Month: April 2008

Red Bull Air Race – 10th & 11th April 2008 at Abu Dhabi Corniche

Do not miss the action, be there, watch live at Abu Dhabi Corniche

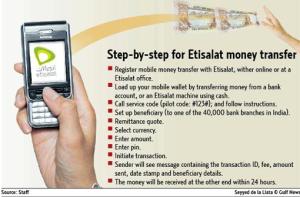

etisalat gears up to offer mobile remittance services

etisalat gears up to offer mobile remittance services By Nadia Saleem, Staff Reporter GULF NEWS Published: April 02, 2008, 00:01

Dubai: etisalat is poised to start offering mobile remittance services in June this year, a move that promises to help millions of expatriates send money in seconds instead of queueing at the exchange houses every month.

etisalat officials on Tuesday said it has started the mobile remittance pilot project to India in partnership with mashreq, Tata Communications, Idea Cellular and HSBC India.

It expects 350,000 users to avail the services next three years. Nearly 80 per cent of the UAE’s more than five million population are expatriates, the majority of whom remit money regularly.

Formal remittance flow in 2005 crossed $7 billion (Dh25 billion), making the UAE the second-largest remittance source in the Gulf after Saudi Arabia.

The company emphasised on micro transactions, which usually take place through unofficial channels. “Mobile money transfer will be a viable service for low-value transactions,” said Abdullah Hashim, vice-president, marketing, enterprise solutions, etisalat. “This service is modelled over existing remittance flows,” he added.

Registered users of the mobile money transfer service will be able to access it abroad through etisalat roaming service.

Officials, however, could not give any indication of the cost of this services. Electronic remittance service charges starts from Dh3 onwards.

The company said on Tuesday that it has no plans to compete with money exchanges but rather will complement them. In addition, the company intends to partner with such organisations in the future.

The new service designed to be cost-effective, convenient and secure will have low transaction costs. The pilot project will allow for feedback to develop the service features and pricing.

“In the current phase, selected participants of the pilot project will be able to transfer funds to over 40,000 bank branches in India,” said Hashim.

etisalat is working closely with leading banks, financial institutions and telecom operators in other countries to offer a comprehensive network of partners for the service. It is expected that etisalat customers in the UAE will have the first opportunity to use this service to send money to various countries including India, Pakistan, Bangladesh, Philippines Egypt, Jordan, Sri-Lanka, and Nepal.

Extension

The telecom operator plans to extend the service three more countries by the end of the year. In addition, the company is in the process of launching mobile banking, parking, ticketing, government payments and purchases in the UAE.

A mobile wallet (mwallet) will be provided when users register with the mobile money transfer service. The mwallet will act like a traditional wallet.

“The service enables to add value [credit] in the mwallet which can then be used for remittance,” said Amol Natu, manager, product marketing ebusiness. The company said yesterday that it is also working on salary transfer option based on mobile wallet offering.

Mubadala unit takes 20% stake in Shell’s oil venture

Mubadala unit takes 20% stake in Shell’s oil venture Staff Report GULF NEWS Published: April 01, 2008, 15:36

Dubai: Mubadala Development Company (Mub-adala) yesterday said its wholly-owned subsidiary Liwa Energy has purchased a 20 per cent stake in Shell’s current exploration and production ventures in Algeria.

Shell holds two production sharing contracts in the Reggane Djebel Hirane and Zerafa permits in Algeria where it is conducting an exploration and appraisal campaign in partnership with Sonatrach, the Algerian national oil and gas company.

The revised interests in the Reggane Djebel Hirane and Zerafa Production Sharing Contracts give a 25 per cent share to Sonatrach (carried interest during exploration), 60 per cent to Shell affiliates and 15 per cent to Liwa Energy.

The new agreement highlights Mubadala’s increasing interest in Algeria, where the company has already made a number of significant investments in the energy sector, including several power stations and oil and gas projects.

Among these is the Hadjret Independent Power Project, which represents over a fifth of today’s generation capacity in Algeria with initiatives including a natural cycle gas fired power station in Tipaza. Mubadala is also involved in the construction of the first Algerian aluminium smelter at Beni Saf.

The exploration agreement is part of a strategic alliance formed in 2005 between Mubadala and Shell to cooperate in the economic development of new and existing hydrocarbon resources, pursue research and development of economically viable and environmentally acceptable energy solutions in the Middle East and North Africa.

The agreement also provides Mubadala learning and development opportunities with Shell.

India will shift focus to Angola

India will shift focus to Angola

Bloomberg Published: April 01, 2008, 00:41

New Delhi : India, Asia’s third-largest consumer of oil, will focus on obtaining energy assets in Angola after failing to secure supplies closer to home.

“Angola is the next country where we are going to concentrate,” Indian Oil Minister Murli Deora said in an interview in New Delhi. “We lost because our bid wasn’t good enough” in previous auctions, he said. “We have learned from this,” the minister said.

