Information – Money Market

‘Making money will not be easy in ’08’

‘Making money will not be easy in ’08’

31 Dec, 2007, 0454 hrs IST,Shakti Shankar Patra, TNN

At ET Intelligence Group, we have always strived to help readers take well-informed decisions. And we leave no stone unturned in doing this. Apart from providing analytical insights and expert opinions to anticipate the trends in ’08, we decided to lend an ear to what the celestial elements are telling us.

To have a better understanding of what ’08 has in store for us, ETIG caught up with renowned astrologer Bejan Daruwala .

According to this fond worshipper of Lord Ganesha, India’s best period started from September 3, ’07. Mr Daruwala — who had predicted India’s emergence as an economic superpower way back in January ’00 — claims that India will have a great time in the next few years and will emerge as a powerhouse some time around the year ’12.

“In ’08, Jupiter will land up in India’s sun sign Capricorn. This ensures prosperity and good luck,” he says. He further enunciates that other natives of Capricorn, including Ratan Tata, Baba Kalyani of Bharat Forge and Vikram Pandit of Citibank, will have a wonderful year ahead.

Mr Daruwala emphasises that ’08 will see Saturn teaming up with Virgo, which means only the ‘practical-minded and ruthless’ will survive. Companies that emphasise on cutting down unnecessary expenses and are willing to overhaul old management practices will do well. Similarly, Capricorn, the big daddy of all sun signs, will ensure that managements that act with a strict hand do well.

However, Mr Daruwala feels the Sensex may not reflect the strength of the Indian economy to the fullest. “The year ’08 will see the Sensex fluctuating wildly and money-making won’t be as easy as it has been in ’07,” he says. He further predicts that the months of March, June, September and December will be particularly tough for the market.

Looking beyond the economic scenario, Mr Daruwala sees the country facing a few new problems. He cautions that the next 2-3 years will see the emergence and rise of new forms of terrorism. He foresees that India and Pakistan will have a more permanent and long-term truce.

On a more positive note, Mr Daruwala opines that India’s favourable time had begun when Atal Bihari Vajpayee took over as prime minister, and both he and Manmohan Singh are lucky for the country.

Who all are the biggest winners in the market?

Who all are the biggest winners in the market?

31 Dec, 2007, 1555 hrs IST,DEEPAK MOHONI,

The market bounced back last week, with the Sensex finishing 5.45% or 1,044 points higher, the Nifty up 5.43% and the CNX Midcap gaining 6.63%. Tata Steel was the biggest winner among the Sensex stocks with a 12.9% gain. Other gainers were Reliance Energy, DLF, Bhel, Wipro, HDFC and Hindalco with gains between 7% and 12%. Bajaj Auto was the biggest loser among the Sensex stocks with a 6.5% loss. Maruti Suzuki lost just 0.8%, and was the only other Sensex stock to finish lower.

Era Construction was the biggest winner among the more heavily traded non-Sensex stocks with a 38.7% gain, followed by Everonn Systems with a 38.3% gain. Mercator Lines, Parsvnath Developers, Adani Enterprise, Videocon Industries, Essar Oil, Alok Industries, IOC, Ansal Infra and Mundra Port all gained between 17% and 33%. Ispat Industries was the biggest loser among the more heavily traded non-Sensex stocks with a 2% loss. There were no other significant losers.

Intermediate Trend: The indices remain in intermediate uptrends, with last week’s rally helping them avert the downtrend threat. The uptrend has started from the Sensex’s November 22 low of 18183 for the Sensex and Nifty, while the CNX Midcap index has been in an uptrend since October 22.

The uptrend will end if the Sensex falls below 18886, the Nifty under 5676 and the CNX Midcap below 8430. Our market is one of the very few that has managed to escape an intermediate downtrend. The uptrend will become more stable if the global rally evolves into an intermediate uptrend.

Outlook For ’08: The market’s long-term (major) trend remained up during all of ’07. The Sensex had gained 46.57% or 6,420 points until Friday, and the Nifty 53.28%. The CNX Midcap outperformed them with a gain of 74.39%.

Reliance Energy was the biggest winner among the Sensex stocks with a 314.7% gain. Larsen & Toubro, Reliance, Bhel, Tata Steel, State Bank, DLF and HDFC followed, with gains between 80% and 188%.

Infosys was the biggest loser among the Sensex stocks with a 19.9% loss. Other losers were Tata Motors, Cipla, Wipro, TCS, Mahindra, Satyam Computers and ACC with losses falling between 7% and 19%. The bull market will end if the indices close below their previous intermediate bottoms. These stand at 18183 for the Sensex, 5394 for the Nifty, and still 6463 for the CNX Midcap.

