Month: January 2008

Knowledge Village to phase out use of halogen lamps

Knowledge Village to phase out use of halogen lamps

Staff Report GULF NEWS Published: January 03, 2008, 01:31

Dubai: As part of its efforts to conserve the environment and mitigate air pollution, Dubai Knowledge Village with the support of Sustainable Energy and Environment Division, have launched a campaign to phase out the use of halogen lamps in the Knowledge Village premises.

The Sustainable Energy and Environment Division (SEED) was created by Tecom Investments as one of its key initiatives under the Sustainable Development Policy, in line with the vision of His Highness Shaikh Mohammad Bin Rashid Al Maktoum, Vice-President and Prime Minister of the UAE and Ruler of Dubai, to make the emirate a sustainable place to live in.

Initiative

The Dubai Knowledge Village’s (DKV) initiative is estimated to reduce at least 174 tonnes of CO2 emission per year, which is equivalent to one passenger abstaining from 26 round trip flights from Dubai to New York.

Dr Ayoub Kazim, Executive Director, DKV and Dubai International Academic City, said: “[DKV] has come a long way since its launch in 2003. However, we know that success comes with a responsibility to contribute something of benefit to the community that has impacted our growth.

“We are expressing this through a series of initiatives towards safe guarding the environment, which we believe will not only have a sustainable impact on our immediate surroundings but also motivate others to emulate our example.

“In April 2007, we rolled out a comprehensive Energy and Water Conservation Programme that reduced CO2 emissions by 1,148 tonnes within seven months. Two months ago, we erected the first and largest solar tracker in the Middle East in front of DKV buildings on Al Soufouh road.

“This year, we have accomplished a major feat in switching off the halogen lamps in our indoor areas at DKV.

“Our next step is to involve our business partners in the initiative, and we are currently discussing the extension of the programme to their offices,” said Dr Kazim.

Ali Bin Towaih, Director, Seed, said: “We are extremely pleased with the commitment that DKV has shown toward this project, which has already generated sound results. Switching off the halogen lamps not only helps reduce energy consumption, it also makes indoor areas cooler and comfortable by eliminating the harsh glare that is emitted by the lamps.

“We hope the initiative will encourage the participation of every facility in Dubai as studies have shown that approximately 270,000 tonnes of CO2 emission can be stopped from reaching the atmosphere if everyone switches off or replaces their halogen lamps, using of course, certain assumptions and conservative extrapolations.”

SEED has carried out several sustainable development initiatives across all entities of Tecom Investments, while playing a vital role in setting up the Energy and Environment Park (Enpark) as a comprehensive eco-friendly community for both commercial and residential use.

One-year ban on workers who leave country without cancelling visa

One-year ban on workers who leave country without cancelling visa

By Ahmed Abdul Aziz (Our staff reporter)/KHALEEJ TIMES 3 January 2008

ABU DHABI — The workers who had left the UAE without completing the formalities for cancellation of their visas will face a one-year ban from entering the country, according to Obaid Rashid Al Zahmi, Assistant Undersecretary of the Ministry of Labour (MoL).

During the Open Day session at the MoL, Al Zahmi met around 45 people, including PROs, owners of firms and workers to find solutions to their problems.

A worker’s request to reimburse the fees charged for issuing work permit to him was rejected by Al Zahmi as he had left the company during the probation period.

When a PRO of a company demanded refund of the work permit fees and the bank guarantee, Al Zahmi said the ministry would refund any fees which the companies were forced to pay due to mistakes of the MoL staff or any system snag.

8 guidelines to make money from IPOs

8 guidelines to make money from IPOs

There are basically two ways in which you can buy shares: you can either buy them from the stock market, or you can apply for them in a public issue. The stock market is a secondary market where shares are bought and sold, whereas the primary market is one where companies issue shares for the first time.

When a company raises funds by issuing new shares or debentures for sale to the public, it is called a public issue, or an IPO (initial public offering). Such new shares and debentures are called new issues.

New issues of capital can be made both by existing companies as well as by new companies. Bonus shares and rights shares are also new issues but since they are only issued to existing shareholders of the company, they are not called public issues.

Why IPOs are profitable?

Public issues provide you with an opportunity for picking up shares at relatively low prices. Newly formed companies usually offer their shares for subscription at par values, whereas existing companies price their new issues at levels which are sometimes as much as 20 to 30 per cent lower than the market price of their existing shares.

For example, new issues priced at Rs. 12 to Rs. 15 per share may be quoted as high as Rs. 20 to Rs. 25 per share in the secondary market soon after their listing on the bourses.

Similarly, shares issued at par by new companies also quote at high premiums soon after they get listed on the stock exchange. For example, in early 2004 public issues of Maruti Udyog, Indraprastha Gas and Divi’s Labs listed at high premiums.

Equally, most companies, which went in for IPOs in 2005 and 2006 did well. In most cases, the initial days after listing saw the stock prices moving well above the listing prices before settling down in a price range.

Many companies, which listed during this period gave double digit returns, some companies like Indiabulls, Bharati Shipyard, India Infoline. PTC India Limited, Shoppers Stop, Sun TV Limited, Suzlon Energy and Tulip IT Services even gave triple digit returns.

This is the main reason why public issues are so popular with investors; they offer opportunities for making quick money which few other forms of investment can hope to match, match particularly during the market’s bull phase.

The only snag lies in getting a firm allotment of shares. Since most good public issues are heavily oversubscribed, lots have to be drawn and only a few of the applicants succeed in getting a firm allotment. Sometimes the allotment is done on a proportionate basis.

Therefore, you should consider yourself lucky if you get an allotment of even a small number of shares. It is with this background in mind that you should calculate the pros and cons of applying for IPOs.

How to apply for an IPO?

IPOs are generally given widespread, nation-wide publicity through advertisements in newspapers and magazines well before the date fixed for the opening of their issues. These advertisements, along with the other highlights of the issue, give the names and addresses of brokers and the bankers to the issue from whom you can get copies of the prospectus and application forms. If you write to any one of them, they will send you the prospectus and application forms free of cost.

The prospectus is a document inviting the public to purchase or subscribe to the shares of the company. It contains all relevant information you may need to decide whether a company is worth investing in. It would, therefore, be in your interest to read a company’s prospectus carefully before applying for its shares.

The subscription list is required to be kept open for a minimum of three days and a maximum of ten days. Since most of the IPOs are oversubscribed, the subscription list is usually closed immediately after three to five days.

You have to submit your application form and the stipulated application money to any one of the banks or their branches listed on the reverse of the application form. Applications, whether handed personally or sent by post, should reach the bank within the period during which the subscription list remains open.

If you are lucky and get an allotment, the company will send you an allotment letter which will inform you that shares allotted to you have been credited to your demat account.

Nowadays, for IPOs with an issue size of Rs 10 crore (Rs 100 million) or more, shares are issued only in the demat form. For IPOs with an issue size of Rs 100 crore (Rs 1 billion) or more, shares are issued only through the book building process.

Where the IPO is issued through the book building process, reservations are made for QIBs (qualified institutional buyers), non-institutional buyers (large investors), and retail investors who apply for less than Rs 50,000 worth of shares.

What exactly is book building? Book building is a process whereby the demand for a share is ascertained so that it can be issued at the maximum price. Before the opening of the public issue, the lead manager to the issue announces a price band in which the company plans to allot the shares.

For example, in the case ONGC’s [Get Quote] public issue in March 2004 the price band was Rs. 680 to Rs 750 per share. After the issue, the cut-off price is fixed in such a manner that all the shares are offloaded to the QIBs and the public either at, or above, the cut-off price. In this way the company gets the maximum price for its shares.

Companies cannot allot shares arbitrarily. They do so in consultation with the stock exchange authorities. The principles on which allotment is done are heavily weighted in favour of large applicants.

If you are living in a city where one or more bank branches have been designated for accepting application forms, you should give in your application only on the third, or closing, day of the subscription list.

On the first two days you should visit the concerned banks for making an on-the-spot assessment of the public response to the issue. If the public response is poor, then your chances of getting a firm allotment are brighter.

On the other hand, if the public response is very heavy, then your chances of getting an allotment will obviously be very low and it may not be worthwhile to apply at all. The enthusiasm with which the public responds to a particular issue will also give you an idea of the premium the shares are likely to subsequently command after listing.

The greater the public interest in any share, the higher will be the price at which it is later likely to be quoted in the stock markets.

The gap between the issue price of a share and the price at which it is initially quoted on the stock exchange is in the nature of a windfall gain. Should you get a firm allotment in any issue, don’t miss out on the opportunity to encash these gains unless you want to retain the share as a long-term investment for tax purposes.

If you sell a share at a premium soon after it is allotted to you, your money is freed for recycling in other new issues and you can maximise the returns on your investments in public issues.

Guidelines for investing in new issues

New issues can be divided into two broad groups:

New issues of newly formed companies, and

New issues of existing companies.

New issues of existing companies are, by and large, very good investments. They provide an opportunity for acquiring shares in ongoing profit-making companies at relatively low prices. On the other hand, all new issues of newly formed companies are not good investments.

You have to be careful in selecting a new company to invest in, as the incidence of failure among these is quite high. We give below some guidelines, which should help you select the right new issues for investment:

Don’t invest blindly in a company having unknown and untried promoters. First study the performance of other companies set up by the same promoters. If these have done well, then chances of the new one doing well are also high.

Don’t invest in a company, which is not ready to start business operations. This will help you avoid investing in companies, which may have long gestation periods before business operation can commence.

Invest in companies that have something new to offer. Companies introducing a new product or industrial process for the first time, companies proposing to manufacture a product which is currently being imported, companies introducing a technologically advanced or better quality product, or companies venturing into new areas are likely to be better and more remunerative investments.

Invest in companies that operate in high-growth sectors of the economy. The incidence of failure is likely to be lower for such companies.

Avoid investing in very small companies.

Check the reputation and market standing of the foreign collaborator, if there is one. For example, new issues of Vesuvius India [Get Quote] and Birla Ericsson evoked a very good response from investors because of the excellent international reputation of their parent companies.

Companies where the foreign collaborator has an equity stake are often good investments. Foreign collaborators do not readily opt for an equity stake in any company unless they are confident of its bright future prospects.

Do apply for the mega issues of well-known profit-earning companies. The sheer size of such issues ensures better chances of getting a firm allotment. This is what happened in the public issue of the State Bank of India [Get Quote]. The bigger the size of the issue, the better will be your chances of getting a firm allotment.

Excerpt from Profitable Investment in Shares by S S Grewal and Navjot Grewal.

S S Grewal was a practicing investment consultant with an educational backgrand spanning science, engineering, literature, and economics. Navjot Grewal is a specialist in industrial psychology and a keen investor on the stock markets

Money Matters – End of Day Review – Wednesday, 2nd January 2008

Money Matters – End of Day Review – Wednesday, 2nd January 2008

Indices close at all-time high

2 Jan 2008, 1711 hrs IST,INDIATIMES NEWS NETWORK

MUMBAI: Short covering and renewed buying towards end of the session saw key indices close at all-time highs. Banking shares remained in the lime light while midcaps and smallcaps continued to rally.

Bombay Stock Exchange’s Sensex closed at an all-time high of 20,465.30, up 164.59 points or 0.81 per cent. In the day, it touched an intra-day high of 20, 529.48 and low of 20,077.40. National Stock Exchange’s Nifty ended at 6179.40, up 35.05 points or 0.57 per cent. It hit an all-time high of 6197 and low of 6060.85 in the day.

Biggest Sensex gainers were Reliance Energy (up 4.09%), Tata Motors (4.06%), HDFC (3.81%), ICICI Bank (3.42%), Cipla (2.76%), Hindalco Industries (1.9%) and ITC (1.75%). Satyam Computer (down 1.59%), BHEL (1.33%), Hindustan Unilever (1.31%), Reliance Communications (1.06%), Wipro (0.88%) and HDFC Bank (0.86%) were the losers.

Buying continued in tier II and III stocks pushing Midcap and Smallcap indices to all time highs. BSE Midcap Index closed at 10,058.94 after touching high of 10,096.13. Among midcaps, Bombay Dyeing (up 19.11%), UCO Bank (15.11%), M&M Financia Services (11.34%) and ING Vysya (10.62%) posted significant gains.

