Month: January 2008

The 10 biggest falls in Sensex history

The 10 biggest falls in Sensex history

rediff Business Bureau

January 21, 2008

It is a Terrible Tuesday for the bourses. The Sensex saw its biggest intra-day fall today. The Sensex fell further to a low of 15,332, down 2,273 points from the previous close. The Nifty has fallen further to 4,470, down 738 points.

Trading was suspended for one hour at the Bombay Stock Exchange after the benchmark Sensex crashed to a low of 15,576.30 within minutes of opening, crossing the circuit limit of 10 per cent.

At the time of suspension, the Sensex was quoted at 15,576.30 points, plunging 2029 points (11.53 per cent) from Monday’s close.

Investors on Tuesday lost over Rs 6 lakh crore (Rs 6 trillion) within minutes of opening of the Bombay Stock Exchange, which was immediately suspended for an hour after the 30-share barometer index, Sensex, hit the circuit limit of 10 per cent.

This loss of Rs 6,54,887.85 crore (Rs 6.548 trillion) comes on top of over Rs 11 trillion loss suffered by investors on the Dalal Street [Get Quote] in the last six days.

The Sensex and Nifty saw its second biggest loss on Monday. Relentless selling saw the index crash to a low of 16,951 – down 2,063 points (10.8%) from the previous close, the largest ever loss in a single day.

The index shed 1408.35 points (7.1%) to close at 17,605.40, the biggest-ever loss in absolute terms and also the first-ever four digit loss for the index at close.

The Nifty lost 496.50 points (8.70%) to close at 5,208.80 points.

The Sensex saw its third biggest intra-day loss on October 17, 2007, when it plunged by 1,743 points. The Sensex hit a low of 17,307.90 points within minutes of opening, following which trading was suspended in the market for an hour.

The markets had crashed on the wake of Securities and Exchange Board of India’s (Sebi) proposal to tighten the rules for purchase of shares and bonds in Indian companies through the participatory note (PN) route.

Here are the 10 biggest falls in the Indian stock market history:

Jan 21, 2008: The Sensex saw its highest ever loss of 1,408 points at the end of the session on Monday. The Sensex recovered to close at 17,605.40 after it tumbled to the day’s low of 16,963.96, on high volatility as investors panicked following weak global cues amid fears of the US recession.

May 18, 2006: The Sensex registered a fall of 826 points (6.76 per cent) to close at 11,391, following heavy selling by FIIs, retail investors and a weakness in global markets. The Nifty crashed by 496.50 points (8.70%) points to close at 5,208.80 points.

December 17, 2007: A heavy bout of selling in the late noon deals saw the index plunge to a low of 19,177 – down 856 points from the day’s open. The Sensex finally ended with a huge loss of 769 points (3.8%) at 19,261. The NSE Nifty ended at 5,777, down 271 points.

October 18, 2007: Profit-taking in noon trades saw the index pare gains and slip into negative zone. The intensity of selling increased towards the closing bell, and the index tumbled all the way to a low of 17,771 – down 1,428 points from the day’s high. The Sensex finally ended with a hefty loss of 717 points (3.8%) at 17,998. The Nifty lost 208 points to close at 5,351.

January 18, 2008: Unabated selling in the last one hour of trade saw the index tumble to a low of 18,930 – down 786 points from the day’s high. The Sensex finally ended with a hefty loss of 687 points (3.5%) at 19,014. The index thus shed 8.7% (1,813 points) during the week. The NSE Nifty plunged 3.5% (208 points) to 5,705.

November 21, 2007: Mirroring weakness in other Asian markets, the Sensex saw relentless selling. The index tumbled to a low of 18,515 – down 766 points from the previous close. The Sensex finally ended with a loss of 678 points at 18,603. The Nifty lost 220 points to close at 5,561.

August 16, 2007: The Sensex, after languishing over 500 points lower for most of the trading sesion, slipped again towards the close to a low of 14,345. The index finally ended with a hefty loss of 643 points at 14,358.

April 02, 2007: The Sensex opened with a huge negative gap of 260 points at 12,812 following the Reserve Bank of India [Get Quote] decision to hike the cash reserve ratio and repo rate. Unabated selling, mainly in auto and banking stocks, saw the index drift to lower levels as the day progressed. The index tumbled to a low of 12,426 before finally settling with a hefty loss of 617 points (4.7%) at 12,455.

