Information – Money Market

All is not lost: 12 rules that can save you further losses

All is not lost: 12 rules that can save you further losses

With the markets sliding leaps and bounds, you need to keep your calm and find ways to cushion the free fall. In a book review of Zurich Axioms, our expert Kanu Doshi, talks about 12 strategies that can help you reduce your loss.

Reviewer’s Note:

The author (Max) son of a very wealthy Swiss citizen by name, Franz Heinrich, (whom Americans preferred to call Frank Henry), jotted down all the principles of speculation strategies, particularly in stocks, adopted by his father and his father’s several other Swiss friends to make large fortunes on the Wall Street in USA in roaring Eighties. Principles perfected by these Swiss gentlemen have therefore been called “Zurich Axioms” by Max.

Enumerated below are twelve major principles and sixteen minor ones with brief comments by Kanu Doshi on each of them:

First Major Axiom: On Risk

“Worry is not a sickness but sign of health. If you are not worried, you are not risking enough.”

Adventure is what makes life worth living. Every occupation has its aches and pains. The rich have to worry about their wealth. But, if there is a choice between remaining poor and worry-free, the selection is obvious. It is better to be wealthy and worried than to be worry-free and poor.

Minor Axiom I:

“Always play for Meaningful Stakes.”

If you invest Rs. 1000 and your investment doubles, you have only Rs. 2000 and are still poor! So if you want to be rich, you must increase your stakes.

Minor Axiom II:

“Resist the allure of diversification”.

Firstly, diversification negates the earlier principle of playing for meaningful stakes. Secondly, it may keep you where you began so that your gains on few will cancel out the losses on the other few. Thirdly, it entails keeping track of many more items leading to confusion and occasional panic.

Second Major Axiom: On Greed

“Always take your profit too soon.”

Lay investors having made the investment tend to stay too long on it out of greed for higher profits. But, one must conquer this weakness and book profits soon. If one is less greedy for more profits one will take in more. Don’t stretch your luck. In effect, it suggests, SELL sooner than later.

Minor Axiom III:

“Decide in advance what gain you want from the venture, and when you get it, get out. Decide where the finish line is before you start the race”.

This is self explanatory and hence needs no comment.

Third Major Axiom: On Hope

“When the ship starts to sink, don’t pray, jump”

This axiom is about what to do when things go wrong. Learn how to accept a loss. One should accept small losses to protect oneself from big ones. When the market starts falling, sell, take your money and run!

Minor Axiom IV:

“Accept small losses cheerfully as a fact of life.”

Expect to experience several smaller losses while awaiting a large gain.

Fourth Major Axiom: On Forecasts

“Human behavior cannot be predicted. Distrust anyone who claims to know the future, however dimly.”

The story of a monkey throwing darts on the stock exchange page of a newspaper, to select the companies to buy, and coming out a winner is too well known to be recited. Recent news from London, further proves the truth, when an untrained chemist’s stock selections, in a widely publicised contest open to all and sundry, registered higher appreciation over several full time highly qualified fund managers’ well researched selections. Human events cannot be predicted by any method by anyone and, hence, don’t trust anybody’s predictions.

Fifth Major Axiom: On Patterns

“Chaos is not dangerous until it begins to look orderly.”

The truth is that the world of money is a world of patternless disorder and utter chaos. This axiom is a commentary on Technical Analysis – a branch of investment strategies based on charts and patterns. The fact is, no formula that ignores own intuition’s dominant role can ever be trusted.

Minor Axiom V:

“Beware the Historian’s Trap”.

This is based on the age old but entirely unwarranted belief that history repeats itself.

Minor Axiom VI:

“Beware the Chartist’s Illusion”.

Life is never a straight line. Let us not be hypnotised by a line on a chart.

Minor Axiom VII:

“Beware the Co-relation and Causality Delusions.”

Don’t be taken in by coincidences in the market.

Minor Axiom VIII:

“Beware the Gambler’s Fallacy.”

There is a gambling theory which suggests that one should put small stakes initially and test their luck, and if these turn out well one should go for big stakes on the dice table. But this is not correct. It only shows that winning streaks happen. But nothing is orderly about it. You can’t know how long it will last or when it will strike.

Sixth Major Axiom: On Mobility

“Stay away from putting down roots. They impede motion”.

You may feel socially comforting to have roots. But in financial life, roots can cost a lot of money. Have a flexible approach while investing. This axiom implies a state of mind.