We will enter ’08 with a strong possibility that we are in a bubble, as the market caps of several underachieving companies are rising on hope and hype, rather than performance. Hence, there can be a correction — perhaps along the lines of the one seen in May ’06. However, bubbles are always unpredictable, and stocks can continue to rise beyond most expectations before the bubble bursts.

Short-Term Outlook: Global markets were rallying again after dipping on Thursday night and Friday morning, and this should lead to further gains at the start of the new week. A fresh global intermediate uptrend can mean more gains ahead. Europe and the US were rising again on Friday, and a global intermediate uptrend appears to be on the cards now.

Strategy: Fresh long and medium-term purchases should be made only after the next intermediate downtrend ends, and provided the bull market continues. Day traders should find the mid-caps more profitable, as the larger moves are happening in this category once again.

The intermediate uptrend looks stable for now, and swing traders can carry positions overnight on the long side with normal risk. Please note that all forms of short-term trading will succeed only with a proper risk and money management strategy.

Global Perspective: Most major global markets rallied all week, except for a sell-off on Thursday night and Friday morning. However, most of the main global indices are still in intermediate downtrends, but a persistent rally should lead to an early confirmation of an intermediate uptrend.

Several global indices went into these intermediate downtrends after making lower intermediate tops, and there’s a question mark on the global bull market. A closing below its last intermediate bottom of 12700 will be a bear market signal for the Dow, and such an event can well trigger a global bear market too.

The Sensex’s gain for ’07 (until Thursday) stands at 46.6%, making it the fourth best performer among 40 well-known global indices considered for the study. Shanghai heads the list with a 98.4% gain. Indonesia and Pakistan follow with gains of 47.1% and 51.7%, respectively . (These rankings do not take exchange rate effects into consideration). The Dow Jones Industrial Average has gained 7.2% and the Nasdaq Composite 10.8% during the year.

(The author is an independent technical analyst)

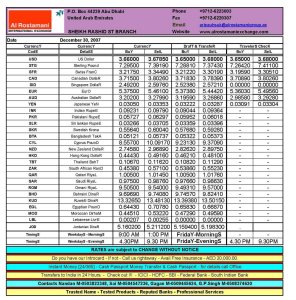

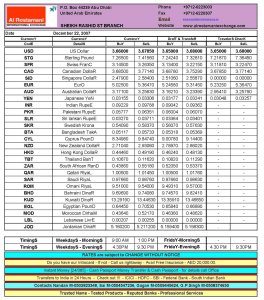

Daily Exchange Rates – Saturday, 29 December 2007

Brought to you by

Al Rostamani International Exchange

Abu Dhabi

Phone: +9712 6223003

http://www.alrostamaniexchange.com

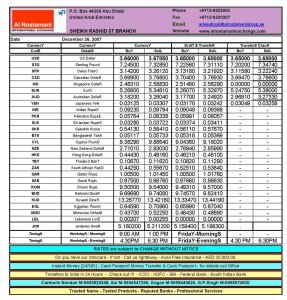

Daily Exchange Rates – Wednesday, 26 December 2007

Brought to you by

Al Rostamani International Exchange

Abu Dhabi

Phone: +9712 6223003

http://www.alrostamaniexchange.com

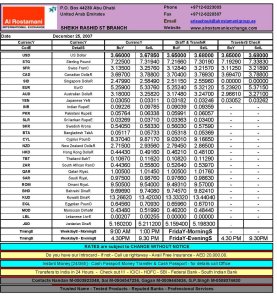

Daily Exchange Rates – Tuesday 25 December 2007

Brought to you by

Al Rostamani International Exchange

Abu Dhabi

Phone: +9712 6223003

http://www.alrostamaniexchange.com

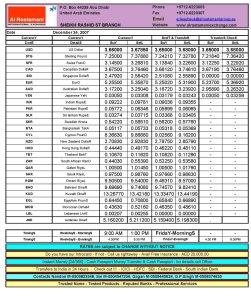

Daily Exchange Rates – Monday, 24 December 2007

Brought to you by

Al Rostamani International Exchange

Abu Dhabi

Phone: +9712 6223003

http://www.alrostamaniexchange.com

Daily Exchange Rates – Saturday, 22 December 2007

Brought to you by

Al Rostamani International ExchangeAbu Dhabi

Tel : + 9712 6223003

What’s short-selling of shares?

What’s short-selling of shares?