State-run explorers from India and China have submitted bids for oil blocks in Angola as the world’s two most populous nations need imports to sustain economic growth. India’s oil shortage has spurred Deora to turn to Angola, Opec’s fastest-growing member with reserves equivalent to 11 years of India’s imports, after losing out to China in $10 billion of auctions.

India’s energy independence has been threatened because it hasn’t been able to increase production at home, where output from three-decade-old fields is declining. India will also compete for oil in Nigeria, Africa’s biggest producer, and Sudan.

“India has to acquire assets overseas. There is no other way,” said Prashant Periwal, an analyst at B&K Securities in London. “China has slowly and steadily spread across most of Africa and is sitting on huge resources. For fuel security, you have to take control of supplies.”

India has been beaten by China to auctions for energy assets in Kazakhstan and Myanmar in the past three years. India has offered to build ports and railways in Nigeria and Sudan, copying tactics used by China.

The South Asian nation hosted a two-day India-Africa conference in Nov-ember to discuss oil cooperation, where Deora offered to build refineries and pipelines.

India sought stakes of as much as 32 per cent in two fields in Sudan, R.S. Butola, managing director of ONGC Videsh, said during the November conference in New Delhi.

Deora will travel to Venezuela next month to complete an agreement to acquire a stake in fields in the biggest crude-exporting nation in the Americas.

The bidding has been delayed after Angola extended the deadline indefinitely.

Statistics: Growing demand

– India, the fastest-growing economy after China, estimates demand for oil will rise 62 per cent over the next five years to 241 million tonnes a year.

– ONGC Videsh Ltd., the overseas exploration unit of Oil & Natural Gas Corp, India’s biggest producer, will invest up to $356 million in a venture with state-owned Petroleos de Venezuela SA, to operate the San Cristobal area.

– ONGC Videsh and China Petroleum & Chemical Corp., Asia’s largest refiner, are among 43 companies that will bid to explore for oil in Angola, according to state-run Sonangol SA.

– The African nation is offering 11 licences for fields with a potential of 9.6 billion barrels of oil reserves, Sonangol said on its website.

There seems to be a good chance oil prices are going to stay hot

There seems to be a good chance oil prices are going to stay hot By Leah Bower, Special to Gulf News Published: April 01, 2008, 00:41

Summer is just around the corner, along with that seasonal hike in energy prices.

And since the traditional lull in oil prices that comes between winter’s cold and summer’s heat failed to, er, lull this year – we’ve seen record highs throughout the last month when the price per barrel should be at its lowest. And there seems to be a good chance that prices are going to stay hot, hot, hot.

We’ve heard it all before, but Opec and analysts are continuing to beat the “weak fundamentals” drum while prices shoot through the stratosphere.

For now, we can thank the unwelcome combination of the weak dollar and institutional investors searching for a safe haven as stock markets around the world fluctuate.

Commodities have become increasingly attractive as the United States economy officially slips closer to recession and the dollar continues to lose steam.

Witness gold spiking to an all-time high of $1,030.80 an ounce on March 17, and oil following suit with a record high of $111.80 a barrel at about the same time.

Even corn is seeing some record numbers. And with every price dip, talk surfaces that the bubble is bursting and prices will once again stabilise at reasonable levels.

However, if you watch the dips carefully they never go very low and are pretty short-lived.

Sure, oil is down a little at the start of the week. It has dipped a couple of times this year, but never very low and it has always shot back up.

Those investors who’ve been crowding into commodities also decided to shift gears a little on speculation that the US Federal Reserve might crack down on inflationary pressures, which could subdue the growth in commodity prices.

But all it took was a damaged pipeline in Iraq to send prices soaring last week, despite the fact that an insignificant – compared to overall Opec output – of black gold flows out of the war-torn nation.

There is no question that oil’s price is confounding, and even angering, everyone from Opec oil ministers to analysts who keep revising price projections downward, only to see their predictions pushed aside by what many are seeing as irrational investors.

Ali Al Yabhouni, the UAE Opec governor, pointed the finger at speculators earlier this week, telling an energy conference in Dubai that the market has sufficient supply of crude oil, and that Opec is not in the habit of catering to the appetites of investors.

Regardless of how you feel about Opec, and its current policy of keeping oil production at current levels, Al Yabhouni has a pretty strong point.

Why should Opec pump more oil when every indicator points to lower demand in the near future?

Reserves are rising and despite US President George W. Bush’s push for more crude on the market, the general consensus is that there is enough oil to go around despite strong demand from India and China.

Every indicator is also pointing to a recession in the United States. Studies show that American consumers are increasingly choosing to spend less as the housing market continues to head downwards, and eventually that will mean spending less at the pump.

Despite these factors, we’ve already seen the market climb towards and maintain what most analysts have considered an unreasonable price level, ignoring traditional fundamentals in the process.

Energy analyst Stephen Schork even vented to the Wall Street Journal that oil’s rise proves “once again that markets can remain illogical far longer than you or we can remain solvent.”