August 01, 2007: The Sensex opened with a negative gap of 207 points at 15,344 amid weak trends in the global market and slipped deeper into the red. Unabated selling across-the-board saw the index tumble to a low of 14,911. The Sensex finally ended with a hefty loss of 615 points at 14,936. The NSE Nifty ended at 4,346, down 183 points. This is the third biggest loss in absolute terms for the index.

April 28, 1992: The Sensex registered a fall of 570 points (12.77 per cent) to close at 3,870, following the coming to light of the Harshad Mehta securities scam.

The dos and don’ts of buying stocks

The dos and don’ts of buying stocks

Rajesh Kumar, Outlook Money January 19, 2007

So you’ve made up your mind to invest in the stock market. Having overcome initial inhibitions, you’re now looking to become a millionaire overnight. After all, if your friend A or your cousin B could do it, why not you?

For investment-innocents, here’s a shocker: It is not where you invest your money, but how you invest it that decides the profits. That is to say, stocks are only as good as the investor; they respond to the individual’s abilities and acumen. In that sense, stocks are quite distinct from consumer durables. You can reasonably expect a washing machine to perform as well for you as for your neighbour, but that is not the case for stocks, which are a different breed altogether.

So, instead of investment tips, here are some attitude tips.

Don’t commit large amounts of money or short-term money. Even if you can afford to take risks, we suggest you don’t commit large sums of money – at least not in the initial stages. It would be wiser to start with small amounts and increase your investments as your confidence and grasp of the markets grows. It is not easy to pick up the right stocks or keep track of them when you are starting out.

Also, don’t break FDs to invest in rising markets. Always invest the surplus, money for which you have no immediate plans. Equity, as an investment, carries in-built risk and volatility and investing short-term money may force you to quit at the wrong time.

Do be sceptical of self-proclaimed experts. As an investment ing�nue, stay away from self-proclaimed experts or overzealous advisers. The so-called ‘hot tips’ they offer to investors are largely short-term trading tips, which are very risky for a retail investor. Because the reaction time is limited, chances are you will end up losing wealth.

Similarly, TV gurus and the like are forever ready with “buy” recommendations; few, if any, come out with “sell” advisories for your advantage.

Further, expert recommendations often have vested interests. Recently, market regulator Securities and Exchange Board of India fined an expert for acting exactly contrary to his own recommendations. To curtail such rogue elements, the market regulator is planning a law to govern experts, who comment on the markets in the mass media.

Don’t trade for short-term. Short-term trading or day trading is very risky and not recommended for retail and small investors for two reasons. First, it requires lot of time, which small investors can rarely spare since it is not their primary business. Second, retail investors may not have the necessary skills and tools required for short-term and day trading. Do not try to time the markets: it’s one of the most difficult things to do.

Invest long-term in fundamentally strong companies. Our advice to retail investors is to invest long-term in fundamentally strong companies. Give your portfolio adequate time to grow. Do not panic in technical corrections. If you are invested in fundamentally strong companies, you are safe. We saw two sharp corrections in 2006, first in May-June and again in December. On both occasions, the market bounced back and crossed previous highs because the fundamentals were intact.

Don’t ignore stock fundamentals. There is no set formula for fundamental analysis. You have to study various indicators like sectoral growth, company growth – both top and bottomlines – and various ratios like price to earning ratio, price earning to growth, dividend yield, book value, price to book value, price to sales ratio, debt-equity ratio, return on capital employed, to name just a few.

If number-crunching is not your cup of tea, you must still investigate the nature, business and size of the company and its growth in the last three years – sales, profit and earning per share – all of which are accessible on the websites of stock exchanges.

Do not be tempted to buy small caps and penny stocks. The risk involved in small companies is huge, but higher risk may not necessarily lead to higher gain. That is not to say that you should ignore small companies completely, but at the same time you must have solid reasons for buying into them. And when you do, make sure they are only a small portion of your portfolio.

Do be critical of media reports. It’s tempting, when you are just about beginning to follow the jargon, to buy into glowing media reports about corporates. But they could be misleading. For instance, you may read of a company setting up a new plant. Such announcements usually push up prices in anticipation of earning growth.

Before you join the queue for their stocks, you need to understand the cost benefit of the new plant. Ask yourself a few questions: where is the money coming from�equity or debt? If it’s equity, how will it impact the EPS in the near future? If the source is debt, is the company in a position to leverage the increased debt? What will be the gestation period? When will the earnings really start coming in? What will be the return on capital employed?