TNN

What is short-selling?

Short-selling, in the context of the stock market, is the practice where an investor sells shares that he does not own at the time of selling them. He sells them in the hope that the price of those shares will decline, and he will profit by buying back those shares at a lower price. In India, there is no prohibition on short-selling by retail investors. Institutional investors —domestic mutual funds and foreign institutional investors registered with the Securities and Exchange Board of India (Sebi), banks and insurance companies — are prohibited from short-selling and are mandatorily required to settle on the basis of deliveries of securities owned and held by them.

How is short-selling beneficial?

Short-selling is considered an essential feature of the securities market not just for providing liquidity, but also for helping price corrections in over valued stocks. Supporters of short-selling claim its absence distort efficient price discovery, gives promoters the unfettered freedom to manipulate prices and favours manipulators than rational investors. Securities market regulators in most countries, and in particular, all developed securities markets, recognise short-selling as a legitimate investment activity. The International Organisation of Securities Commissions (IOSCO) has also reviewed short-selling and securities lending practices across markets and has recommended transparency of short-selling, rather than prohibit it.

Are there any drawbacks of short-selling?

Critics of short-selling feel selling, directly or indirectly, poses potential risks and can easily destabilise the market. They believe that short-selling can exacerbate declining trend in share prices, increase share price volatility, and force the price of individual stocks down to levels that might not otherwise be reached. They also argue that declining trend in the share prices of a company can even impact its fund raising capability and undermine the commercial confidence of the company. In a bear market in particular, short-selling can contribute to disorderly trading, give rise to heightened short-term price volatility and could be used in manipulative trading strategies.

Will institutional investors in India be allowed to short-sell securities?

Sebi is working on a proposal to introduce a stock borrowing and lending mechanism. This will allow institutional investors to short-sell by borrowing shares. Under this arrangement, an investor A, who feels that a certain stock is overpriced, borrows those shares for a charge from investor B, who is willing to lend those shares. Investor A then sells those shares in the market, hoping that the price declines so that he can buy cheap and return them to investor B.

What is the difference between covered short sales and naked short sales?

Covered short sales are those in which the seller arranges for the delivery of shares he has sold by borrowing them. Naked short sales are those in which the seller does not intend to provide for the delivery of shares he has sold. Most international securities market regulators have prohibited naked short-selling and require the client to have documentary evidence of borrowing/tie-up with lenders before executing the sale transaction. This is because naked short sales in huge quantities can destabilise the market.

How does the stock lending and borrowing mechanism function in other markets?

World over, securities lending and borrowing transactions are, by and large, over-the-counter (OTC) contractual obligations executed between lenders and borrowers. International securities market regulators do not directly regulate the lending and borrowing transactions. In many international markets, entities like custodians and depositories run the lending and borrowing scheme and have their own screens for meeting the demand and supply of securities from their clients.

( With inputs from the Sebi discussion paper on short-selling and stock lending )

Top 10 tips to save money for your start-up

Top 10 tips to save money for your start-up

Before you turn to the bank for a loan, think about creative ways to finance your business without raising start-up capital from external sources. Here are 10 top tips:

Start small: Even if you have a grand vision for your business, concentrate on generating short-term revenue to get enough cash to fund the long-term business idea.

Focus on sales: Get on the phone and start cold calling. Go for quick wins — contracts that bring in cash and will lead to other sales. Generating cash flow is the immediate goal in order to start building your business.

Concentrate on networking: Don’t waste money on expensive advertising which can be a hit or a miss. Concentrate on networking and building up contacts, as word of mouth is the most effective form of promotion.

Keep overheads to a minimum: Work from home if you can and borrow or lease rather than buy expensive equipment. It’s easy to get carried away resourcing a new business, but only buy what you really need to get the job done.

Choose wisely: Open a company bank account that offers free business banking for start-ups for at least the first 12-18 months. Internet banking makes it easier to keep a close eye on transactions.

Control debt: Utilise a 0% credit card for essential expenditure, — but be careful to keep debt under control and either pay it off or transfer to another 0% card well before the interest rate goes up.

Invoice your clients in stages: 50% at the half-way point and 50% on completion. Make sure you have clear payment terms in the contract and on the invoice.

Retain cash in the business: Take as little out yourself as possible. This might mean going without a holiday or you may need to start your business whilst still in part-time employment to cover your bills.

Try business bartering: Offer your design services in exchange for goods and services you need. This saves you spending cash and can be a good way to develop relations with a new client base.