– The writer is a freelance journalist based in Alaska, USA.

New Abu Dhabi food safety rule to be announced

New Abu Dhabi food safety rule to be announced

By Binsal Abdul Kader, Staff Reporter GULF NEWS Published: April 01, 2008, 17:21

Abu Dhabi: A new food law with stricter provisions for food safety in the emirate will be officially announced on Thursday, Abu Dhabi Food Control Authority (ADFCA) told Gulf News.

The new law, which gives more powers to ADFCA, will be announced at a function at the Abu Dhabi Chamber of Commerce and Industry at 10am on Thursday, said a senior official.

The new law will define the rights and responsibilities of all stake holders in the food sector, which will be explained at the function after its official announcement, said Mohammad Jalal Al Reyaysa, Manager of Communication and Information Department at ADFCA.

Abu Dhabi holds camel beauty pageant

Abu Dhabi holds camel beauty pageant

Staff Report GULF NEWS Published: April 01, 2008, 12:42

Abu Dhabi: Thousands of well-groomed camels will line-up for the UAE’s first-ever camel beauty pageant this week.

It is part of the country’s first Camel Festival, which kicks off Wednesday, with a total of Dh 35 million in prize money up for grabs as well as 100 cars.

The participating camels are required to be of pure-bred origin and free from any contagious diseases. They are then divided into age groups and owners can participate with more than one camel as long as they can prove ownership.

Shaikh Mohammad Bin Butti Al Hamed, Head of the High Committee for the Festival, Representative of the Ruler at the Western Region, praised the status camels held in traditional Arab life.

“Although the camel has always been a companion to the Arab during his travel in the old days, today camels still play a part in our lives, as thousands of people continue to attend camel races and watch what is perceived as part of our heritage.”

Abu Dhabi pharmacies issued new directives

Abu Dhabi pharmacies issued new directives

Staff Report GULF NEWS Published: April 01, 2008, 00:42

Abu Dhabi: Health Authority Abu Dhabi (HAAD) has issued instructions asking pharmacies to have a licensed pharmacist on duty during business hours.

It also issued another circular informing all pharmacies that it is mandatory to use a new triplicate controlled prescription form.

A copy will remain with the pharmacy, another one will be handed to the patient and a third copy given to the insurance company.

Red Bull Air race in Abu Dhabi to kick off April 10

Red Bull Air race in Abu Dhabi to kick off April 10

posted on 01/04/2008

Ten days countdown to the long awaited festival, the Red Bull Air Race, with the first round of the World Series 2008 hosted by the Emirati capital Abu Dhabi for the fourth consecutive year. This first round comes under the patronage of H.H. Sheikh Hazza Bin Zayed Al Nahyan, and in cooperation with the Abu Dhabi Tourism Authority. Abu Dhabi Corniche will be the platform of this awaited event, drawing attention of all motor-sports lovers from around the world into the UAE capital. In addition to the air race, the organizing committee has also prepared a festival starting from April 7-9, 2008. The festival begins three days before the Qualifying and four days before the race day, gathering different attractions for all fans – Emirates News Agency, WAM

RTA announces Dubai Metro’s Naming rights project for stations and lines as world first

RTA announces Dubai Metro’s Naming rights project for stations and lines as world first

posted on 01/04/2008

Dubai’s place in marketing history looks set to be further enhanced with an innovative new project for its Metro, to be launched to business leaders soon. The Dubai Metro naming rights project gives companies and institutions the opportunity to put their name to 23 stations and two lines on the Metro, the first of which is set to open in September 2009 and the second in March 2010.

The Dubai Metro’s naming rights project is a world-first revenue model for public transport infrastructure and the first programme of its kind to help improve transport services with partnership funding raised through a naming rights initiative.

Managed by the emirate’s Roads and Transport Authority (RTA), naming rights will be offered to local and international companies wanting to anchor their association with Dubai. Each of the 23 stations available will have a unique value, calculated according to its location, anticipated passenger numbers and other variable factors.

Mattar Al Tayer, RTA Chairman of the Board and Executive Director said at the press launch of the project: “The ability to secure a station name from the outset is unique – no other Government in the world has planned naming rights as part of its transport infrastructure at conception stage. We expect this innovation to make its mark world-wide, and kick start a new marketing concept that sees governments raising funds to improve services, whilst giving companies a totally new platform for marketing, sampling and customer interaction.” Corporate partners will be able to leverage their naming rights with integrated marketing opportunities at the stations; a combination unseen to-date anywhere in the world.

Al Tayer also revealed that in addition to the 23 stations whose names will be available for sale, a further eight will be named after RTA partners which have co-funded the construction of the stations.

The naming rights sales effort will be undertaken by global sponsorship and event marketing specialists IMG, who had previously undertaken market research for the RTA to determine how the naming rights program could most effectively be structured. – Emirates News Agency, WAM

- ← Previous

- 1

- …

- 10

- 11

- 12

- Next →

You must be logged in to post a comment.