Minor Axiom IX:

“Do not become trapped in a souring venture because of sentiments like loyalty and nostalgia.”

Do not develop emotional attachment to your investment. You should feel free to sell when desired.

Minor Axiom X:

“Never hesitate to abandon a venture if something more attractive comes into view.”

Never get attached to things, but only to people. Otherwise it hits your mobility. Never get rooted in an investment. You should remain footloose, ready to jump away from trouble or into a profitable opportunity as and when circumstances demand.

Seventh Major Axiom: On Intuition

‘A hunch can be trusted if it can be explained.’

A good hunch is something that you know but you don’t know how to recognise it. When a hunch hits you, try to locate some data in your mind for any familiarity. Then only should you act on it.

Minor Axiom XI:

‘Never confuse a hunch with a hope’.

Be highly sceptical. Examine every hunch with extra care.

Eight Major Axiom: On Religion and The Occult

‘It is unlikely that god’s plan for the universe includes making you rich’.

You can’t only pray that you should be made rich. You will have to work at becoming rich. Mere prayers will not suffice.

Minor Axiom XII:

‘If Astrology worked, all astrologers would be rich.’

This is self explanatory. Don’t trust predictions.

Minor Axiom XIII:

‘As superstition need not be exorcised, it can be enjoyed provided it is kept in its place.’

In your day-to-day financial matters, act rationally. But, when buying a lottery ticket, give it a full play to amuse yourself.

Ninth Major Axiom: On Optimism and Pessimism

‘Optimism means expecting the best, but confidence means knowing how you will handle the worst. Never make a move if you are merely optimistic.’

In poker and a lot of other speculative worlds, things are never as bad as they seem – most of the times they are WORSE.

Confidence comes not from expecting the best but from knowing how you will handle the worst. Optimism can be treacherous because it makes you feel good.

Tenth Major Axiom: On Consensus

‘Disregard the majority opinion. It is probably wrong’.

It is likely that the Truth has been found out by a few rather than by many.

Minor Axiom XIV:

‘Never follow speculative fads. Often, the best time to buy something is when nobody else wants it.’

This is the best way to get a good stock cheaply.

Eleventh Major Axiom: On Stubbornness

‘If it doesn’t pay off the first time, forget it’.

If at first you don’t succeed, try and try again and you will succeed in the end. This is good advice for spiders and kings but not for ordinary persons with regard to financial matters. Every trial is a costly error.

Minor Axiom XV:

‘Never try to save a bad investment by averaging down.’

If the price of the stock goes down after your purchase don’t buy more to bring down’ the average cost of your total holding. Investigate why the price went down rather than put good money in a bad bargain.

Twelfth Major Axiom: On Planning

‘Long-range plans engender the dangerous belief that the future is under control. It is important never to take your own long-range plans, or other people’s seriously.’

This is self explanatory and hence needs no comment.

Minor Axiom XVI:

‘Shun long-term investments.’

If possible try to stay away fro long-term investments. The author noticed that the Swiss group never took a long-term view of their stock purchases. They always sold out as soon as their targeted profit was achieved.

Great investing tips from Rakesh Jhunjhunwala

Great investing tips from Rakesh Jhunjhunwala

Great investing tips from Rakesh Jhunjhunwala

“Markets are like women — always commanding, mysterious, unpredictable and volatile,” quipped ‘Big Bull’ Rakesh Jhunjhunwala (inset) while addressing a meet organised by Shailesh J Mehta School of Management, IIT, Bombay on August 10.

A champion broker, often termed as Warren Buffett of the Indian stock market, Jhunjhunwala had a full-to-the-brim auditorium spellbound as he traced how he made his fortune from a starting capital of Rs 5,000. His career path is stuff dreams are made of.

What earned him fame is his skill to pick under-valued stocks. Some of his renowned calls are Karur Vysya Bank, CRISIL and Bharat Electronics. There are, however, quite a few more. Talking about his company RARE (derived from the first two letters of his name and that of his wife Rekha) Enterprises, Jhunjhunwala says, “My company has only one client — my wife — so that I don’t need to handle others’ money.”

One of the biggest bulls of the Indian market, Jhunjhunwala believes in trading by the hunches. “If in doubt, listen to your heart,” is what he tells young investors. Extremely optimistic about India’s growth story, Jhunjhunwala shared with his audience some valuable insights about the Indian economy, future of Sensex. Read on.

