Information – Money Market

The dos and don’ts of buying stocks

The dos and don’ts of buying stocks

Rajesh Kumar, Outlook Money January 19, 2007

So you’ve made up your mind to invest in the stock market. Having overcome initial inhibitions, you’re now looking to become a millionaire overnight. After all, if your friend A or your cousin B could do it, why not you?

For investment-innocents, here’s a shocker: It is not where you invest your money, but how you invest it that decides the profits. That is to say, stocks are only as good as the investor; they respond to the individual’s abilities and acumen. In that sense, stocks are quite distinct from consumer durables. You can reasonably expect a washing machine to perform as well for you as for your neighbour, but that is not the case for stocks, which are a different breed altogether.

So, instead of investment tips, here are some attitude tips.

Don’t commit large amounts of money or short-term money. Even if you can afford to take risks, we suggest you don’t commit large sums of money – at least not in the initial stages. It would be wiser to start with small amounts and increase your investments as your confidence and grasp of the markets grows. It is not easy to pick up the right stocks or keep track of them when you are starting out.

Also, don’t break FDs to invest in rising markets. Always invest the surplus, money for which you have no immediate plans. Equity, as an investment, carries in-built risk and volatility and investing short-term money may force you to quit at the wrong time.

Do be sceptical of self-proclaimed experts. As an investment ing�nue, stay away from self-proclaimed experts or overzealous advisers. The so-called ‘hot tips’ they offer to investors are largely short-term trading tips, which are very risky for a retail investor. Because the reaction time is limited, chances are you will end up losing wealth.

Similarly, TV gurus and the like are forever ready with “buy” recommendations; few, if any, come out with “sell” advisories for your advantage.

Further, expert recommendations often have vested interests. Recently, market regulator Securities and Exchange Board of India fined an expert for acting exactly contrary to his own recommendations. To curtail such rogue elements, the market regulator is planning a law to govern experts, who comment on the markets in the mass media.

Don’t trade for short-term. Short-term trading or day trading is very risky and not recommended for retail and small investors for two reasons. First, it requires lot of time, which small investors can rarely spare since it is not their primary business. Second, retail investors may not have the necessary skills and tools required for short-term and day trading. Do not try to time the markets: it’s one of the most difficult things to do.

Invest long-term in fundamentally strong companies. Our advice to retail investors is to invest long-term in fundamentally strong companies. Give your portfolio adequate time to grow. Do not panic in technical corrections. If you are invested in fundamentally strong companies, you are safe. We saw two sharp corrections in 2006, first in May-June and again in December. On both occasions, the market bounced back and crossed previous highs because the fundamentals were intact.

Don’t ignore stock fundamentals. There is no set formula for fundamental analysis. You have to study various indicators like sectoral growth, company growth – both top and bottomlines – and various ratios like price to earning ratio, price earning to growth, dividend yield, book value, price to book value, price to sales ratio, debt-equity ratio, return on capital employed, to name just a few.

If number-crunching is not your cup of tea, you must still investigate the nature, business and size of the company and its growth in the last three years – sales, profit and earning per share – all of which are accessible on the websites of stock exchanges.

Do not be tempted to buy small caps and penny stocks. The risk involved in small companies is huge, but higher risk may not necessarily lead to higher gain. That is not to say that you should ignore small companies completely, but at the same time you must have solid reasons for buying into them. And when you do, make sure they are only a small portion of your portfolio.

Do be critical of media reports. It’s tempting, when you are just about beginning to follow the jargon, to buy into glowing media reports about corporates. But they could be misleading. For instance, you may read of a company setting up a new plant. Such announcements usually push up prices in anticipation of earning growth.

Before you join the queue for their stocks, you need to understand the cost benefit of the new plant. Ask yourself a few questions: where is the money coming from�equity or debt? If it’s equity, how will it impact the EPS in the near future? If the source is debt, is the company in a position to leverage the increased debt? What will be the gestation period? When will the earnings really start coming in? What will be the return on capital employed?

Don’t follow other investors blindly. People often talk about their success in the stockmarket, rarely of their failures. Your friend may have made money in the past, but there’s no guarantee he will continue to do so in future.

If, however, he offers to share his stocks research with you, welcome the opportunity. It will help you build your own research, but remember it is not a substitute for your own investigation.

Do stay away from a large number of stocks. Investors generally hold a large number of stocks in the name of diversification. But this may not always be the case.

Harry Markowitz, known as the Father of the Modern Portfolio, warned investors: “Holding securities that tend to move in concert with each other does not lower risk.” A truly diversified portfolio, he said, comprises non-correlated asset classes that could provide the highest returns with the least amount of volatility.

If you are still looking to diversify within equity, do not go in for stocks of more companies than you can track regularly. Seven to 10 would be ideal, though, of course, this is a highly individual call. The biggest disadvantage of holding a large number of stocks is failing to quit at the right time.

Capitalise on this crash: Sectors to eye right now

Capitalise on this crash: Sectors to eye right now

2008-01-21 13:16:01 Source : CNBC-TV18

India is the worst performing market today and Japan’s Nikkei declined 3.865% or 535.35 points, Hong Kong’s Hang Seng tumbled 4.425% or 1115.12 points Singapore’s Straits Times slipped 3.23 and South Korea’s Seoul Composite fell 2.95%.

It is proving to be an extremely scary session for the markets as fall has continued further. There is panic selling in markets and nearing to hit a down circuit which comes in at 10% down. