of the State Bank of India [Get Quote]. The bigger the size of the issue, the better will be your chances of getting a firm allotment.

Excerpt from Profitable Investment in Shares by S S Grewal and Navjot Grewal.

S S Grewal was a practicing investment consultant with an educational backgrand spanning science, engineering, literature, and economics. Navjot Grewal is a specialist in industrial psychology and a keen investor on the stock markets

Money Matters – End of Day Review – Wednesday, 2nd January 2008

Money Matters – End of Day Review – Wednesday, 2nd January 2008

Indices close at all-time high

2 Jan 2008, 1711 hrs IST,INDIATIMES NEWS NETWORK

MUMBAI: Short covering and renewed buying towards end of the session saw key indices close at all-time highs. Banking shares remained in the lime light while midcaps and smallcaps continued to rally.

Bombay Stock Exchange’s Sensex closed at an all-time high of 20,465.30, up 164.59 points or 0.81 per cent. In the day, it touched an intra-day high of 20, 529.48 and low of 20,077.40. National Stock Exchange’s Nifty ended at 6179.40, up 35.05 points or 0.57 per cent. It hit an all-time high of 6197 and low of 6060.85 in the day.

Biggest Sensex gainers were Reliance Energy (up 4.09%), Tata Motors (4.06%), HDFC (3.81%), ICICI Bank (3.42%), Cipla (2.76%), Hindalco Industries (1.9%) and ITC (1.75%). Satyam Computer (down 1.59%), BHEL (1.33%), Hindustan Unilever (1.31%), Reliance Communications (1.06%), Wipro (0.88%) and HDFC Bank (0.86%) were the losers.

Buying continued in tier II and III stocks pushing Midcap and Smallcap indices to all time highs. BSE Midcap Index closed at 10,058.94 after touching high of 10,096.13. Among midcaps, Bombay Dyeing (up 19.11%), UCO Bank (15.11%), M&M Financia Services (11.34%) and ING Vysya (10.62%) posted significant gains.

BSE Smallcap Index ended 1.50 per cent high at 13,908.97. It touched a high of 13,998.01 and low of 13,628.65 In the small cap space, Batliboi and BSeL Infrastructure Realty and Paramount Communications gained 20 per cent each. Omnitech (up 15.98%), Surana Industries (13.82%) and Tanej Aerospace (12.67%) were the other smallcap gainers.

Amongst the sectors, Bankex out-performed other sectors by closing 3.13 per cent high at 11,870.49. The upside was led by midcaps like Canara Bank, Kotak Bank, Karnataka Bank and Allahabad Bank. Across BSE, 2,002 shares advanced and 926 declined.

(Courtesy: http://www.economictimes.com )

Sensex, Nifty end at new closing peaks

Mumbai, Jan 2 (PTI) New Year celebrations are continuing in the stock markets with benchmark Sensex scaling a new high of 20,465.30 points at closing level on the Bombay Stock Exchange, led by blue-chip stocks HDFC, Tata Motors and Reliance Energy The 30-share BSE barometer added 164.59 points today over its previous close of 20,300.71 points to set the new closing level record.

The index touched the day’s high of 20,529.48 points and a low of 20,077.40 points. The Sensex also hit an all-time intra-trade high of 20,529.48.

The broader S&P CNX Nifty of the National Stock Exchange also jumped 35.05 points to close at a new life-time high of 6,179.40 from previous close of 6,144.35.

The market surged in the late afternoon trade on sustained across-the-board value buying from investors after showing some pressure due to to weakness in Asian markets, which were down in the range of about 1.0 to 2.3 per cent at close.

The market breadth was strong following widespread gains in the small-cap and the mid-cap shares.

However, analysts said the market has reached the 20,500 resistance level and is expected to correct downwards.

Crediting the upsurge to technical factors, brokers said there was shortage of scrips while liquidity remained comfortable in the market.

Today’s rally was led by banks and realty sector with their indices moving up by 3.13 per cent and 2.93 per cent respectively. Stocks of the country’s largest private sector lender ICICI Bank surged by 2.88 per cent. BSE Bankex rose to 11,870.49 while the realty index was up at 13,419.67 points. PTI

TOP 5 GAINERS

Symbol, Curr.Price, % Change

BOMBAYDYEI, 900.85, 19.11

CANARA BAN, 394.20, 14.66

ING VYSYA, 374.05, 10.62

FDC, 52.15, 9.91

KOTAK BANK, 1,395.40, 8.17

TOP 5 LOSERS

Symbol, Curr.Price, % Change

FINOLEXCAB, 119.65, -5.53

JB CHEM&PH, 92.95, -5.39

MIRC ELTRN, 37.95, -4.89

ISPATINDUS, 78.70, -3.85

HCLTECHNOL, 314.40, -2.74

TOP 5 VOLUME STOCK

Symbol, Curr.Price, Volume

ISPATINDUS, 78.70, 19655560

SPICE TELE, 66.85, 15053632

APOLLO TYR, 61.55, 11252064

RPL, 228.15, 7107806

NTPC, 257.25, 6457113

TOP VALUE STOCK

Symbol, Curr.Price, Value (‘000)

REL, 2,365.50, 2307960.69

NTPC, 257.25, 1639658.36

RPL, 228.15, 1610627.30

ISPATINDUS, 78.70, 1546288.82

RELINCECAP, 2,595.80, 1351107.81

World Indices

NIFTY 6,179.40 0.57%

SENSEX 20,465.30 0.81%

DOW 13,264.82 -0.76%

NASDAQ 2,652.28 -0.83

FTSE 6,492.90 0.56%

NIKKEI 15,307.78 -1.65%

Mutual Funds – Top Performers from high-risk, high-returns category

Reliance Diversified Power Sector Fund, Equity-Sector Fund,Growth,Open Ended, 124.42

Reliance Diversified Power Sector Fund,Equity-Sector Fund,Bonus,Open Ended, 124.42

Taurus Libra Taxshield,Equity – ELSS,Growth,Open Ended,111.69

JM Basic Fund,Equity – Sector Fund,Growth,Open Ended,111.44

Standard Chartered Premier Equity Fund,Equity-Diversified,Growth,Open Ended,110.47

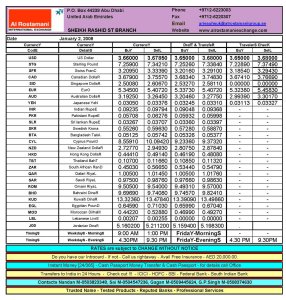

Daily Exchange Rates – Wednesday, 02 January 2008

Brought to you by

Al Rostamani International Exchange

Abu Dhabi

Phone: +9712 6223003

http://www.alrostamaniexchange.com

20 great stocks to buy in 2008

20 great stocks to buy in 2008

BS Smart Investor Team

December 31, 2007

Stock selection will be the key factor in determining returns in 2008, given concerns of a global slowdown and premium valuations in domestic markets.

Year 2007 saw the market deliver good returns amidst volatility, especially in the second half, thanks to global concerns. The BSE Sensex was up a good 46.6 per cent, helped by strong foreign and domestic inflows.

And what led to these inflows was none other than a strong performance by India Inc. For investors, the moot question is how will 2008 be? The answer is not simple given that none of the global concerns have eased, while the Indian rupee is still firm and India Inc is experiencing a deceleration in growth rates.

“Year 2008 will be difficult globally, although it is not yet known how deep the US downturn will be,” says Andrew Holland, managing director — strategic risk group, DSP Merrill Lynch.

While India’s vulnerability to global shocks has been put to test adequately over the past year, the overall macroeconomic growth remained strong owing to infrastructure, capital goods and real estate sectors.

Notably, the story is not likely to be very different in 2008 barring drastic surprises, which means that domestic consumption plays should remain in flavour.

By this logic, the most certain sectors are capital goods, financial services, infrastructure, power, logistics and oil, gas and energy sectors among others. Even among these sectors, not all stocks can be expected to do well, owing to the differences in business models and the individual strengths and weaknesses.

Further, in our selection, we have looked at the fundamentals of companies and their potential to deliver earnings growth of over 20-25 per cent.

But, while growth is a must, valuations too need to be fair, which is why we kept a tab on the price earnings to growth (PEG) ratio. Here, most stocks are trading at a PEG of less than 1 times based on FY09 earnings estimates, which ensures that the price is not exorbitant.

To ease your effort of picking the juiciest fruits from the orchard, we have handpicked a few likely winners of 2008. Read on.

Adlabs Films

With a strong presence across the entertainment industry value chain of content production, distribution, and exhibition, Adlabs becomes the choicest pick.

Domestic consumption and leisure spends will remain buoyant as disposable incomes rise across the country fuelling growth at Adlabs.

Adlabs produces and distributes films, and is a dominant player in the multiplex segment. It has also acquired 51 per cent stake in television content producer Synergy Communications, the maker of Jhalak Dikhhla Jaa and Kaun Banega Crorepati.

In the FM radio business, its subsidiary, which runs Big FM has 44 FM licenses across India. This could also become a value unlocking opportunity going forward.

Over the past three years, Adlabs has impeccably delivered a top line growth of over 100 per cent y-o-y, along with high profitability. In the September 2007 quarter, it raked in a whopping 69 per cent operating profit margin.

But going by the past numbers, operating margins have remained in excess of 50 per cent consistently, with net profit margins at over 22 per cent. The stock has appreciated three-fold since January 2007 and should do well.

Bank of Baroda

Bank of Baroda has a strong presence in western India — a key zone for retail and industrial growth– with equally good rural network.

Further, the bank is one of the few banks having a substantial international presence, which contributes 18-20 per cent to total business and 30 per cent to profits. This business is expected to rise further with the bank growing its global presence.

The bank has improved its fundamentals over the past several years on key parameters such as net interest margins (NIMs) and asset quality despite growing at a robust pace (asset growth CAGR of 19 per cent in FY04-07). Going ahead, the bank’s focus on NIMs backed by moderate growth augurs well.

Besides, its initiatives such as online trading services, and joint ventures in insurance and asset management, will help it create value for its shareholders.

Additional triggers could be in the form of consolidation within the public sector bank space. All this put together makes this stock, which is reasonably valued at 1.4 times its FY09 estimated book value, an attractive investment opportunity.

Bharat Bijlee

Though Bharat Bijlee has risen by a whopping 228.5 per cent in the last one year, even at current levels, it is inexpensive.

Consider this: The company has investment in various companies including Siemens, HDFC [Get Quote] and ICICI Bank [Get Quote].

At current rates, their combined value works out to Rs 317 crore (Rs 3.17 billion), or about Rs 560 per share.

Excluding this, the core business is valued at attractive valuations of 20 times FY08 earnings and 15 times FY09 estimated earnings.