BSE Smallcap Index ended 1.50 per cent high at 13,908.97. It touched a high of 13,998.01 and low of 13,628.65 In the small cap space, Batliboi and BSeL Infrastructure Realty and Paramount Communications gained 20 per cent each. Omnitech (up 15.98%), Surana Industries (13.82%) and Tanej Aerospace (12.67%) were the other smallcap gainers.

Amongst the sectors, Bankex out-performed other sectors by closing 3.13 per cent high at 11,870.49. The upside was led by midcaps like Canara Bank, Kotak Bank, Karnataka Bank and Allahabad Bank. Across BSE, 2,002 shares advanced and 926 declined.

(Courtesy: http://www.economictimes.com )

Sensex, Nifty end at new closing peaks

Mumbai, Jan 2 (PTI) New Year celebrations are continuing in the stock markets with benchmark Sensex scaling a new high of 20,465.30 points at closing level on the Bombay Stock Exchange, led by blue-chip stocks HDFC, Tata Motors and Reliance Energy The 30-share BSE barometer added 164.59 points today over its previous close of 20,300.71 points to set the new closing level record.

The index touched the day’s high of 20,529.48 points and a low of 20,077.40 points. The Sensex also hit an all-time intra-trade high of 20,529.48.

The broader S&P CNX Nifty of the National Stock Exchange also jumped 35.05 points to close at a new life-time high of 6,179.40 from previous close of 6,144.35.

The market surged in the late afternoon trade on sustained across-the-board value buying from investors after showing some pressure due to to weakness in Asian markets, which were down in the range of about 1.0 to 2.3 per cent at close.

The market breadth was strong following widespread gains in the small-cap and the mid-cap shares.

However, analysts said the market has reached the 20,500 resistance level and is expected to correct downwards.

Crediting the upsurge to technical factors, brokers said there was shortage of scrips while liquidity remained comfortable in the market.

Today’s rally was led by banks and realty sector with their indices moving up by 3.13 per cent and 2.93 per cent respectively. Stocks of the country’s largest private sector lender ICICI Bank surged by 2.88 per cent. BSE Bankex rose to 11,870.49 while the realty index was up at 13,419.67 points. PTI

TOP 5 GAINERS

Symbol, Curr.Price, % Change

BOMBAYDYEI, 900.85, 19.11

CANARA BAN, 394.20, 14.66

ING VYSYA, 374.05, 10.62

FDC, 52.15, 9.91

KOTAK BANK, 1,395.40, 8.17

TOP 5 LOSERS

Symbol, Curr.Price, % Change

FINOLEXCAB, 119.65, -5.53

JB CHEM&PH, 92.95, -5.39

MIRC ELTRN, 37.95, -4.89

ISPATINDUS, 78.70, -3.85

HCLTECHNOL, 314.40, -2.74

TOP 5 VOLUME STOCK

Symbol, Curr.Price, Volume

ISPATINDUS, 78.70, 19655560

SPICE TELE, 66.85, 15053632

APOLLO TYR, 61.55, 11252064

RPL, 228.15, 7107806

NTPC, 257.25, 6457113

TOP VALUE STOCK

Symbol, Curr.Price, Value (‘000)

REL, 2,365.50, 2307960.69

NTPC, 257.25, 1639658.36

RPL, 228.15, 1610627.30

ISPATINDUS, 78.70, 1546288.82

RELINCECAP, 2,595.80, 1351107.81

World Indices

NIFTY 6,179.40 0.57%

SENSEX 20,465.30 0.81%

DOW 13,264.82 -0.76%

NASDAQ 2,652.28 -0.83

FTSE 6,492.90 0.56%

NIKKEI 15,307.78 -1.65%

Mutual Funds – Top Performers from high-risk, high-returns category

Reliance Diversified Power Sector Fund, Equity-Sector Fund,Growth,Open Ended, 124.42

Reliance Diversified Power Sector Fund,Equity-Sector Fund,Bonus,Open Ended, 124.42

Taurus Libra Taxshield,Equity – ELSS,Growth,Open Ended,111.69

JM Basic Fund,Equity – Sector Fund,Growth,Open Ended,111.44

Standard Chartered Premier Equity Fund,Equity-Diversified,Growth,Open Ended,110.47

Diversity lessons from Taare Zameen Par

The moment of the year 2007 for me was the evocative scene in Aamir Khan’s Taare Zameen Par where the young protagonist defies all the odds and walks up shyly to receive an art prize, thereby demonstrating that every social and intellectual shortcoming can be overcome through genuine appreciation of potential.

