Month: October 2007

Facing skills shortage

Facing skills shortage

By Andrew England, Financial Times Published: October 08, 2007, 23:16

Rising drilling and riggings costs, combined with shortages of skilled personnel and equipment, are affecting hydrocarbon projects throughout the Middle East, with some being delayed and other contracts being renegotiated. Producers in the region, from Libya to Saudi Arabia, have embarked on ambitious plans to increase production and capacity to meet growing global demand and take advantage of record oil prices.

But many will struggle to meet their schedules, experts say, and can expect to pay exorbitant prices if they are to ensure they have the material and personnel in a market suffering severe constraints.

“It’s having an impact and that impact is going to increase over the next few years. We are seeing projects being delayed simply because they can’t get the equipment delivered on the timescale they used to,” says Candida Scott, an analyst at Cambridge Energy Research Associates (Cera).

Experts say a critical bottleneck is the shortage of skilled staff, with an industry workforce dominated by people close to retirement and inexperienced graduates.

The issues affect producers worldwide, with the Middle East and Libya accounting for 20 per cent of world projects adding productive capacity between 2007 and 2011, according to Cera.

Significantly, it is also the region requiring the most manpower for design and project management over the same period, with 35 per cent of the world’s projected total, the institute says.

One of the most high-profile examples of a project affected is in Algeria where Sonatrach, the state oil company, cancelled the contract of Repsol YPF and Gas Natural to develop the 5tcf (trillion cubic feet) Gassi Touil project citing development delays and cost overruns. When the consortium won the contract in 2004 the deal’s economics were “marginal”, according to Wood Mackenzie analysis.

Since then, rising upstream costs and the increasing cost of setting up liquefaction plants raised the project’s overall costs by 127 per cent from $3 billion to $6.8 billion, according to the energy consultants.

“A lot of people have suggested Sonatrach’s decision to cancel the project was nationalism, but we would disagree with that; the fact is it was based on simple economics,” says Craig McMahon, at Wood Mackenzie.

At best, the project will start producing in mid-2012, at least two and half years later than expected, he adds.

In Abu Dhabi, which produces around 95 per cent of the UAE’s hydrocarbons, the completion of some larger projects is being put back by between nine and 12 months, an industry source said.

Development of the onshore Bab field has also been delayed mainly because of the scarcity of specialised equipment needed for the sour gas project. The lead time for some equipment is 18 months to two years, experts say.

Officials had put the development of the Bab and Shah fields out to a joint tender, hoping the two would eventually produce 3bcf (billion cubic feet) per day. However, given the technical challenges of the sour gas fields and market difficulties the authorities later elected to re-tender just for Shah, which is less complex and has higher liquid yields, analysts say.

Abu Dhabi is also taking a more “stringent” approach in terms of its commercial deals than others, such as Saudi Arabia, the industry source says. “My understanding is they are taking a more liberal view of the market, they will pay top dollar to secure resources, while here we are more prudent and not willing to be bullied by the market,” the source says. Saudi Arabia maintains the world’s largest crude oil production capacity, estimated to be 10.5 million to 11 million barrels per day.

In 2006 Aramco, the state oil company, announced an $18 billion plan to increase capacity to 12.5 million barrels per day by 2009 and 15 million barrels per day by 2020, according to the US’s Energy Information Administration. Experts say the kingdom seems on track, but will pay high prices.

“The Saudis have been fairly adept at ordering equipment and rigs; their project management skills are fairly honed – getting access to the equipment they need. But in doing that they are paying much more than they would have five years,” says David Fyfe, at the International Energy Agency. There are about 270 rigs operating in the Middle East, compared to 158 in September 2000, according to Baker Hughes, the oil services company, with Saudi Arabia estimated to be employing around 130.

Four or five years ago, the kingdom would have been using 30 or 40, says Gene Shiels at Baker Hughes. But even as costs rise, Saudi Arabia has the advantage of scale, says Colin Lothian, a Gulf specialist at Wood Mackenzie.

“While the projects in Saudi Arabia are highly capital intensive, when you look at the unit cost of bringing that production on stream it’s low in global terms, just because of the size and scale of these assets,” he says. For smaller producers it means having to compete with large producers who can offer longer contracts and pay top rates.

The issues can be exacerbated by difficult operating environments. In Libya, for example, there are clear attractions for international oil companies given the nation’s unexplored status and its proximity to Europe. But one expert says there has already been a decline in oil majors’ interest in the North African state. “If there were no shortage globally the Libyan programme would be challenging simply because of the time taken to get permission to get the necessary people and equipment into Libya, which raises costs significantly [and] slows everything down,” the expert says.