Don’t follow other investors blindly. People often talk about their success in the stockmarket, rarely of their failures. Your friend may have made money in the past, but there’s no guarantee he will continue to do so in future.

If, however, he offers to share his stocks research with you, welcome the opportunity. It will help you build your own research, but remember it is not a substitute for your own investigation.

Do stay away from a large number of stocks. Investors generally hold a large number of stocks in the name of diversification. But this may not always be the case.

Harry Markowitz, known as the Father of the Modern Portfolio, warned investors: “Holding securities that tend to move in concert with each other does not lower risk.” A truly diversified portfolio, he said, comprises non-correlated asset classes that could provide the highest returns with the least amount of volatility.

If you are still looking to diversify within equity, do not go in for stocks of more companies than you can track regularly. Seven to 10 would be ideal, though, of course, this is a highly individual call. The biggest disadvantage of holding a large number of stocks is failing to quit at the right time.

Capitalise on this crash: Sectors to eye right now

Capitalise on this crash: Sectors to eye right now

2008-01-21 13:16:01 Source : CNBC-TV18

India is the worst performing market today and Japan’s Nikkei declined 3.865% or 535.35 points, Hong Kong’s Hang Seng tumbled 4.425% or 1115.12 points Singapore’s Straits Times slipped 3.23 and South Korea’s Seoul Composite fell 2.95%.

It is proving to be an extremely scary session for the markets as fall has continued further. There is panic selling in markets and nearing to hit a down circuit which comes in at 10% down. Now the Sensex and Nifty are down nearly 7%. Margin call is seen building up.

It has broken all technical and psychological levels. Both Sensex and Nifty has fallen 16% from their highs. Breadth has worsened and the advance decline ratio is over 1:50. According to analyst the scenario is similar to the May 2006 fall. There is pressure due to triggering of margin call. Nifty Futures is trading at 100 points discount.

Shashank Khade, VP – Portfolio Management Services, Kotak Securities feels that the value that is right now emerging is clearly in technology, in auto and in FMCG. Valuations are really cheap right now in these three sectors, he feels.

He said, “My sense is that the markets may tend to go ahead and rotate the sectors itself. The underperformance that you had seen in the last six to eight months may actually start looking good, because not only did they not participate on the way up, they have also participated on the way down, which clearly means that the valuations of these stocks have got much more interesting. Sectors, in this sort of space would include FMCG, auto, technology, which may actually become extremely cheap in terms of valuations. So, while the infrastructure stocks may continue their consolidation and correction, it could be that monies may actually get rotated into the other stocks, which haven’t participated at all.”

He adds that, “The value that is right now emerging is clearly in technology, in auto and in FMCG. It is a call as to how much of the negatives in these sectors per se have been factored into these prices. That is the biggest call here. In FMCG and auto, the growth has not been as strong and that is the reason why these stocks have been really down and under. But valuations are really cheap right now in these three sectors.”

Vibhav Kapoor of IL&FS said, “We like banking a lot. There is definitely value in banking, capital goods; infrastructure has been beaten down. But there is good value in some of those sectors. In fact we are basically avoiding cement, technology sector and global commodities, which are metals. Apart from these three sectors, we think there is a lot of value in many other sectors.

Jaywalkers to be fined in Abu Dhabi

Jaywalkers to be fined in Abu Dhabi

By Rayeesa Absal, Staff Reporter GULF NEWS Published: January 18, 2008, 23:12

Abu Dhabi: People caught jaywalking will soon be fined Dh50 after Abu Dhabi recorded 91 pedestrian deaths last year, mostly involving people running across busy streets, police said.

Police will start a campaign against jaywalking in the capital on Monday to try to stop deaths on the roads. Last year, 647 pedestrians were involved in traffic accidents, said the police.

“Fatalities have increased by 20 per cent,” said Colonel Adel Hamad Al Shamsi, Director of the Traffic Department. He urged people to cross streets only at zebra crossings. “Lack of attention while driving is also a major cause of accidents,” he said.

The safety campaign’s motto is, “Pedestrian safety is everyone’s responsibility.”

According to statistics, 584 accidents involving pedestrians occurred last year. Besides the 91 pedestrians who died, 91 others were seriously injured.

The figures show that 140 pedestrians involved in accidents were younger than 18. Eight teenagers died and 36 others were seriously injured.

There have been a number of deaths due to jaywalking in Dubai and the Roads and Transport Authority (RTA) is planning to spend more than Dh70 million to construct pedestrian crossings.