Rakesh Jhunjhunwala’s secret to success

What paved the way to Jhunjhunwala’s success?

A democratic growth process rather than an imposed one and a biological evolution, pat comes the reply.

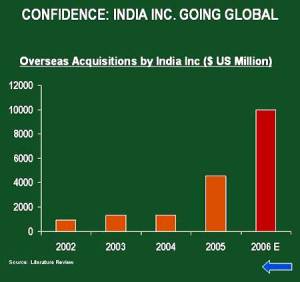

He owes a lot to resurrection of a dormant and vigorous entrepreneurial gene of India. “The country has rediscovered its confidence.”

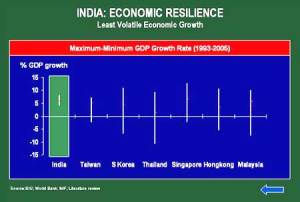

There has been a strong improvement in India’s macroeconomic indicators, combined with a robust banking system.

Improvement has also been observed in India’s corporate performance, powered through productivity gains. Jhunjhunwala is convinced that on-going reforms would have a multiplier effect on India’s economy.

Jhunjhunwala’s investment strategies

Jhunjhunwala learnt investment strategies the hard way. And he was more than willing to share it with his audience. Here are a few gems from his book of learning

* Necessary for any investor is optimism.

* Be opportunistic but wait for the right moment

* Study the market thoroughly. Refer to history

* Maximise profits and minimise losses

* Invest in a business not a company

* Always have an independent opinion. Observe and read relevant information with an open mind

* Be happy with your gains but learn to accept losses with a smile

* Be prepared for challenges and risks

Predicting a brighter and better future for the Indian markets, Jhunjhunwala signed of by saying that the Indian markets will reach the peak by 2010.

Gems from Jhunjhunwala

For beginners in the market, here are a few invaluable gems from Jhunjhunwala’s book:

* Whatever you can do or dream you can, begin it. Boldness has genius, power and magic in it.

* Do something you love

* The means are as important as the end

* Aspire, but never envy

* Be paranoid of success — never take it for granted. Realise success can be temporary and transient

* Build a fighting spirit — take the bad with the good

* When you see a horizon, it seems so distant. When you reach that horizon, you will realize how many more horizons are within reach

5 things you need to be successful

Asked how much patience should an investor have, Jhunjhunwala said, “Get married and you will understand how patient you need to be.”

“Patience may be tested, but conviction will be rewarded,” he asserted. He appealed to the budding investors to go by what George Soros said: ‘It’s not important whether you are right or wrong, it more important how much you lose when you are wrong and how much money you make when you are right.’

To be successful in investing, five things are critical. There has to be:

* an attractive, addressable, external opportunity;

* a sustainable competitive advantage;

* scalability and operating leverage; and

* a qualified and integral management

* Last but not least, it is of vital importance what one buys and at what price.

‘India has everything’

Rakesh Jhunjhunwala believes that India has all ingredients that the stock markets value and hold in high regard. Some of them are:

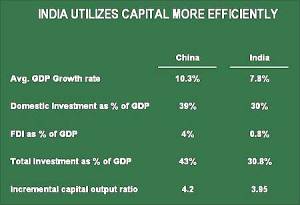

* Efficient capital allocation

* Sustained earnings expansion driven by growth and productivity

* 8 per cent+ real GDP growth + 4%+ Inflation = 12%+ Nominal GDP growth

* Corporates to grow faster than unorganised sector

* Operating and financial Leverage to kick-in

* Corporate earnings to grow at 18%+

* Favourable framework for equity investing

* Rising savings, yet low equity ownership — significant potential

* Corporate governance

* Transparency

* Effective regulation

* Electronic trading

* Dematerialisation

* Tax paradise for equity investing under the STT regime

‘Be realistic’

Jhunjhunwala also spoke about his beliefs that made a case for sustaining the India growth story.

He said enormous wealth was created over the last five years because opportunities in India have grown manifold.

Admitting that gains were going to be moderate in future unlike the manifold rise over the last few years, he advised investors to be realistic in their expectations.

‘The market is always right’

Jhunjhunwala takes the cue from Warren Buffett’s words: “Most people get interested in stocks when everyone else is. The time to get interested is when no one else is. You can’t buy what is popular and do well.”