Put time into PR: Think of an unusual hook and write a press release or article. Conduct a survey about a topical or controversial issue with your potential customers. Publish the results as a story to attract free publicity for your business.

Excerpts from bytestart.co.uk

Currency Crunch: Hard-Up Dirham

Currency Crunch: Hard-Up Dirham

By Derek Baldwin, Jay B. Hilotin and Subramani Dharmarajan, Staff Reporters GULF NEWS

Expatriates say the weak dirham means they will have to stay working in Dubai longer than they had planned to shore up savings.

Hopes of an imminent revaluation of the dirham faded this week after Gulf leaders declined to discuss the weakened US dollar.

The Central Bank also warned money changers and hotels this week not to exchange dollars at less than the usual rate of the dirham.

It’s anyone’s guess, meanwhile, where the dirham rate will go in the near future as expats and financial officials wrestle with up to 24 per cent losses on the dirham as a result of its long-time peg of 3.6725 to the US dollar.

Less Purchasing Power

Ronald Simmonds is a Canadian lawyer who moved to Dubai in 2006 with his wife and two children with hopes of earning a high income.

However, Simmond’s Dubai savings account ledger is disappointing to say the least, he told XPRESS, because the dirhams that he sends home every month have less purchasing power to buy Canadian dollars.

Simmonds, 38, had instructed his local bank to automatically transfer Dh10,000 a month to his Canadian investment fund but has stopped doing so because he was losing more than Dh1,500 when the money was exchanged.

“We’re hanging on to our dirhams now until we see where they are headed against the US dollar,” said Simmonds

“To take this kind of hit every month really hurts our future when you add it up over the long term.”

For the moment, Simmonds said he is banking his money here in the UAE until he decides the best means of getting the biggest value for the dirham.

He is carefully watching international money markets with the hope that predictions that the dirham could rebound are true.

Simmonds said his dream is to save enough cash to buy a home in Toronto or at least save a large portion of the cost to ease years ahead when he returns.

David Wright, 56, is an American engineer who has been frustratingly watching his earning power drop steadily in recent months. He said he will hang on to his money until the dirham comes back in value.

Wright as well is trying to save money to buy a new home outside of Chicago when he returns to America but said the devalued dirham is making it difficult.

“We’re going to have to spend more time than we planned on living and working in Dubai to make up for the lost value,” Wright said.

“My wife really wants to go home but we need to stay a little longer than we expected.”

Diminished Income

Harold Orona, 30, a Filipino food technologist, doesn’t like the devalued dirham either.

“The dollar’s decline has cut my income [in Philippine peso terms] by about 20 per cent in the last 24 months. I had started paying for a two-storey house in Manila in 2005 and expected to finish paying for the mortgage in six months. Now, it looks like it would take more than that. ” he said.

Janytte Siega, 28, a Filipina events organiser, said the dirham dilemma has put her between a rock and a hard place.

“I came here four years ago, when the dirham’s value against the peso was about 1:15. Due to the dirham’s peg to the greenback, the exchange rate now is about 12 pesos for one dirham.

“The peso appreciation also means I am saving less and shell out more for the same expenses back home. But here too I can’t save because of the rising cost of living. It’s a big squeeze,” she said.

Money Trail

Indian Rupee vs. Dirham

Dec. 5, 2003 – Dh1 = INR12.44282

Dec. 5, 2004 – Dh1 = INR12.02506

Dec. 5, 2005 – Dh1 = INR12.58809

Dec. 5, 2006 – Dh1 = INR12.15018

Dec. 5, 2007 – Dh1 = INR10.74094

Peso vs. Dirham

Dec. 5, 2003 – Dh1 = Php15.07841

Dec. 5, 2004 – Dh1 = Php15.33433

Dec. 5, 2005 – Dh1 = Php14.75343

Dec. 5, 2006 – Dh1 = Php13.59078

Dec. 5, 2007 – Dh1 = Php11.51132

UK Pound vs. Dirham

Dec. 5, 2003 – £1 = Dh6.32562

Dec. 5, 2004 – £1 = Dh7.14360

Dec. 5, 2005 – £1 = Dh6.36781

Dec. 5, 2006 – £1 = Dh7.26910

Dec. 5, 2007 – £1 = Dh7.57604

Euro vs. Dirham

Dec. 5, 2003 – €1 = Dh4.43576

Dec. 5, 2004 – €1 = Dh4.94771

Dec. 5, 2005 – €1 = Dh4.30632

Dec. 5, 2006 – €1 = Dh4.89504

Dec. 5, 2007 – €1 = Dh5.39751

You must be logged in to post a comment.