“And everybody who has got kit and people has got lots of other places they can deploy, so why on earth should I go through all the time and trouble.”

Sand storms hit UAE

Sand storms hit UAE

By Mahmood Saberi, Staff Reporter GULF NEWS Published: October 10, 2007, 12:26

Dubai: Strong easterly winds whipped up huge dust storms across Dubai and Sharjah reducing visibility to under 500 metres at Dubai Airport, the met office said.

Flights were not disrupted, but the visibility on the ground was even even less, specially on Emirates Road, said the duty forecaster, warning motorists to be careful.

“All flights are on time,” according to flight operations at the aiport.

In Sharjah winds of 30 knots forced drivers to switch on their parking lights because of low visibility while driving and in Jebel Ali construction nearly came to a standstill because of the high winds.

Workers were seen masking their faces against the harsh winds blowing sand on their faces.

The met office expects the winds to die down and the weather to clear up by the night.

“The bad weather is due to the seasonal changes,” said the forecaster, noting that temperatures are still hovering around 36 to 37 degrees Celsius.

The winds also whipped high swells offshore but there was no marine warning.

In Abu Dhabi it was a clear day.

Khalifa Park opens on first day of Eid

Khalifa Park opens on first day of Eid

By Rayeesa Absal, Staff Reporter GULF NEWS Published: October 10, 2007, 00:22

Abu Dhabi: The much-awaited Khalifa Park will open at 5pm on the first day of Eid as a gift to residents of the capital city.

The park is 1-kilometre long by half a kilometer wide and has cost Dh220 million to create. The park has been designed on a ‘parks within a park’ concept to cater to society as a whole.

The contemporary design of the park brings together the best principles of landscaping and innovative architecture encompassing aspects such as environmental conservation, culture, heritage, art and theatre, theme park, gardens and much more.

Khalifa Park, located on the Eastern Ring Road, has a National History Museum and Maritime Museum for educational purposes. The museum will feature details of a civilisation that existed in and around Umm Al Nar region for over 5,000 years.

Also glimpses from ancient times depicting the daily life of historical cultures will take visitors through a time travel tunnel. The ‘Time Tunnel’ ride makes you travel on a monorail through a living history with all the sights sounds and smells of an era past.

A serpentine route, a long green strip providing an array of activities with shaded corridors and seating areas, runs through the park.

On either side of the park’s Grand Avenue are jewel gardens, palm oasis gardens, water gardens with different types of water displays like musical fountains, waterfalls, computerised water display and cascades. Islamic gardens have been created within the park following traditional designs.

There are also demonstration gardens that highlight the use of plants for decoration and beauty, for food production and commercial purposes.

Math Buffs: I bet you didn’t know this…

Math Buffs: I bet you didn’t know this…

Do you know,

Letters ‘a’, ‘b’, ‘c’ &’d’ do not appear anywhere in the spellings of 1 to 99

(Letter ‘d’ comes for the first time in Hundred)

Letters ‘a’, ‘b’ & ‘c’ do not appear anywhere in the spellings of 1 to 999.

Letter ‘a’ comes for the first time in Thousand)

Letters ‘b’ & ‘c’ do not appear anywhere in the spellings of 1 to 999,999,999

(Letter ‘b’ comes for the first time in Billion)

And

Letter ‘c’ does not appear anywhere in the spellings of entire English Counting

Gearing up to observe end of blessed month

Gearing up to observe end of blessed month

By Samir Salama, Bureau Chief GULF NEWS Published: October 10, 2007, 00:37

Abu Dhabi : Eid Al Fitr, the Islamic celebration following the end of Ramadan, is upon us once again and the choice of activities during the public holiday is wide across the Emirates. From contemporary Arabic music concerts, international dance troupes and theatre, there is something to do for all the family.

Eid Al Fitr is a day of blessings for all fasting Muslims as they are promised great rewards by Almighty Allah for observing their fast. It is one of the two festivals of Islam and celebrated by all Muslims on the first day of Shawwal – the tenth month of the lunar Islamic calendar, which marks the completion of Ramadan.

By the end of Ramadan, Muslims express their gratitude to Allah for enabling them to fast and at the same time granted them abundant provision during the blessed month.