In Dubai alone, 56 pedestrian deaths were recorded in the first six months of 2007.

An RTA executive said that 17 pedestrian crossings will be constructed. The main reason pedestrians were killed is because they crossed dangerous roads, he said.

Fence

A number of deaths have been recorded on Emirates Road near a labour accommodation.

Shaikh Zayed Road was also a major site of pedestrian deaths until the RTA constructed a fence along it. But there are no pedestrian bridges except one near Emirates Towers.

The other dangerous spot where a number of pedestrian deaths have occurred is in front of Ansar Mall at the entrance to Sharjah.

Residents have been complaining of a lack of a pedestrian bridges being constructed.

Apple unveils super-thin laptop

Apple unveils super-thin laptop

REUTERS[ WEDNESDAY, JANUARY 16, 2008 10:20:34 AM]

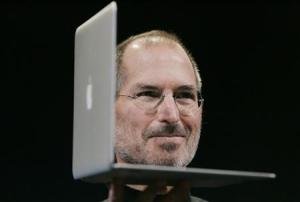

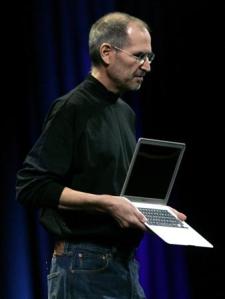

SAN FRANCISCO: Apple at the annual Macworld convention in San Francisco launched an aluminum-clad laptop, just three-quarters of an inch thick, seeking to bring a new computer to market with the same cachet as its iPod and iPhone devices.

Apple also said it would let people rent films over the Web with upgrades to its iTunes online media store, a technological challenge to a movie industry still largely focused on DVDs.

Shares of movie rental firms Netflix and Blockbuster fell sharply in response, and Apple’s own stock lost 5.5 per cent since the announcements were widely expected and Chief Executive Steve Jobs failed to conjure up any big surprises.

Jobs set a high bar last year by unveiling the iPhone. In addition, many times he ends presentations with by saying, “One more thing…” as a prelude to something unexpected. This year there was none.

Still, Jobs’ talents as a showman were on display when he took the stage at the event to cheers and applause from a few thousand software developers, customers and Apple employees.

He detailed a series of new products and services but saved the laptop, dubbed the MacBook Air, for last, drawing it out of a standard manila envelope to emphasise its slim dimensions.

Jobs said the new notebook was the thinnest available, measuring 0.76 inches at its thickest point and tapering to just 0.16 inches.

Priced from $1,800, the Air bridges the gap between Apple’s entry-level and high-end laptops, but analysts voiced concern that it could steal customers away from pricier products.

“It’s not really clear how many more incremental buyers you can drive, and there could be some cannibalisation,” said Shaw Wu, an analyst with American Technology Research.

MacBook laptops have been one of the company’s strongest products, with sales rising 37 per cent on the year in the fiscal fourth quarter ended last September.

New Apple users sought

Phil Schiller, Apple’s vice president of marketing, said the new laptop could appeal to a large swath of customers, including business travelers, those in education and people who wanted a more attractive computer at home.

“The goal overall is to continue to grow the business, so having another product in the line helps to do that. If the mix (of customers) changes a little bit, it doesn’t matter as long as we grow everything,” Schiller said.

Apple stock has nearly doubled since last year’s Macworld, and in late December topped $200 for the first time, driven by market-share gains by Mac computers, continued iPod strength, and enthusiasm over the iPhone, which Jobs said had sold more than four million units since its release last June.

Jobs showed off new iPhone features such as displaying a user’s location on a map and a way to customise the main screen with icons linking directly to specific parts of a website.

“The iPhone is not standing still. We keep making it better and better and better,” Jobs said.

But the company has struggled to find a big audience for Apple TV, a product originally designed as a Mac accessory for watching Internet video on a television and unveiled alongside the iPhone a year ago.

“It’s not what people wanted. We learned what people wanted was … movies, movies, movies,” Jobs said.

A new version of Apple TV will be able to connect to the Internet directly and download TV shows, movies and music through iTunes. Viewers will be able to choose movies directly from their TVs and Apple said viewers could start watching within seconds if they had a fast Internet connection.

Jobs announced deals with all six major movie studios and several smaller ones to offer movies for rental through iTunes, with new releases costing $3.99 and library titles $2.99. High-definition movies will also be available.

The revamp of Apple TV hardware combined with a broad selection of movies would give Apple an edge over competitors such as Amazon.com Inc, Netflix and Microsoft Corp, American Technology Research’s Wu said.