So too, leaders in organizations can build stars if they are able to look beyond the appeal of ordinary success in pre-defined criteria such as a management degree from the right school, perfect articulation, polished dress sense etc. This may mean nurturing the stellar young woman returning after a career break to have children, offering tailor-made opportunities to those with specific handicaps such as blindness or being wheelchair bound, or identifying those who for reasons of financial difficulty, may not have benefited from the final polish of the top business schools.

Indeed, modern organisations can no longer afford to overlook the capabilities of those historically run over by the rat race. Recent studies by the Organization for Economic Cooperation and Development (OECD), whose developed country members have of late suffered from declining productivity and ageing, shrinking populations, underscore this fact. Countries that have adopted women and family-friendly work practices including flexible working, such as Norway and Finland, have shown remarkable improvements in both business productivity and birth rate, as women find balancing career progression with child-rearing more manageable. On the other hand, Italy, with its traditional domestic values and macho corporate environment, has witnessed declines in both.

In the knowledge sector in our country, a lot is being to done to correct the gender imbalance that normally pervades all organisations in the corporate sector.

However, one identified factor that can come in the way of sustained growth is the availability of manpower of the right quality and numbers – the perennial refrain of poor quality of engineers and other technical graduates is not going to disappear and industry chieftains need to explore other avenues to find the talent they need to fuel growth of both the IT and business process outsourcing (BPO) sectors. Early experiments by progressive organisations like Satyam through their rural empowerment programme and the Thermax-Zensar-Forbes Marshall connsortium supported by Dr Reddy’s Foundation have focused on creating employability for urban slum children and demonstrated that the talent that exists at the bottom of the socio-economic pyramid can be tapped for individual and business benefits.

There is no doubt that a greater degree of effort is required to make worthy knowledge workers out of the weaker segments of society but the results can make this effort truly worthwhile, not just through the satisfaction that each success story can bring but also by the sheer scale of new employment that is feasible if one looks beyond the traditional talent pools for future resources. Can we overcome our very own brand of corporate dyslexia and put new meaning into the lives of millions of our countrymen?

Ganesh Natrajan

Deputy Chairman & MD, Zensar Technologies

Adnoc vows to protect environment

Adnoc vows to protect environment

posted on 31/12/2007

The Abu Dhabi National Oil Company (Adnoc) has pledged to protect the environment by putting in place internal standards that push the company to decrease its impact on the earth. The government-controlled company, one of the largest oil producers in the world, made the commitment at the Arab Corporate Environmental Responsibility Summit organised by the Abu Dhabi Environment Agency and other local and international organisations.

“Adnoc and its group of companies are fully committed to environmental protection through a set of laws, corporate policies and codes of conduct,” said Ali Rashid Al Jarwan, general manager, ADMA-OPCO. He said leadership, commitment, policies, laws, management systems and corporate social responsibility form a strong bond that helps the group to shoulder its environmental responsibility. “We use the latest environmental management systems to ensure continuous improvement,” he said, adding that one of the major achievements of the group is the success made towards achieving a zero-flaring goal through upgrading facilities.

Meanwhile, the Abu Dhabi Environment Agency has urged all businesses in the emirate to live up to their promises concerning the environment and to take preventative measures to protect the earth. The agency said the Arab Environment Ministers Council has approved last month’s Abu Dhabi Declaration on Corporate Responsibility and Cleaner Production, which called for the private sector to support environmental protection efforts.

More than 120 chief executives, representing major business sectors from the Arab world, attended the summit and made commitments to take responsibility for the environmental costs associated with their businesses and to work towards green alternatives. “The protection of the environment is the responsibility of all business sectors. They have to contribute to environmental protection efforts and need to invest towards this,” Majid Al Mansouri, secretary-general of the Environment Agency, told Emirates Business.