Eid Al Fitr, therefore, is a day of joy, acts of worship, thanksgiving to Allah, brotherhood, unity, and spiritual provision.

As Almighty Allah has put Muslims to test during Ramadan, Muslims feel a great sense of achievement at the end of the month: it is the joy of spiritual fulfilment.

Zakat Al Fitr, or the giving of alms, is offered to the poor during Eid.

The ceremony of Eid Al Fitr starts early morning with Eid prayers. This service is generally held in a large open place and is attended by thousands of Muslims.

After the prayer, the leader of the prayer or the Imam delivers a short sermon and then people greet each other. The rest of the ceremonies, generally, are held privately with families and friends.

Even though fasting is not permitted during Eid, the major part of the celebration is not to just eat and drink but to pray, and for Muslims to get together to remember Allah’s bounties and celebrate His glory and greatness.

Two festivals

Muslims have two festivals – Eid Al Fitr and Eid Al Adha, which mark the conclusion of important periods of worship like fasting and the Haj, or pilgrimage to Makkah. They also show determination to continue to obey and submit to Almighty Allah.

When Prophet Mohammad (PBUH) came to Madinah, the people of Madinah used to have two festivals. On of those two days they had carnivals and festivity. The Prophet asked the Ansar (the Muslims of Madinah) about it.

They replied that before Islam they used to have carnivals on those two joyous days. The Prophet told them: “Instead of those two days, Allah has appointed two other days which are better, the days of Eid Al Fitr and Eid Al Adha.”

For Muslims, the two Eids are an occasion to increase their good deeds.

What Muslims do during Eid

On the day of Eid, there are some Sunnah acts that Muslims should do, including:

Wake up early and have breakfast before leaving for the Eid prayer ground.

Dress in the best clothes that a Muslim can afford, that are reasonable and modest.

Apply perfume (men only).

Offer Eid prayers in congregation in an open place.

Engage in takbir prayers after the Faj, or sunrise prayer, until the imam comes out for prayers. Takbir is recommended for males, females, young and old.

It is also important to make sure to pay Zakat Al Fitr before the prayer. Ideally, it should be given in advance so that the poor can enjoy their Eid.

Wish every one the joy of Eid.

It is also a good Islamic practice to visit one another and exchange gifts. The Prophet (PBUH) said: “Exchange gifts in order to foster love.”

Remember the true spirit of Eid is reflected in extreme generosity to the poor and the needy. So, a Muslim should be charitable as best as he or she can.

Changing route on returning from the prayer ground

to exchange Eid greetings with as many Muslims.

Movies

With movie going becoming an increasingly popular Eid holiday pastime, cinemas are gearing up to release some popular English, Arabic and Hindi titles.

“The Eid season has traditionally been the busiest week of the year for cinemas in terms of admissions,” said Cameron Mitchell, General Manager of Cinestar Middle East.

“Ramadan, on the other hand, is the slowest time of the year”.

Mitchell said film distributors often wait till the Eid season to release movies if they expect them to do better then.

Some of the major releases:

The Kingdom

Resident Evil 3

Daddy Daycare

Georgia Rule

Omar wa Salma (Arabic)

– Laga Chunari me Daag (Hindi)

Bhulbulaiyaa (Hindi)

Entertainment

Abu Dhabi

October 10 – 13

Moroccan Live cooking activities

Where: Al Wadha Mall

Price: Free

October 13 – 15

Who: Story tellers will be there to entertain children under the theme of Ramadan – Zamman or Ramadan in the past, backgammon competitions

Where: Marina Mall

First day of Eid

Who: Fatoon – Emirati singer, Live Music Performance by International Dance Group

Where: Al Wahda Mall

Second day of Eid

Who: Fatoon – Emirati singer, Live Music Performance by International Dance Group

Where: Al Wahda Mall

Third day of Eid

Who: Live Music Performance by International Dance Group

Where: Al Raha Mall

October 14 – Middle East International Film Festival at the Emirates Palace in association with the Abu Dhabi Authority for Culture and Heritage (ADACH).

Who: opening night of The Atonement followed by an after party

Where: Emirates Palace

Price: Dh500

October 15 – Free screenings of films across Abu Dhabi, for listings check http://www.meiff.com

Dubai

October 10 – Dubai Ramadan Fair You can also make your way to the Airport Expo Dubai for one last night to meander amongst products from 10 countries from around the world. The fair is a unique event and attracts a large numbers of consumers from across the GCC.

Theatre every night during Eid – 9pm

“Travel Blind” by Safer Alemian performed in Arabic

Where: Rashid Auditorium, Indian School Council.

Price: Dh20 per person, with the proceeds going towards Dubai Cares.

“Shaabiyat” by Dubai Folklore Society Theatre, a comedy performed in Arabic

Where: Al Mamzar area, under the patronage of Dubai Cultural Council.

Price: Dh20 per person, with the proceeds going towards Dubai Cares.

Jumana – Secret of the Desert is a pyrotechnics show, which includes waterworks, fireworks and laser effects with hundreds of actors and acrobats who bring a stage play to life in the middle of the desert. The show takes place at the Al Sahra Desert Resort part of Dubailand.

First day of Eid

Who : Fares Karam, Aasi Al Helani and Nancy Ajram

Where: Madinat Jumeirah Arena

Price: Dh300

Second day of Eid

Who : Hussain Al Jasmi, Rashid Al Majid and Yara

Where : Madinat Jumeirah Arena

Price: Dh300

Who : Mohammad Hamaki, Myriam Fares

Where : The Aviation Club

Price: Dh150 to Dh750

Third day of Eid

Who: Elissa, Fadel Shakir and Shereen.

Where: Madinat Jumeirah Arena

Price: Dh300

Oct 15 – Disney Star Show will be staged at Dubai Creek Park between 7pm and 9pm. The Disney Symphony will feature songs from the early classics through to recent releases, including ‘The Lion King’ and ‘The Little Mermaid’, accompanied by two giant screens displaying scenes from each film. Call 04 366 22 77 for tickets.

Inputs by Emmanuelle Landais, Siham Al Najami, Zoi Constantine, Dina El Shamma, Staff Reporters

Thousands of festive lights set Abu Dhabi aglow

Thousands of festive lights set Abu Dhabi aglow

By Rayeesa Absal, Staff Reporter GULF NEWS Published: October 09, 2007, 23:51

Abu Dhabi: The city’s exuberant mood is set during the Eid holiday by thousands of multicoloured lights that bring the capital aglow.

The garlands of lights draped across buildings add a real holiday atmosphere with the city’s well known skyscrapers twinkling for all to see.

Three Indian brothers Yousuf Karikkayil, Salam and Kabeer are behind the bright lights in the big city and work hard for days to design and create the look of buildings such as the Abu Dhabi Chamber of Commerce and Industries.

The Karikkayils’ business, the Light Tower, is also behind the buildings of the ADNOC group of companies such as the ADNOC headquarters and the Etisalat buildings, to name but a few.

In fact, the Light Tower has been contracted to do the lighting jobs for many of the capital’s landmark buildings over the past years. And not just for Eid, but also for all other festive days such as National Day.

“I have decorated the Chambers building for the last 15 years, ADNOC for the last 10 years and the National Drilling Company (NDC) for the last nine years,” said Yousuf, adding their job is not for novices.

“The foremost constraint is that during a festive season all the buildings have to be decorated at the same time. Also we have to mind the wind speed for safety reasons, two people are engaged at a time and as they work if the wind seems to get harder we have to stop. Well-trained workers are a must.”

Talking about a very special design, Yousuf said that last year to mark National Day celebrations the NDC building was lit up using more than 100,000 bulbs.

Blue LED bulbs were used for this expensive type of decoration. It usually takes 25 days to decorate a building but sometimes for bigger buildings we take up to 45 days, he added.

Abu Dhabi Awards deadline extended – 4 more days to nominate

Abu Dhabi Awards deadline extended

By M. A. Qudoos (Deputy Bureau Chief) KHALEEJ TIMES 7 October 2007

ABU DHABI — The deadline for nominations to the Abu Dhabi Awards has been extended to October 14 in order to ensure participation of citizens and residents of the emirate of Abu Dhabi, including Al Ain and the Western region. This has been done keeping in mind the upcoming Eid holidays.

Through the Abu Dhabi Awards, local residents are encouraged to take advantage of the Eid holidays to honour those who have carried out deeds of exemplary kindness and generosity for the good of the emirate of Abu Dhabi.

Commenting on the event, Abu Dhabi Awards 2006 recipient Sana’a Darwish Al Kitby, who was honoured for her leadership role in the Red Crescent Society, said: “It only takes a few minutes to fill out a nomination form, but the impact it could have may be life-changing for the individual you are recognising. This is encouragement for them and others in our community to keep making a contribution.”