“Blindly following stock picks by big investors is not a wise thing to do,” he warns investors. “I don’t think the government is necessarily interested in hurting growth. The government is interested in growth with controlled inflation.”

“The market,” he says, “is always right. Markets cannot be taught, they have to be learnt.”

“We must have an attitude where we must balance fear and greed,” was the hot tip by one of India’s most high-profile investor.

Why growth will continue

Speaking on the strength in India’s fundamentals, Jhunjhunwala elaborated on forces that would sustain the growth momentum.

According to him, growth enablers (such as favourable demographics, higher base of skilled people and education base), liberalisation catalysts (such as competition), fall in interest rates, multiplier effect (on account of reforms), structural changes in quality of corporate earnings and micro trends (such as change in mindset of companies who are aspiring to become global) are likely to drive India’s growth story to a higher level.

Text, courtesy: RARE Enterprises and Shailesh J Mehta School of Management, IIT, Bombay

Dirham needs 35pc surge against dollar: experts

Dirham needs 35pc surge against dollar: experts

By Isaac John (Deputy Business Editor)KHALEEJ TIMES 6 October 2007

DUBAI — Predicting a 30 per cent possibility for an imminent revaluation of the UAE dirham, monetary experts said the UAE currency needed a significant appreciation of 35 per cent against dollar to regain its intrinsic strength in relation to other currencies.

Gary Dugan, Chief Investment Officer, Global Wealth Management, Merrill Lynch, told Khaleej Times that the GCC currencies needed to appreciate by around 35 per cent to reduce excessive savings. “In the shorter term, we expect the UAE or Qatar will move to peg versus a basket of currencies this year.”

According to Pradeep Unni from Vision Commodities Services, the UAE currency has lost 55.09 per cent against euro since 2001 — from Dh3.34, the euro is now selling at Dh5.18. Against, the British pound, dirham has lost 38 per cent in the same period, with the exchange rate surging from Dh5.41 in 2001 to Dh7.48, while against the Indian rupee, dirham has lost 24 per cent since May 2002 — dropping from Rs13.32 to Rs10.73 per dirham at present.

Despite UAE Central Bank’s insistence that it would neither opt for a revaluation of dirham nor move away from the US dollar peg, currency experts and economists believe that the likelihood of an imminent revaluation of the UAE dirham is 30 per cent.

Currency strategists said a revaluation of the dirham, which is currently estimated to 30 to 35 per cent undervalued against the US currency, could also provide investors a nice bonus on a property purchased in the UAE compared to parking that investment in a US dollar deposit account.

While affirming that an upward adjustment of dirham to the US dollar will be increasingly likely unless inflation begins to slow more noticeably next year, economists are of the view that there is increasing pressure on the UAE monetary authorities to drop dollar peg and switch to a basket of currencies as Kuwait and Syria have done. “Such a move will ward off any further inflationary trends by strengthening the dirham against other currencies,” they contend.

However, experts warn that the UAE has to undertake a series of currency realignments to ensure the true value of its currency. “While most of the UAE’s exports (oil and gas) are priced in dollars, the country’s biggest share of imports comes from non-dollar zone. A steadily falling US dollar is thus aggravating inflation which last year hovered above 10 per cent due to higher cost of imported goods, a steep surge in rents and other living expenses.”

Dugan said the dollar looked set for further weakness. “We believe that dollar weakness comes from both cyclical and structural factors. Cyclically the US economy is set to be one of the weakest in 2008. Structurally the US economy is still facing the twin deficits of a current account and fiscal deficit. Also the weakness of the dollar has gained some momentum that may extend through the fourth quarter of 2007.”

Food for thought about exchange-rate controversies

Food for thought about exchange-rate controversies

Jul 5th 2007 From The Economist print edition

AMERICAN politicians bash China for its policy of keeping the yuan weak. France blames a strong euro for its sluggish economy. The Swiss are worried about a falling franc. New Zealanders fret that their currency has risen too far.

All these anxieties rest on a belief that exchange rates are out of whack. Is this justified? The Economist’s Big Mac Index, a light-hearted guide to how far currencies are from fair value, provides some answers. It is based on the theory of purchasing-power parity (PPP), which says that exchange rates should equalise the price of a basket of goods in any two countries. Our basket contains just a single representative purchase, but one that is available in 120 countries: a Big Mac hamburger. The implied PPP, our hamburger standard, is the exchange rate that makes the dollar price of a burger the same in each country.