The company is capitalising on the emerging opportunities in the power transformer sector, which accounts for 65 per cent of its total revenues with the balance from motors.

In the Eleventh Five Year Plan, a total power generation capacity of 78,000 mw is planned. This augurs well for transformer manufacturers such as Bharat Bijlee.

The company on its part has recently expanded its transformer capacity to 11,000 MVA from 8,000 MVA. The motors business is also witnessing 25 per cent growth and Bharat Bijlee has forayed into higher frame motors of up to 400 kw. All this put together make Bharat Bijlee a good pick.

Bharati Shipyard

Stocks of shipbuilding companies have been re-rated on the back of rising order book-to-sales to over seven times. The stock price of ABG Shipyard [Get Quote] has gone up 267 per cent, while Bharati Shipyard is up 107 per cent over the last one year.

The gain has been higher in the case of ABG Shipyard, thus stretching its valuation at 33 times its FY08 estimated earnings. Bharati Shipyard is still trading at a comfortable 18 times estimated FY08 EPS and 13 times FY09 EPS.

Also, its current order book of about Rs 4,639 crore (Rs 46.39 billion) (11 times its FY07 revenue) is strong enough for maintaining 50 per cent growth for the next three years.

Bharati is building a greenfield shipyard which will enable it to build six vessels up to 60,000 dwt (dead weight tonne) against 15,000 dwt currently by December 2008. This will enable Bharati to improve its execution speed and bid for more projects.

Besides, it is planning to invest Rs 2,000 crore (Rs 20 billion) along with Apeejay Shipping to set up a shipbuilding yard on the eastern coast, which will be commissioned in FY 2011. A relatively lower valuation and strong earnings visibility makes this stock an attractive investment.

Bhel

Today, the biggest constraint in the power sector is the supply of equipment, especially the critical power equipment required for the larger projects.

But, for Bhel, which commands about 65 per cent market share in the domestic power equipment industry, this provides long-term earnings visibility.

While competition is rising with new players like L&T and Chinese companies vying for a share, Bhel’s order book of Rs 62,400 crore (Rs 624 billion), almost 3.6 times its FY07 revenues, instils confidence. The successful acquisition of orders for super critical boilers and high technology gas turbines required for the bigger projects would only improve its order book further.

Considering the huge order backlog and the orders in pipeline, Bhel is expanding its capacities by 67 per cent to 10,000 mw by January 2008, which will further increase to 15,000 mw by December 2009.

Bhel is also expanding its forging and casting capacities and a new fabrication plant to help reduce its dependence on imports. These should also help lower costs in the years to come. Overall, a better industry outlook, strong order book and expansion of existing capacities will drive the stock from the current levels.

Bharti Airtel

With a mobile subscriber base of 51 million, Bharti Airtel is India’s largest mobile service provider. While it has added an average of 2 million subscribers a month in Q2, it is expected to crack the 100 million subscriber mark by FY10.

While the company has experienced good growth, its ARPU has fallen by 10 per cent over the last three quarters, much ahead of the 4 per cent decline experienced by Reliance Communications [Get Quote]. Even then, operating margins have improved, on the back of higher margin in broadband business and cost reduction.

Going forward, increase in scale of operations will keep costs in check. Capital and operating expenditure is also likely to come down after the formation of Indus, a tower infrastructure company, which will manage the tower infrastructure of Bharti, Vodafone and Idea.

A trigger for the stock could be the listing of Bharti Infratel, the tower division and which holds 42 per cent in Indus. Bharti Infratel already has 20,000 towers and plans to set up more.

RCOM will be the biggest threat for the company if it manages to soon roll out its GSM services across 15 circles. Additionally, any unfavourable outcome over the spectrum issue will have its impact; it could lead to increased investments in upgradation of existing equipment.

To conclude, Bharti’s revenues should grow by 35 per cent in the next two years on the back of subscriber expansion, start of Sri Lankan operations by March 2008, and launch of IPTV and DTH. A sum-of-parts valuation puts the per share value of Bharti at Rs 1,200, a 27 per cent upside from the current levels.

Blue Star

The central air conditioning major, Blue Star, is a key beneficiary of the economic boom in the country across sectors like IT/ITES, retail and telecom.

This is reflected in the strong CAGR of 32 per cent and 40 per cent in sales and operating profit respectively in the past three years.

Notably, such strong growth traction is expected to continue as the company is sitting on a strong order book position, which is at Rs 1,030 crore (Rs 10.30 billion) as on September 2007. It is likely to get repeat orders from its existing customers as they expand operations.

It is expanding its capacities by investing about Rs 60-70 crore (Rs 60-700 million), which will lead to economies of scale and rationalisation of costs leading to margin expansion. Its return on equity and return on capital employed, which were at 34 per cent and 26 per cent, respectively, in FY07, will only improve.

However, the full benefits will be reflected only from the next financial year. The macro factors too continue to be robust, with huge investments planned in all the above mentioned sectors.

Dishman Pharmaceuticals

Dishman, a pharma outsourcing player, is moving up the value chain from being a commoditised chemicals supplier to a research partner for innovator companies.

Its acquisition of Swiss-based Carbogen-Amcis (CA), which offers drug development and commercialisation services, has helped it tap into the client base of CA that includes seven of the top ten US drug companies.

With three projects in phase-III development, and likely to hit commercial production in two years, CA’s revenues are expected to grow 15 per cent annually to Rs 400 crore (Rs 4 billion) by December 2008.

Dishman caters to 50 per cent of Dutch pharma major Solvay Pharma’s requirement of eposartan mesylate, an anti-hypertension medication. Its acquisition of Solvay’s Vitamin-D business will boost revenues. Its foray into China to manufacture Quats, a catalyst, is also seen positively.

All these should help reduce Solvay’s share of 25 per cent in Dishman’s revenues going forward. With earnings expected to grow between 25-30 per cent in the next two years (Rs 12 in FY08, Rs 15 in FY09 and Rs 20 in FY10), the stock can deliver 28-30 per cent returns in one year.

Educomp Solutions

Educomp, the market leader in Kindergarten-12 education products, is a successful niche player. It has made some smart acquisitions, entered new areas. and garnered a client base of almost 6,000 schools across India besides, a small presence in Singapore and the US. Its first mover advantage makes it difficult for competition to catch up anytime soon.

Besides, the company has so far acquired and built the abilities to design and create content for schools, learning and school infrastructure management solutions, online teaching solutions, community building solutions and more recently into setting up its own schools.

Financially, Educomp’s top line has almost doubled every year and operating margins have been maintained above 50 per cent.

Considering the growth potential in the Indian education industry, Educomp is likely to keep its juggernaut rolling for the coming few years. In FY09, Educomp will double its top line again and grow its earnings by 75 per cent. Although there has been a concern over valuations, the consistent earnings growth justify the same.

HDFC

HDFC is an ideal play on the gamut of financial services. Besides market dominance in housing finance, it provides huge potential for value unlocking from its investment in banking, insurance and mutual fund subsidiaries.

The proposed UTI Mutual Fund IPO, stake sale by Reliance Capital [Get Quote] in its mutual fund entity and the probability of listing of insurance companies though in the long term, should provide triggers. Moreover, there is a possibility of a merger with HDFC Bank.

Its core business–housing finance will continue to do well. Its loan book is expected to witness a CAGR of 25 per cent over the next two years. Its net interest margins are expected to remain stable at around 3 per cent.

And, HDFC is known for its asset quality. HDFC’s stock trades at about 5 times FY09 estimated book value (adjusted for the value of its subsidiaries, which is about 30 per cent of HDFC’s market capitalisation), and is a worthy pick.

India Infoline

India Infoline is another company representing financial services, except the lending business.

Its stock price has grown more than fourfold in the last one year amid many positive triggers like capital raising for expansions, tie-up with strategic investors for investments in subsidiaries and restructuring of its various businesses.

Besides equity broking, it has expanded its product basket to include institutional equities broking, commodities broking, margin finance, investment banking and, distribution of life insurance, mutual fund and loans products.

It is investing towards building a strong distribution network (596 branches in 345 cities) and customer base (5 lakh clients) for its various services. Accordingly, the share of its traditional broking business of about 56 per cent in FY07 revenues is expected to come down over the years.

The stock trades at 51 times and 44 times estimated earnings for FY08 and FY09, respectively. While it looks cheaper than Edelweiss, in terms of market capitalisation to revenues, it trades at a higher P/E than Indiabulls [Get Quote].

However, it has the most de-risked business model compared to other players. Given India Infoline’s aggressive growth strategy, the stock is ideal for long term investors.

Jain Irrigation

Jain Irrigation, which is in the businesses of micro irrigation systems, food processing and plastic pipes and sheets, is a direct play on the growing emphasis on agriculture. Irrigation systems account for 30 per cent of its revenue. It’s revenues from micro irrigation have grown at 70 per cent annually.

Growth will be maintained on the back of its plans to launch new irrigation systems, higher replacement demand, focus on geographical diversification.

Jain’s five overseas acquisitions, including a 50 per cent stake in NaanDan of Israel, the world’s fifth largest micro-irrigation company, will help in terms of access to technology and access to large markets such as South Africa, US, and Europe.

In food processing, which accounts for 14 per cent of total income and grew by 74 per cent in FY07, Jain produces juices and dehydrated vegetables for companies like Coco Cola, Nestle [Get Quote], etc. This business to grow at healthy from hereon.

In plastic pipes and sheets, its products find application in agriculture (30 per cent market share) and telecom (70% share) among others and, should continue to grow at a healthy pace.

To sum up, Jain is operating in high growth areas, while exports too are expected to grow rapidly, which makes it a good investment case.

Jindal Saw

Jindal Saw, the most diversified Indian pipe manufacturer, makes submerged arc welded (Saw), seamless and ductile iron spun pipes, which are used in diverse applications like oil & gas and water-based infrastructure.

The company is expanding its capacities in phases which will bring economies of scale– longitudinal Saw pipes (by 25 per cent), helical Saw pipes (233 per cent) and seamless pipes (150 per cent) — by FY09. These expansions are well-timed due to strong demand for pipes on account of surging demand for oil and gas globally.

Over the next three-four years, global demand (including India), for Saw pipes is estimated at 200,000 km involving an investment of $60 billion.

Jindal Saw is likely to gain due to restructuring of the investment holdings in Jindal Group companies, wherein it has substantial investments in Nalwa Sons, Jindal Stainless [Get Quote], JSW Steel [Get Quote] and Jindal Steel & Power, are worth about Rs 2,200 crore (Rs 22 billion). Excluding the value of investments, the stock trades at 9 times its FY09 estimated earnings, which is attractive as compared with 17 times for Welspun Gujarat.

Larsen & Toubro

Reinventing itself and successfully developing new businesses are among L&T’s key strengths. That, along with the domestic infrastructure and global hydrocarbon investments, is responsible for the rising revenues and order book. It is now targeting a turnover of Rs 30,000 crore (Rs 300 billion) by FY10 as compared with Rs 18,363 crore (Rs 183.63 billion) in FY07.

Going forward, there is more business to come, as the government has estimated an infrastructure investment of $500 billion during the Eleventh Five Year Plan. Besides, a lot of money will also be spent by domestic players in the metal, oil and gas, power and other industries.

Little wonder, L&T’s order book has been rising. As of September 2007, the engineering and construction division had an order book of Rs 42,000 crore (Rs 420 billion).

Going forward, L&T is also focusing on the overseas markets and has targeted exports to increase to 25 per cent of 2010 sales. It is entering shipbuilding, railway locomotives, power generation and power equipment as well.

While all these investments in different businesses will help sustain future growth, the medium term continues to be robust. Some of it is already rubbing off positively on the share price. Although the stock seems richly valued, it can fetch good returns.

Maruti Suzuki

On the back of a sound foundation of existing products (13 models priced between Rs 2 lakh and Rs 15 lakh), strong distribution, efficient service network and new product launches, Maruti Suzuki will maintain its dominant position.

The company has 52 per cent market share by volume of the Indian car market and 62.5 per cent of the small car segment, which is commendable given the stiff competition from global majors.

Maruti grew at a scorching 18 per cent, compared with the 13 per cent recorded by passenger car market in H1 FY08. For eight months ended November 2007, sales volume was up 19.7 per cent to 500,108 vehicles led by 49 per cent growth in exports. Notably, exports are expected to grow 40 per cent annually for the next two years; its share in total sales is likely to move up to 12 per cent in 2010 from 7 per cent in FY07.

Maruti is already augmenting capacities by 3 lakh in a phased manner by FY10 to a million units. Besides, it has lined up Splash (A2 segment) and the concept car A-Star (A1 segment), while a Swift sedan is on the cards. These will help earnings grow by 20 per cent annually in the next two years. Aggressive pricing, enhanced margins on the back of improved product mix, indigenisation and scale benefits, will help Maruti do well.

ONGC

Oil exploration companies are set to benefit from the current high oil prices and firm outlook. India’s largest oil exploration company, ONGC is the best bet in this space. ONGC with interest in 85 domestic blocks including 52 offshore fields, has made 28 discoveries in the past two years, of which, 14 were made in FY08 itself.

Further, its 100 per cent subsidiary, ONGC Videsh has stakes in 26 blocks across 15 countries and is expected to be the key growth driver with its share in ONGC’s consolidated revenues and profits expected to rise to 20 per cent (14 per cent now) and 14 per cent (9 per cent now), respectively.

ONGC’s substantial interests in MRPL, Petronet LNG [Get Quote], GAIL and Indian Oil Corporation [Get Quote] are the topping. Moreover, the IPO of Oil India in the next few months could provide further triggers.

What also makes ONGC attractive is that it is the cheapest among its Asian peers trading at 10.1 times estimated FY09 earnings and enterprise value per barrel oil equivalent of about 7.5 times for FY09.

Going ahead, exploration successes especially in the KG basin and favourable announcement on various issues like sharing of subsidy burden, cess and deregulation in gas prices will be big positives.

Patel Engineering

Patel Engineering, which is having an order book of Rs 5,400 crore (Rs 54 billion) almost 4.8 times its FY07 revenues, would be the key beneficiary of the boom in the construction, power and real estate sectors.

Within power sector, the 11th Five Year Plan has an outlay of Rs 70,000 crore (Rs 700 billion), adding another 18,000 mw in hydropower generation. Patel Engineering has 22 per cent market share in the domestic hydropower construction, which accounts for 60 per cent of its current order book.

Also, the company has pre-qualified for new projects worth over Rs 6,000 crore (Rs 60 billion) as on September 30, 2007.

Besides, its entry into own power generation setting up of 1,200 mw thermal power plant at an investment of Rs 5,000 crore (Rs 50 billion) are positive triggers. Meanwhile, its core businesses including construction of dams, transportation and micro-tunneling are growing at a faster pace thus providing sustainable earnings growth.

The immediate trigger would come from its real estate business. Patel Engineering has transferred a land bank of about 1,000 acres spread across Bangalore, Chennai, Hyderabad and Mumbai to Patel Realty India, a 100 per cent subsidiary.

According to estimates, the real estate business is valued between Rs 500-520 per share. All of these make Patel Engineering an attractive investment.

Reliance Communications

Reliance Communications (RCOM) has a mobile telephony market share of 18 per cent and subscriber base of 38 million, which is rising by a million every month. And this should continue to rise as RCOM penetrates into smaller towns.

What’s more interesting is that despite concerns over declining, operating margins have improved to 42.2 per cent in Q2 FY08, thanks to the benefits of larger scale.

This is expected to improve further if RCOM gets the go-ahead to operate an additional 15 GSM circles as 65 per cent of passive infrastructure such as telecom towers, is common to both GSM and CDMA technologies and the investments in its existing networks will be incremental.

Additionally, it is the value unlocking in its subsidiaries that are likely to provide further triggers.

In 2008, RCOM is likely to announce a stake sale and subsequently list its tower subsidiary, Reliance Telecom Infrastructure, list its submarine cable subsidiary, FLAG Telecom, hive off of its SEZ and BPO businesses and the launch IPTV and DTH services by the first quarter of 2008.

Analysts estimate that a conservative sum-of-parts valuation based on FY09 numbers for RCOM comes to Rs 850-Rs 900 per share, which indicates an appreciation of 17-24 per cent from current levels.

Reliance Industries

In 2008, Reliance Industries’ (RIL) exploration and production (E&P) division, which accounts for 50 per cent of its sum-of-parts valuation, will start selling gas from the KG Basin. The only ambiguous aspect here seems to be the pricing of gas and settlement with the ADA group and NTPC.

Within a few months, Reliance Petroleum [Get Quote] will also start operations, all of which should lead to a jump in RIL’s profits.

Also, the bids for NELP VII will be awarded by July 2008. While further wins will add to reserves, new discoveries at existing reserves should further add to valuations and the possible de-merger of RIL’s E&P division would unlock value.

While the company is yet to prove its mettle in its retail and SEZ initiatives, given its track record managing mammoth projects, one can hope to see positive results here as well.

Notably, analysts maintain their bullish outlook on the core businesses. Refining margins for RIL, already the best among global players, should remain firm until FY11, while petrochemical margins are expected to be stable with good growth in volumes. At a P/E of under 12 times FY09 estimated core earnings, RIL is a worthy investment.

State Bank of India

SBI’s move to merge State Bank of [Get Quote] Saurashtra with itself has the potential to trigger the re-rating of public sector banking stocks by pushing the much needed consolidation process.

To further expedite consolidation, the boards of SBI and its other six associate banks are meeting in January to consider merger. Should that happen, SBI’s standalone balance sheet size will grow 1.5 times to Rs 8.20 lakh crore (Rs 8.20 trillion), almost double the size of ICICI Bank’s.

Also, its branch network will jump 50 per cent to 14,400 branches. But, the improvement in valuations (re-rating) should get a boost when the merged entity is able to rationalise costs and extract benefits from the merger.

SBI will raise Rs 17,000 crore (Rs 170 billion) through a rights issue that should provide fuel for future growth. In a competitive Indian banking business, it is important for banks to achieve size and scale to be globally competitive.

And for investors, it is more important to find such banks at reasonable valuations. SBI meets both these criteria. SBI’s stock trades at 2.2 times and 2 times its estimated consolidated book value for FY08 and FY09, respectively.

Further, SBI has investments in mutual fund and life insurance subsidiaries, which make valuations more compelling.

Research stocks well to become smart investor

Research stocks well to become smart investor

1 Jan, 2008, 1730 hrs IST,Prerna Katiyar, TNN

Guptaji has got a “hot tip” on a buzzing stop and he can hardly wait for the markets to open to place his order. He got this tip from his colleague, considered to be an old hand in stock markets. His colleagues stock ideas come from a couple of websites that claim to give recommendations on stocks that give high returns. So Guptaji was glad to see his transaction executed and was already making a rough estimate on his expected returns. To his surprise, within the next few trading sessions the stock shed nearly 30%.

Guptaji is not alone. The market seems to be flooded with information from news channels, newspapers, websites, hotlines, and even astrology-linked tips, not to forget our own friends and colleagues, continuously feeding us with stock picks. Retail investors and first-time investors are becoming a easy prey hoping to make quick bucks sitting at home.

Making investments based on these heard-on-the-street tips not only makes investor’s lose their hard-earned money, but also sends wrong notions that the stock market is meant to be understood by a niche few.

Ask any retail investor and one can hear innumerable stories about people who have made amazing gains as well as nerve-wrecking losses by speculative trading based on these hot tips. “When I started investing in 2004, I followed tips offered by a few websites and lost close to 40% of my principal. I was so disappointed that I stopped investing after that,” says a retail investor from Jaipur, Sudip Verma.

There have been instances when the people who gave stock recommendations through popular means were caught doing exactly the opposite so as to benefit themselves out of this contrarian situation. “It needs to be seen if the source himself is well informed or not. In most cases, one should avoid these tips unless one is sure of the authenticity of the source,” says SBI mutual fund manager Jayesh Shroff.

The idea here is to do your own homework before making any investments. Popular and quite easy ways to do this is to check the company’s website to accustom oneself of the company’s line of business, working model, management, performance over a couple of years, new products, latest announcements, etc.

Key numbers to judge the performance are rate of increase in revenue and net profit over past few years, return on equity, return on capital employed, dividend history, relative price to earning ratio (P/E) vis-à-vis its peers, price to book value (BV) and so on. Most of these numbers can be compared not just with the corresponding period of past quarters and years but also with the peers in the same sector.

In addition, one should take into account the market capitalisation of the company, as risk of manipulation is higher if you have decided to invest in a low-cap company. Large caps, because of their sheer size, are less prone to manipulative trading. In fact, attending the annual general meeting, if one gets the opportunity, is also a good idea as one gets the chance to talk to the management on their plans and can also get their individual doubts clarified.

It’s not that one should keep himself totally aloof from these recommendations. The stock ideas one gets from

various sources may act as a cue but needs to be validated by checking the fundamentals (and if possible the technicals) yourself. There are few genuine reasons to take a hint from these recommendations.

First, it’s not practically possible for a retail investor to carry out an extensive research on quality of management and future plans of the company. Second, there can be islands of opportunities among this vast sea of recommendations. So choosing the right stock and not betting on anything and everything that comes your way may be a good idea.

“An investor should first prepare his own trading strategy. Protecting one’s capital is of primary importance, and before taking any advise one should have the basic idea as to how much of it he is ready to lose if he runs into a sequence of losing trades,” says Deepak Mohoni, who gives stock recommendations for the short term. “Following a particular target is not a good idea, as the target either limits profits or is never reached. Traders should use stop losses and trailing stops instead,” he adds.

After all, we do ask the vendor to cut the watermelon and show if it is red or not before buying, compare prices of the same product across different brands, try a dress if it actually fits our size, and the like. Don’t we do that, Guptaji?

Sensex closes at 20,286 for 2007

Sensex closes at 20,286 for 2007

Saurabh Kumar for NDTVMond ay, December 31, 2007 (Mumbai):

Markets closed mixed on Monday, the last trading day of the year 2007, with the benchmark index Sensex at 20,287 making a gain of 0.4 per cent or 80 points. The 30-share index touched a day high of 20,484 levels.

In the broader markets, Nifty held up in green by 0.97 per cent. The 50-share index closed at 6,137 levels. While buying emerged in oil & gas, healthcare and real estate counters, information technology counters were hit.

�The oil & gas is a reliable space and anyone can invest money in these counters and relax as they will definitely reap benefit in long-term. Media and multiplex counters will also boom in 2008. Education is a booming space and more corporatisation is happening. I won�t be surprised to see schools getting listed,� said Rajesh Jain, Director & CEO, Pranav Securities.

�It is immaterial even if we close above the all time high or not, rather we should be satisfied that we are closing so near to it. As we move towards the Budget, the markets will saturate and we will have to be very selective about our scrip selection. There is going to momentum play in the first quarter,� said Anu Jain, Technical Advisor, The Omniscient Securities.

The Asian markets also closed mixed on Monday. While Hong Kong�s Hang Seng closed firm making a gain of 1.62 per cent, Japan�s Nikkei and South Korea�s Kospi closed in the negative territory by over 0.6 per cent each.

Bharti Airtel, Reliance Communications, Mahindra & Mahindra, NTPC, Ranbaxy and ITC Ltd led the positive sentiment in the BSE-30 pack. The stocks registered smart gains of over 1.9 per cent each.

Among the NSE-50 scrips, Tata Power Company, Zee Entertainment, BPCL, Idea Cellular and Cairn India were some of the key gainers; they firmed up by over 4 per cent per cent each.

However, Infosys Technologies, Ambuja Cements, HDFC, Nalco and Sterlite Industries were the few counters which lost ground. The stocks slipped into red by over 1.36 per cent each.

Healthcare firm

BSE healthcare index firmed up by 1.48 per cent or 64 points was the biggest gainer among the sectoral indices. Real estate, metal and oil & gas indices also gained ground.

FDC Ltd at Rs 47 surged 9.94 per cent or Rs 4.25 led the gains in the healthcare pack. Dishman Pharma (up 7.29 per cent), Matrix Laboratories (up 4.57 per cent), Fortis Healthcare (up 4.35 per cent), Opto Circuits (up 4.18 per cent) and Aventis Pharma (up 3.69 per cent) were some of the key gainers.

Buying was visible in real estate counters with Kolte-Patil Developers, Puravankara Projects, Indiabulls Real Estate, Akruti City and HDI firming up by over 2.79 per cent each.

Metal counters extended their gains Monday with Ispat Industries, Gujarat NRE Coke, Maharashtra Seamless, Jindal Saw, Jindal Stainless and SAIL gaining over 1.74 per cent each.

Action was also visible in oil & gas counters with HPCL (up 7.69 per cent), IOC (up 7.48 per cent), Cairn India (up 4.37 per cent) and Aban Offshore (up 2.69 per cent) emerging as some of the key gainers.

However, information technology counters lost momentum once again with NIIT Tech, Wipro, Tech Mahindra and I-Flex solutions shedding over 0.44 per cent each.

Daily Stock Movement – BSE – 1 January 2008

Market position as at 2 pm IST

TOP 5 GAINERS

Symbol,Curr.Price,% Charge

INDO RAMA,78.50,19.94

JB CHEM&PH,95.00,16.00

APOLLO HSP,598.90,14.02

EIH,202.00,9.46

MTNL,208.25,8.29

TOP VOLUME STOCK

Symbol,Curr.Price,Volume

RPL,227.00,7156172

ISPATINDUS,82.90,6864847

APOLLO TYR,57.10,4441374

MTNL,208.25,4411854

ASHOKLEYLA,52.30,3188885

TOP LOSERS

Symbol,Curr.Price,% Charge

CAIRN INDI,249.15,-3.32

AVENTIS PH,1,125.25,-3.25

GSK CONSUM,715.00,-2.81

ESSEL PROP,75.00,-2.79

DREDGINGCO,1,050.05,-2.74

TOP VALUE STOCK

Symbol,Curr.Price,Value (‘000)

REL,2,275.00,2070325.08

RPL,227.00,1624451.04

MTNL,208.25,918768.60

BRIGADE EN,405.00,762146.82

IDFC,231.65,645306.02

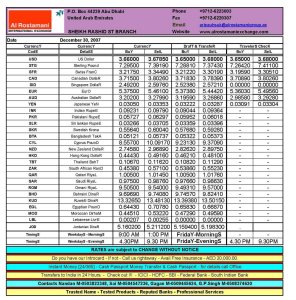

Daily Exchange Rates – Saturday, 29 December 2007

Brought to you by

Al Rostamani International Exchange

Abu Dhabi

Phone: +9712 6223003

http://www.alrostamaniexchange.com

HPCL sells Jan stem to Emirates National Oil Co

HPCL sells Jan stem to Emirates National Oil Co

27 Dec, 2007, 1316 hrs IST, REUTERS

SINGAPORE: Hindustan Petroleum Corp Ltd (HPCL) has sold via tender 25,000-30,000 tonnes of January-loading fuel oil to Emirates National Oil Co (ENOC) at an undisclosed price, traders said on Thursday.

The 380-centistoke (cst) cargo, of 4.0 percent sulphur and 0.998 density, is for loading on Jan. 14-16 from its Vizag terminal, on a free-on-board (FOB) basis.

HPCL last sold a similar lot, for Dec. 15-17 loading from Vizag at a discount of $20-21 a tonne to Singapore spot quotes, on an FOB basis. The cargo was also picked up by ENOC and was re-sold into the Singapore marine fuel market, the world’s largest, traders said.

Stocks to buy: Kotak Mahindra Bank, Titan Industries, Salora Intl, 3i Infotech, Colgate Palmolive

Stocks to buy: Kotak Mahindra Bank, Titan Industries, Salora Intl, 3i Infotech, Colgate Palmolive

28 Nov, 2007, 0719 hrs IST, TNN

Kotak Mahindra Bank

CMP: Rs 1,122.35

Target Price: Rs 1,363

Motilal Oswal Securities has initiated coverage on Kotak Mahindra Bank with a buy rating and a price target of Rs 1,363. “Kotak (Bank) is aggressively building up its banking franchise, with focus on affluent customers and retail services. Its asset management business should see exponential growth,” the Motilal Oswal note to clients said.

“Though its insurance business has been losing market share, we expect better utilisation of Kotak’s distribution strength to change this. We believe KMB deserves premium valuations, given the strong growth expected across its businesses, fast traction in earnings, and quality management,” the note added.

Titan Industries

CMP: Rs 1,531.70

Target Price: Rs 1,850

Merrill Lynch has initiated coverage on Titan Industries with a buy rating and a price target of

Rs 1,850, terming it a “high growth domestic consumption story.” “We expect Titan’s watch business to benefit from mix up-trading and distribution moving more towards high margin channel of ‘World of Titan’”.

“In jewellery, we expect volume growth to remain explosive at around 40% as Titan forays into second-tier cities with the new value format “Gold Plus”,” the Merrill note to clients said. “In the premium “Tanishq” format, larger stores and higher efficiencies should drive margins. Lastly, we expect the new venture of prescription eyewear to take off and account for 4% of EBITDA (earning before interest, taxes, depreciation and amortisation) FY10,” the note added.

Salora Intl

CMP: Rs 223

Target Price: Rs 312

Parag Parikh Financial Advisory Services has assigned a buy rating to Salora International with a price target of Rs 312. “The company derives 85% of its revenues from the telecom & infocom distribution business and more than 90% of the EBIT (earnings before interest and taxes) from the business of distribution, thus making it a clear contender for a re-rating from a CTV components manufacturer to a full-fledged distributor,” the PPFAS note to clients said.

“The company has active plans to get into retailing of products that it is already distributing; the modalities of the same will be out very shortly. The company is very well placed to show a topline growth of above 35% for some time in our expectations,” the note further said, adding that the recently initiated restructuring of the CTV components business will keep overall profitability intact.

3i Infotech

CMP: Rs 134.60

Target Price: Rs 175

ICICI Securities (I-Sec) has initiated coverage on 3i Infotech with a buy rating and a price target of Rs 175. “3i Infotech, with a balanced mix of software products and services (~1:1), has differentiated itself from peers by adopting a diversified business model with a strong foothold in high-growth areas.

With software services providing stability to revenue stream, products add non-linearity to the overall business model,” the I-Sec note to clients said. Additionally, the sharp rupee appreciation, which has baffled the whole software sector, is relatively a lesser concern for 3i Infotech as it derives around 31% revenues from the domestic market and the net dollar exposure is estimated to be less than 10%. Also, 3i Infotech remains comparatively aloof from other sectoral worries such as the subprime issue, impending economic slowdown in the US, wage inflation, attrition,” the note added.

Colgate Palmolive

CMP: Rs 410.35

Target Price: Rs 482

Citigroup Global Markets has assigned a buy rating to Colgate Palmolive with a price target of Rs 482. “Colgate’s business has demonstrated strong growth over the eight quarters, with sales growing in excess of 15%. It has gained share in rural areas through its ‘Cibaca’ brand and has also rolled out innovative toothpaste variants at the higher end, which have gained strong acceptance and helped accelerate growth,” the Citigroup note to clients said.

“With major capital expenditure behind it, and incremental tax and excise savings from its new plants, cash generation is likely to accelerate. We estimate about Rs 1,230 crore of free cash generation over the next three years, more than two times of what was generated over the previous three years and as such, dividend payout could increase,” the note added.

Disclaimer: The above stocks are picked up at random from research reports of brokerage houses. Investors are advised to use their own judgement before acting on these recommendations. ET does not associate itself with the choices.

You must be logged in to post a comment.