Statistics and credit bureaus soon

Challenge will be to ensure sustained non-inflationary growth.

Statistics and credit bureaus soon

By Saifur Rahman, Business News Editor GULF NEWS Published: October 09, 2007, 23:50

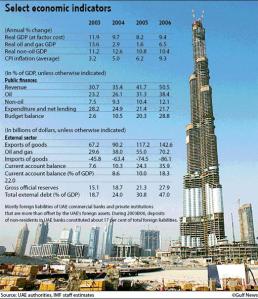

Dubai: The UAE will establish a National Bureau of Statistics (NBS) and a Federal Credit Bureau by the end of this year, the International Monetary Fund (IMF) said yesterday in its latest country report.

The move will be followed by several statistical surveys, currently in the preparatory stage, including a study on household income and expenditure in line with UAE’s efforts to formulate a consumer price index (CPI) to measure real inflation – one of the major woes impacting the lives of its more than 4.5 million residents.

The report, Article IV Consultation 2007 with the UAE, “welcomed the prep-arations to introduce a Value Added Tax (VAT) system at the federal level.”

“Efforts to address the weaknesses of economic statistics at the national level have intensified. Work is under way to improve consumer price data and to establish the NBS by end-2007,” said the report, a copy of which is in possession of Gulf News.

The UAE’s real GDP growth exceeded 9.4 per cent in 2006, with oil production rising by eight per cent and non-oil sectors growing at double-digit rates.

Dr Mohammad Al Asoomi, a UAE-based economist, said a high VAT could hurt the consumers.

“The authorities should introduce VAT from a low base and then gradually bring it up to the five per cent level,” he told Gulf News. “However, it should be a GCC-wide move and not an individual national move.”

Strong domestic demand and housing shortages have led to sharp rises in rents and contributed to upward pressure on other prices. As a result, the CPI inflation exceeded 9.3 per cent in 2006, the IMF said.

The IMF observed that although the assessment of inflation is complicated by data weaknesses, the rate of price increases, driven mainly by strong demand for housing, is too high.

“However, the anticipated reduction of capacity constraints – especially in the housing market – is likely to reduce inflation pressures over the medium term,” the report said.

“Fiscal policy could play a greater role in regulating domestic demand. In particular, expenditure increases – including by public and quasi-public entities – should be consistent with the country’s absorptive capacity. This, together with efforts to alleviate capacity constraints, would help subdue inflation and support a continued economic expansion with macroeconomic stability.”

Reflecting record oil prices, the overall fiscal and external current account surpluses remained large in 2006, and have allowed further accumulation of official foreign assets.

The medium-term outlook is very positive with real GDP growth projected to remain strong in 2007, and slightly decelerating thereafter due to temporary capacity constraints.

The fiscal and external accounts are projected to remain in large surplus. IMF agreed that “the key challenges will be to ensure sustained noninflationary growth and further diversification of the economy.”

Dollar peg

The IMF report agreed that the peg of the dirham to the US dollar has served the UAE well. “The exchange rate of the dirham is in line with fundamentals,” the report said, adding, “Further structural reforms would help to sustain the UAE’s competitiveness.”

The IMF appreciated the authorities’ commitment to work closely with other GCC member countries to a reach consensus on the appropriate future exchange rate regime to be adopted as part of the GCC currency union.

The IMF welcomed steps to enhance the supervision of capital markets and efforts to update the banking law and the company law.

“These steps would, inter alia, remove barriers to foreign participation in UAE markets and help protect shareholder rights,” the report said.

The IMF report called on the authorities to move ahead to enact the draft securities law, encourage the listing on the equity market of large quasi-public enterprises, and promote an increased role for institutional investors in the markets.

You Can Bank On Them

You can bank on UTI, Reliance Banking Fund

8 Oct, 2007, 0544 hrs IST,Bakul Chugan, TNN

The banking and financial services sector has been in the limelight of late, thanks to the sustained momentum in the domestic economy. The sector has gained the confidence of foreign institutional investors (FIIs) and fund managers alike. Even though the sector has been an important component of many equity diversified schemes, currently only two funds completely focus on this space.

This week, ET met up with Gautami Desai, fund manager, UTI Banking Sector Fund, and Sunil B Singhania, fund manager, Reliance Banking Fund, to gauge their views on the sector and the composition of stocks in their respective portfolios. It is interesting to note that while both these funds differ in their stock composition, the returns they have generated are more or less similar. Here are excerpts from the interview:

What is the ideal number of stocks you hold in your portfolio?