Most currencies are trading a long way from that yardstick. China’s currency is the cheapest. A Big Mac in China costs 11 yuan, equivalent to just $1.45 at today’s exchange rate, which means China’s currency is undervalued by 58%. But before China’s critics start warming up for a fight, they should bear in mind that PPP points to where currencies ought to go in the long run. The price of a burger depends heavily on local inputs such as rent and wages, which are not easily arbitraged across borders and tend to be lower in poorer countries. For this reason PPP is a better guide to currency misalignments between countries at a similar stage of development.

The most overvalued currencies are found on the rich fringes of the European Union: in Iceland, Norway and Switzerland. Indeed, nearly all rich-world currencies are expensive compared with the dollar. The exception is the yen, undervalued by 33%. This anomaly seems to justify fears that speculative carry trades, where funds from low-interest countries such as Japan are used to buy high-yield currencies, have pushed the yen too low. But broader measures of PPP suggest the yen is close to fair value. A New Yorker visiting Tokyo would find that although Big Macs were cheap, other goods and services seemed pricey. A trip to Europe would certainly pinch the pocket of an American tourist: the euro is 22% above its fair value.

The Swiss franc, like the yen a source of low-yielding funds for foreign-exchange punters, is 53% overvalued. The franc’s recent fall is a rare example of carry traders moving a currency towards its burger standard. That is because it is borrowed and sold to buy high-yielding investments in rich countries such as New Zealand and Britain, whose currencies look dear against their burger benchmarks. Brazil and Turkey, two emerging economies favoured by speculators, have also been pushed around. Burgernomics hints that their currencies are a little overcooked.

Mkts still attractive for long-term FIIs: BNP Paribas

Mkts still attractive for long-term FIIs: BNP Paribas

2007-10-04 17:12:45 Source : Moneycontrol.com

Chin Loo, Currency Strategist of BNP Paribas said, the underlying sentiment was still quite bullish. She said the reverberation in the markets was more because of backup positions ahead of non-farm payrolls on Friday.

Speaking on volatility, she said it was symptomatic of markets having a split opinion. She added, “There is a fair amount of bulls as well as bears in the markets and interplay of these two leads to intraday volatility.”

She said the year-end target for the rupee was 38.50 and there was still some more downside left.

Excerpts from CNBC-TV18’s exclusive interview with Chin Loo:

Q: What’s the call on what is happening in the Hang Seng and the reverberation that we have had domestically?

A: Well it is still quite selective. The Hang Seng was quite bullish but now it’s under some pressure from profit taking, but underlying sentiment is very bullish. I think I will subscribe this more to scaling backup positions ahead of the non-farm payrolls tomorrow.

Q: How are you reading into the kind of volatility that we are seeing in Hang Seng particularly?

A: Volatility is a result of huge inflows that is coming in and therefore as an exit; there is some chipping off the table. You can expect the decline to be fairly quick as well. I think it’s symptomatic of markets having a split opinion at this stage. There is a fair amount of bulls as well as bears in the markets and interplay of these two leads to intraday volatility.

Q: How are you viewing India amidst this volatility?

A: We remain very positive on India as well as the Indian rupee. We have had calls for some time on the dollar-rupee falling below 40. So, this comes as no surprise to us. What is quite interesting is that the trend in the rupee in the very short-term has been quite separate from the dollar-Asian trends. I think it shows that Indian rupee is marching to its own drumbeat and the appreciation path in the rupee is very much dependent on intraday liquidity and how the RBI managed it.

Q: How much more appreciation do you see in the rupee because we are already at 39.50 right now?

A: Our year-end target is 38.50; I think there is more downside. What is interesting to watch obviously is other risks brewing in the US economy and for the US dollar. And as we head into the G-8 meeting, that should be a non-event because the G-7 leaders had warned for some time about global imbalances and the need for the US dollar to weaken. So, that should not come as a surprise therefore.

Q: A fair amount of liquidity has come our way this week, aside of the deep cut that we saw yesterday and today, the profit booking that we have seen. Would you say that equity markets were looking expensive?

A: I wouldn’t want to comment on equity markets, but in terms of the flows that we are seeing, certainly a lot of flows are still quite positively geared towards Asia because we feel that is a high growth story, and that in terms of drivers behind the growth remains very much intact even into next year.

So, the opportunities that present themselves are still very attractive to long-term foreign investors and that is one of the key drivers for the shift in the Indian rupee sentiment.

Q: How are you viewing the FII appetite across the region at this point in time?

A: It is good. I think the survey is that people have been very much positive across mostly all quarters coming from interest rates, credits as well as equities; most investors do have a positive reading for Asia next year. So if markets do trade the way that people think, then I think there are more advantages to be had for Asia as well as the rupee.

Momentum is good; Sensex may hit 20,000 soon: Forsyth

Momentum is good; Sensex may hit 20,000 soon: Forsyth

2007-10-04 17:12:45 Source : Moneycontrol.com

sees a shift from the US to emerging markets. Fed’s action has given a boost to global investors and they still love emrging markets.

Excerpts from CNBC-TV18’s exclusive interview with Jacqueline Aldhous:

Q: Could you put into perspective what we have seen globally and even in Asia and India over the last few days in light of liquidity and do you see some of this as sustainable?

A: I think it’s sustainable over a long-term. It has been a very fast rise and there are question being asked as to – is it totally justified on the back of 50 bps rate hike by the Fed?

I think the message that Fed gave is that it will take action and I think that has given a boost to global investors and they still love emerging markets.

When you look at the relative growth emerging, in places it is at most 7% to 10%, obviously China you are talking about even upto 12% and developed markets. I think they still love the story and just see that there is a shift in the pattern away from the US to emerging.

Q: How do you interpret the kind of volatility we have seen or even the steep decline we saw in the Hang Seng both yesterday and today? Much of it was mirrored in the Indian Sensex as well and we saw two days of fairly sharp falls coming in.

A: I think one has to bear in mind that there has to be profit taking. Obviously that was a warning today in China. China has been taking measures to try and get their domestic investor frenzy away from the A-share market by opening up Hong Kong a little bit.

So you have to be careful and there will be profit taking. I think that’s been a characteristic of India, particularly maybe even more than other emerging markets, that after strong rallies, you had profit taking. This has been vying with investors looking for an entry point into the market over the longer-term.

And what is healthy is that you still have a lot of skeptics, especially on India, thinking it’s expensive and they are realising that something is happening that they are missing.

It still means you still have marginal bias and there is a shift away from developed markets into emerging markets. There definitely will be a bigger part of institutional portfolios as we go forward. They were a minimal part 10 years ago, maybe 1% if you were lucky and now I see them going up closer to 15% and maybe higher.

Q: What are you expecting to see from interest rates from the ECB today and the BoJ in about 10 days and the Fed at the end of the month?

A: I don’t think, in the UK it is as interesting. We have really been quite squeezed here on rates and for all those people who don’t have fixed rate mortgages, the feeling is that they will hold and they are now actually talking about a cut and the same from the ECB. They have been talking quite firmly about raising rates, but I think the expectation is that they will hold them and we might not see a rise for some time to come. Although, we are more likely to see a rise in Europe than we are in the UK.

Already, house prices have fallen in September for the first time. Obviously, there is a great squeeze on mortgages here and lending is much harder to come by. There is also definitely a contraction in the housing market here.

Q: What are you expecting from the Fed at the end of this month?

A: Very hard to say, I think Bernanke really has to see how things settle. It really will depend on what the news flow is between now and then. Obviously, he doesn’t want to go too far and it is a very fine line. At this point it is very difficult to call.

Q: How are you looking at Indian markets one-year down the line, what kind of Sensex levels will you be looking at?

A: I think over 20,000 that would seem crazy long back, we were talking about 15K-16K, this was the level I was talking about 6 months ago and we have breached that. I think 20,000 is easy, I don’t see a problem with that. The healthy thing is that you still have a lot of skeptics and a lot of marginal bias and there is still a lot going on there, there is still a lot of momentum.

Especially with infrastructure and with jobs moving to India, which is generating a whole new generation of consumers, I think it still has momentum going the same way China has and some other emerging markets like Brazil and Russia where you have domestic consumption really kicking in.

Q: Would you like to take a shot at where you will see the rupee by December 31?

A: I was listening to someone the other day calling for 37. I think the feeling is that the dollar will decline from here partly, because you have a lot of foreign governments looking to move their assets out of dollars. Not just Asia, but some of the Middle East countries want to diversify into the euro. So I think with some of this big money supporting it over the past 8-10 years likely to flow out, it doesn’t bode very well for the dollar. Obviously growth is elsewhere.

I don’t know whether we will see 37 by the end of the year, but at some point it is possible, I believe.

No takers for dollar; Re hits high of 39.35

No takers for dollar; Re hits high of 39.35

2007-10-04 15:53:46 Source : Moneycontrol.com

The rupee hit a high of 39.35 to the dollar in intra-day trade, which is a significant appreciation in just one session. The domestic unit was bit on the front foot in early morning trade because yesterday in late trades it had surged suddenly, analysts said.

The rupee was expected to carry on with that in the morning. This carry on effect is usually there but there was a good bit of buying by oil companies, analysts said. Once that dried up, the dollar fell largely because there were no buyers, they added.

Treasury heads said it’s not that there are huge FII flows today, if any it doesn’t seem to be anything like it has been earlier this week, but the sheer absence of buying (read RBI) led to the dollar falling lower.

However, at 39.35 there seems to have been some concerted PSU bank buying, which has been given the name of RBI, treasury heads said. So, it looks like RBI is supporting the market at around 39.35.

Ashit Parekh of IndusInd Bank has a view that by the year-end rupee may touch 38.75.

Excerpts from the exclusive interview with Ashit Parekh:

Q: Re is at 39.35,what is the cause for this appreciation?

A: We saw strong recovery in stock markets, so that implied continuous inflows and hence we saw rupee appreciating to 39.35. From there a quick move to 39.48 happened because of some strong buying by PSU banks. But it is not sustainable at all as you can see we are back down to 39.42, which is 6 paise lower than the high.

Q: What would you advice an exporter at this juncture? Do you think there is a likelihood of any spike at all or do you think that they should use even at 39.48 to get rid of their dollars?

A: I am not too sure about 39.48 because this morning the high has been 39.62. Still all the spikes should be used to get out of long positions and it should be used to book some exporting.

Q: What kind of a range are you looking at for the dollar itself? Do you think you are going to see it at 39 before this month is out?

A: I am not too sure about the timing of that but yes, definitely 39 is vulnerable. We might see it dipping below 39.

Q: Any year-end levels?

A: 38.75 is possible, I am not saying it will go there. But 38.75 is possible.

Q: That’s December 31st?

A: Yes, before that.

Savings potential for NRIs declines

Savings potential for NRIs declines

By Babu Das Augustine, Banking Editor GULF NEWS Published: October 03, 2007, 23:52

Dubai: Non-resident Indian (NRI) deposits, which account for a major share of India’s foreign exchange reserves, are declining fast due to the weakening dollar, lower interest rates and the Gulf’s rising cost of living.

The Gulf countries, a major source of NRI remittances to India, have been experiencing unprecedented growth in the cost of living on the one hand and the steep decline in exchange rates due to most Gulf currencies’ peg to the dollar.

According to the latest statistical bulletin from the Reserve Bank of India, the country’s central bank, NRI deposits declined by almost $500 million in the April-June quarter, and the current quarter is expected to post a further decline due to the continuing weakness of the dollar and falling interest rates.

“The saving potential of an average Indian working in the Gulf has come down by more than 30 per cent during the past two years. Although many of them are remitting the same amount or more in dollars, the reduced exchange rates of Gulf currencies are directly hitting their saving potential,” said Sudhir Shetty, General Manager of the UAE Exchange Centre.

At the state level Kerala- banks were hit the hardest. According to figures released by the State Level Bankers Committee meeting held in Thiruvananthapuram yesterday, non-resident deposits in Kerala banks amounted to Rs319.95 billion as of last June, which is 34.56 per cent of total deposits in these banks.

Diversification

“While falling rates and the interest rate cap on foreign currency deposits are the main reasons attributed to the decline in deposits, people have also started diverting funds to other investment options such as real estate and the stock market,” said a senior State Bank of India official.

Dollar denominated deposits are no longer attractive due to the decline in the dollar’s value against the rupee and falling interest rates. Currently, foreign currency deposits pay in the range of 3.8 per cent to five per cent. “NRIs were pumping money into India due to the high interest rate differential. Lower interest rates combined with four to six per cent domestic inflation could mean negative return on bank deposits,” said a senior banker.

Although NRI deposits are falling, exchange houses said remittances are not affected. “People with fixed commitments such as mortgages, loans, education costs and other family expenses cannot reduce their remittances. However, with falling exchange rates, people’s saving potential has come down. That is reflected in declining bank deposits, ” said Shetty.

NRIs in the UAE have lost about 12 per cent of their earnings due to exchange rate losses and about 10 per cent is lost in the increased cost of living. It means that in rupees, earnings have fallen by a minimum of 22 per cent, reducing the savings and investment potential of UAE-based NRIs.

Sensex@17000 has 9 new trillion Re members

Sensex@17000 has 9 new trillion Re members

28 Sep, 2007, 1000 hrs IST, TNN

MUMBAI: The surprise bull run has generated so much of wealth that many top-rung companies can now boast of being part of the Rs 1-trillion market cap club.

The list of the biggest wealth creators is expanding with every 1,000-point rise in the Sensex . Nine companies, led by Reliance Industries (RIL), have already entered the hall of fame after their market caps soared beyond Rs 1,00,000 crore (trillion) amid unprecedented rally in their shares in the past few months.

RIL topped the list with Rs 3,23,322 crore as on Thursday when the Sensex soared past the historic 17k-mark to close with a gain of 229 points, or 1.4%, at 17,151. The stock has been on a dream run, jumping 27% to Rs 2,320 in one month. The market is still looking for clues as to what sparked the surge in the scrip.

Public sector oil and gas giant ONGC ranks second, but the company’s market cap at Rs 2,07,826 crore is substantially lower than that of RIL. Apart from RIL and ONGC, Bharti Airtel (Rs 1,82,256 crore), NTPC (Rs 1,59,880 crore) and DLF (Rs 1,26,432 crore) are among the top five wealth creators. Most of them, barring Bharti Airtel, have outperformed the Sensex in the past one month. The stocks have risen between 10% and 27% against a 16% gain in the index.

Two companies — DLF and ICICI Bank (market cap Rs 1,09,222 crore) — have found place in the list of high-fliers during the Sensex’s journey from 15K to 17K in the past two-and-a-half months.

A few more companies are close to touching the Rs 1 trillion-mark. Bhel and SBI, with a market cap of Rs 99,896 crore and Rs 99,260 crore, respectively, may soon achieve the milestone if these stocks continue to rise in the coming days.

5 reasons why market is complacent

5 reasons why market is complacent

28 Sep, 2007, 0310 hrs IST,Pravin Palande, TNN

1. First, the equity earnings yields (the inverse of PE ratio) is at 4.77%. The equity market is attractive when earnings yield is higher than that of bond yield. Today, 10-year bond yield is at 8%. When earnings yield is almost half that of the government bond yield, it indicates a clear complacency. Investors want to look at the next year’s PE of 18.14 which gives an earnings yield of 5.51%. This, according to them, makes the market look very comfortable. Investors expect the equity market to go up irrespective of any events. Again, justifying that the market at a PE of 18.14 may not be a great idea.

2. The implied volatility of Nifty is falling. In other words, investors feel that the market will not be choppy, given that the Sensex has seen an amazing run. The volatility in Nifty is 14%, a level seen two months ago when it was at a lower level. Since, the market has moved up 7% in the past two months, the volatility number should have been higher. This shows that investors are under the impression that there are no bumps ahead.

3. Open interest positions in Nifty futures are rising. Almost 77% of the positions have been rolled over on Thursday to October contracts. Simply put, investors may be taking big bets in derivatives. The October contract of the Nifty is in heavy demand. The market looks optimistic for the coming month, at least going by the Nifty futures positions.

4. Bank stocks are moving up as the market is betting on a rate cut even though there are no such indications from RBI. Over the past two weeks, the Nifty banking index has moved up 15%. Any kind of rate cut is seen as a positive, since it makes money cheaper and leveraging easier. At a time when the Sensex has hit 17K, expecting cheaper money may be wishful thinking.

5. Investors are reading too much into the recent capital outflow liberalisation measures. Many feel that the rupee will turn weaker with more outflow and it’s time to buy IT stocks or cover short-positions in software scrips. The fact is it could be too little, too late. Besides, net FII investments are rising. Since September 20, FIIs have been net buyers of Indian equity. On September 27, net investment was Rs 1,004 crore. These numbers are fuelling in the feel-good sentiment.

- ← Previous

- 1

- …

- 8

- 9

- 10

- Next →

You must be logged in to post a comment.