News Corp’s 20th Century Fox, Walt Disney Co, Time Warner Inc’s Warner Bros, Viacom Inc’s Paramount, General Electric Co’s Universal, Sony Corp’s Sony Pictures, Lionsgate, MGM and New Line have all signed on to Web rentals, Apple said.

“It’s too early to declare that this is going to be a big hit but this is arguably the best offering out there right now,” Wu said.

Apple shares fell to $169.04, while mail rental firm Netflix Inc shed 3.2 per cent, and top video rental chain Blockbuster Inc dropped nearly 17 per cent.

EMS-WWF – Taking Action Today For a Living Planet Tomorrow

WWF Project Office UAE

Overview of WWF UAE Project Office

Left, Prof Dillon Ripley presented with the Getty Prize for his protection of wildlife and natural areas and his rescue of the last three Arabian oryx, by Ms Ann Gettyon 28.10.1977. Middle Major Ian Grimwood, UK, Washington, USA

© WWF-Canon / WWF Intl

His Highness Sheikh Hamdan bin Zayed Al Nahyan

His Highness Sheikh Hamdan bin Zayed Al Nahyan

The WWF UAE Project Office was established in February 2001. Although it was the first WWF office to be set up in the Middle East, WWF’s association with the region can be traced back to the early 1960s where WWF helped establish the ‘Arabian Oryx World Herd,’ which succeeded in breeding the Oryx in captivity and returning them to reserves in Jordan, Saudi Arabia and Oman. Thanks to ‘Operation Oryx’ the Arabian Oryx was saved from extinction.

Emirates Wildlife Society (EWS)

EWS is a national (UAE) environmental NGO. EWS is established under the patronage of HH Sheikh Hamdan bin Zayed Al Nahyan, Deputy Prime Minister and Minister of State for Foreign Affairs, to implement conservation actions for the protection of local biodiversity. In the UAE, EWS works in association with WWF. The EWS is governed by a Board of Directors that also serves as the WWF UAE Project Office Board. EWS-WWF has been active in the UAE since the beginning of 2001 and has initiated several conservation projects in the region.

Role of the WWF UAE Project Office

The WWF UAE Project Office in Abu Dhabi established the first presence of WWF in a Gulf state. Today WWF also have offices in Dubai and in Fujairah.

The mandate of EWS-WWF covers:

• Species

• Habitats

• Climate Change

• Ecological Footprint

• Natural Resources

Our work in the region is implemented through conservation, education, awareness and policy recommendation

EWS-WWF has a valuable role to play in:

• Protection of biodiversity in key sites, species of special concern and ecological processes critical for the region

• Raising awareness and advocating actions to reduce the Ecological Footprint of the UAE (this is among the highest in the world per capita)

• Promoting a sustainable lifestyle in the UAE

• contribution to the shaping of a still evolving, institutional framework in the UAE, so that local, regional and global environmental issues are addressed together

• highlight the responsibility of the UAE on the international conservation scene.

Protection is Vital

The UAE and the region support a rich biodiversity, particularly in marine and coastal ecosystems. At the same time, developmental pressures are enormous. Habitats are destroyed and species are disappearing. The WWF UAE is making sincere efforts to assist in creating protected areas so that biodiversity may be preserved before it is subjected to irretrievable stress and damage.

More details can be obtained by visiting: http://www.panda.org

It’s a rainy rainy day

“Happy Rain” – that was the sms doing rounds today in UAE. Weather forecast for next two days is predicting more heavy rains. Schools are clossed in Dubai, Sharjah and Northern Emirates for tomorrow – news report says.

Incessant rains throw life out of gear in UAE

Incessant rains throw life out of gear in UAE

By Zoe Sinclair KHALEEJ TIMES 15 January 2008

DUBAI—A record rainfall for a January day in Dubai yesterday threw normal life out of gear in the emirate. While the rain led to widespread flooding across areas of Dubai, Sharjah and Ajman, partly submerging cars, disrupting traffic and forcing schools to close yesterday, five people were reported killed and many injured in separate road accidents in the emirates.

In all, more than 800 road accidents were reported in Dubai, Sharjah and Abu Dhabi yesterday morning.

Airports, however, were functioning normally, with minor delays, the maximum of about an hour for some flights. But the traffic jams and waterlogged roads meant many passengers missed their flights and some were even forced to walk to the airport to catch the flights.