GD: On an average, we hold 15-20 stocks.

SS: The ideal number of stocks at any given time is 15-20 stocks.

How come the participation of finance companies appears to be low in your portfolio?

GD: We have non-banking finance companies (NBFCs) in our portfolio, but one may not find brokerage firms, since we feel the valuations are overstretched in that segment.

SS: We invest wherever we find opportunity. The banking sector itself is very huge and the percentage of NBFCs is very small. As such, we look for a proper mix of public and private sector banks, as well as NBFCs.

Reliance Capital has been doing pretty well on the bourses, but it does not appear in your portfolio.

GD: We are not very comfortable with the valuations of this scrip.

SS: Reliance Capital is the immediate parent of the fund holding group. So, we dissuade ourselves from investing in this stock. We believe we are sacrificing our returns by not investing in Reliance Capital, but we intend to maintain our stand on ethical grounds.

How come outperforming stocks like Axis Bank, HDFC and HDFC Bank are not part of the portfolio of Reliance Banking Fund?

SS: Not investing in these stocks was a big mistake on our part. We believe our returns would have been much higher if we had invested in these scrips.

UTI Banking Sector Fund appears to be bullish on Karnataka Bank. It has been in your portfolio since a very long time now.

GD: Karnataka Bank has good valuations and moreover, it is a part of the merger & acquisition story. We expect its merger in the near future.

What is the outlook for public sector banks?

GD: Private sector banks are doing better than PSUs. Hence, we are gradually reducing our exposure to PSU banks. However, State Bank of India (SBI) is an exception and we do intend to hold it since it has attracted a lot of FII interest.

SS: I think public sector banks are doing well. We have PSUs like Dena Bank, South India Bank, Bank of Maharashtra and Andhra Bank in our portfolio, which have generated good returns and SBI is doing exceptionally well too.

What are your expectations from September quarter results?

GD: The second quarter results are expected to be a slight disappointment, mainly on account of the slowdown in credit growth in the past six months. The margins looked good in the previous quarter, but this time round, we expect margins to be a little compressed as the deposits will be re-priced. However, there is a positive element in the market in the form of expectations of rate cuts and people are factoring this in. Thus, stock prices should not be adversely affected.

SS: We do not expect anything negative from the results. The banking sector has to keep pace with the growing economy. We expect at least 15-20% growth in this sector in the next 5-10 years.

What are your views on the current market volatility?

GD: We are a little cautious on the banking sector. Currently, we are holding on to the existing portfolio and gradually look forward to reducing our exposure in PSU banks, but we are not too keen on investing in brokerage firms.

SS: The market will always remain volatile. In fact, volatility is a good opportunity to buy good stocks.

Acting in haste versus vacillation

Acting in haste versus vacillation

8 Oct, 2007, 0110 hrs IST, TNN

A king of ancient India had hung from the ceiling of his palace (as was also the practice in many houses on those days), various manuscripts with selections of pithy quotes of great writers. One night, as the king entered his queen’s chamber, he found her on the cot, embracing a young man. Enraged, the king pulled out his sword, which, as it rose up to the ceiling happened to first hit one of the manuscripts, hanging on the ceiling.

Angry at the distraction, at the same time curious as to the matter written on that particular manuscript, which had thus fallen down, the king restrained himself to read the contents therein. The leaf bore these lines from the ancient Sanskrit work, Kiratarjuniya of poet Bharavi, which, when translated ran thus, “One should not do anything in haste because confused and impulsive behaviour could be most dangerous. Prosperity naturally attends on the virtuous and those who do things after due consideration.”

The king calmed down and demanded an explanation from the queen. Pointing to the youth at her bedside, she replied, “Don’t you recognise him? He is our dear son, who, while yet a boy, had after a tiff with you, run away. He has now returned!”

This was a case, where, thanks to a chance intervention, a major tragedy didn’t come to pass. In most cases, however, problems and often misfortunes follow impetuous actions, as also ill considered and stinging words. Valluvar in his Tamil work, Kural observes that even the wound caused by burns would heal but not the scars inflicted by a harsh tongue.

Though desisting from hasty actions would be ideal, at least expressing sincerely one’s regret or asking for forgiveness could be done as damage control exercises, instead of choosing to stand on prestige. Fortunate indeed is one, possessed of that healthy ego, which often is nourished by a willingness to admit one’s mistakes and shed vain pride!

You must be logged in to post a comment.