In order to achieve this goal, he said, the agency is working with different sectors to implement an Environment, Health and Safety policy and the Environment, Health and Safety Management System at the emirate level so that sustainable development is integrated into every step of corporate strategies. “Financial achievement should not be the only goal of companies. Their corporate responsibilities should include environmental protection and social development. The environment, health and safety management must be considered in any new project,” Al Mansouri said. (Emirates Business 24|7)

IPIC awards 460 million dollars contract

IPIC awards 460 million dollars contract

posted on 02/01/2008 – Emirates News Agency, WAM

International Investment Company IPIC said Monday it awarded contracts worth 460 million dollars to three companies to supply pipes for a domestic crude oil export pipeline linking Abu Dhabi and Fujairah. IPIC, an Abu Dhabi government investment firm, split the contract for a total of 225 thousand tons of coated steel pipes between Sumitomo of Japan, Salzgitter Mannesmann International of Germany and Jindal Group of India. First delivery of the pipe will be in July 2008 and the whole deal will be completed in January 2009. Abu Dhabi plans to build the 360-kilomter pipeline to transport up to 1.5 million barrels a day from Habshan oil fields to Fujairah to bypass the Strait of Hormuz through which Arabian Gulf producers’ ship crude oil exports.

IIT-Bombay to air lectures from today

IIT-Bombay to air lectures from today

2 Jan 2008, 0337 hrs IST,TNN

MUMBAI: For lakhs of aspirants who don’t make it to the Indian Institutes of Technology (IITs), the new year has brought in cheer—this tech school is opening its classrooms beginning Wednesday for engineering colleges across the country.

As reported by TOI on December 8, IIT-Bombay will broadcast its lectures live through Edusat, the satellite which caters exclusively to the educational sector. Students of any engineering institute will now not only have real-time access to IIT-B tutoring, but can also interact with resident faculty at Powai.

Inaugurating the live interactive classroom, former TCS vice chairman F C Kohli said he had visited the MIT’s classrooms of the future and India needs to harness technology in education to a great extent. “I will not call this distance learning, but a classroom redesigned. This is virtual live education,” said Kohli, speaking on the IITB-ISRO initiative.

Hinting at the poor quality of education imparted in tier two engineering colleges, he said institutions need to realise they are not graduating “progressive technicians, but progressive thinkers and knowledge workers.” Kohli, who is also the chairman of the board of governors at the College of Engineering, Pune, which had invested in setting up a dedicated fibre optic line to transmit lectures from IIT-B, said engineering colleges will have to work on “pre-requisites” before exposing their students to IIT-B lectures. “Basic pre-requisites, attendance when the course is on and follow-up are three essentials that colleges will have to keep in mind if they want to start offering the IIT courses,” the father of Indian IT said. Additional chief secretary (higher and technical education) Joyce Shankaran suggested that IITs look beyond engineering colleges and transmit lectures to polytechnics and science colleges too.

For IIT-B, director Ashok Misra pointed out that the initiative will go a long way in furthering the cause of education. IIT will start transmitting lectures from 8.30 am to 8 pm. Head of IIT’s centre for distance engineering education programme Kannan Moudgalya said almost 100 engineering colleges had already purchased ISRO receivers to access the live IIT-B lectures. To begin with, IIT-B will broadcast lectures in 13 courses, including software engineering, information systems, computation fluid dynamics, embedded systems, instrumentation and process control and fibre optics communication. “Besides, this initiative should be seen as an inclusive effort of all the IITs. Subject experts from other IITs and engineering colleges can also come to IIT-B and deliver lectures,” added Moudgalya.

toireporter@timesgroup.com

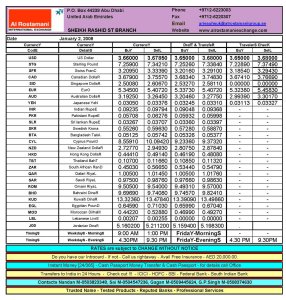

Daily Exchange Rates – Wednesday, 02 January 2008

Brought to you by

Al Rostamani International Exchange

Abu Dhabi

Phone: +9712 6223003

http://www.alrostamaniexchange.com

You must be logged in to post a comment.