Fujairah reported landslides and rock falls although the impact on streets was limited. The emirate also experienced power outages for short periods.

For the third consecutive day, particularly for Dubai residents, life was thrown off gears. Residents of Sharjah, Ajman and other emirates braced through the incessant rainfall and waterlogged streets in the hope of safe shelters of their homes.

More than 105mm of rainfall -20mm higher than the January record- was recorded in Dubai from Monday evening to 6pm yesterday, according to the duty forecasters at the Dubai International Airport meteorological office. The average rainfall for January in Dubai is 17mm.

Sharjah, with 100mm rainfall, was one of the worst affected, where residents alleged weak rain contingency plans. Many woke up to find their cars submerged in rainwater.

Rainwater brought the Ittihad and Emirates Road virtually to a halt, with the traffic across Sharjah and Dubai going into a spin for the third day straight.

Hundreds of municipality workers across the UAE worked non-stop through the day pumping water out of the roads. The Dubai Municipality (DM) earmarked Rashidiya, Jumeirah, Umm Suqeim, Abu Hail and parts of Shaikh Zayed Road as the worst affected areas in the city.

Senior officials of DM said they would be extending their rainwater drainage system within a year in coordination with the Roads and Transport Authority (RTA).

While a limited number of houses, mainly in Ras Al Khaimah, were affected by the floods, labour camps in low lying areas were badly impacted.

A construction worker at the Sonapur labour camp in Jebel Ali said the camp was flooded, with residents desperately trying to patch up leaking roofs with plastic and deal with the flowing sewage as bathrooms backed up. “There is water all around. The conditions of the bathrooms are particularly messy with all the sewage water coming out of it,” he said.

Workers at other labour camps across Dubai too complained of similar experiences.

Many students were unable to reach their schools in the morning, causing high number of absentees, reportedly forcing Dubai and Sharjah schools and universities to close and send students home.

Meanwhile, some residents enjoyed the rain yesterday with Dubai and Sharjah students celebrating a day off and farmers grateful for the much-needed water. Fujairah dams recorded good water levels, including 1.5m at Al Bosira Dam and 2m at Al Rakbi Dam. This signalled relief for farmers who were earlier complaining about the dry month of December.

In Al Ain, mercury dipped to 14 degree Celsius, as the city experienced light to heavy showers in the past 36 hours since Sunday morning.

Heavy showers are expected to continue in Dubai and Sharjah until midday today when it would begin easing. Temperatures are expected to remain between 15 and 18 degrees Celsius.

Authorities have issued warning to residents against venturing out to the sea because of rough swells. Residents and tourists have been advised not to travel to mountainous areas, valleys or wadis because of the danger of flash flooding.

RAINFALL RECORDED ON TUESDAY

ABU DHABI

· City: 21.2mm

· Dhudna: 90.6mm

· Falaj Al Moalla: 65.2mm

· Ghantuat: 59.2mm

· Jabal Mebreh: 58.2mm

· Masafi: 64.1mm

· Sir Bu Nair: 109.2mm

DUBAI

· Airport: 105mm

SHARJAH

· City: approx.100mm

FUJAIRAH

· City: 1.8mm

· Dhedhna: 46.2mm

· Dibba: 44.2mm

RAS AL KHAIMAH

City: 35.2mm

Rain lashes the UAE

Rain lashes the UAE

Gulf News web reportLast updated: January 15, 2008, 12:40

Dubai: Rain has lashed the UAE, causing widespread flooding across the country and traffic chaos.

While Abu Dhabi has largely escaped serious rain, the major roads in Sharjah have been completely flooded.

Weather forecasters have predicted more heavy rain for Wednesday morning.

On the roads, police diverted traffic away from the Emirates Road in both directions because the rain has made it impassable.

Police also cordoned off the National Paints roundabout in Sharjah, making it more difficult to access the major roads.

Several schools in Dubai and Sharjah have cancelled lessons for the day, while Our Own English High School in Sharjah cancelled exams.

Residents in the Al Nahada area of Sharjah have reported their cars being partially submerged by the heavy rains.

Flooding has also been reported at the Emaar office building near the Burj Dubai

Satellite dish antennas were blown off the roof tops in the Al Meena Bazaar area of Dubai

Traffic has also come to a standstill in Dubai with heavy flooding causing long delays on all roads.

In Bur Dubai, readers have reported widespread flooding, with residents having to wade through knee deep water to get to their cars.

You must be logged in to post a comment.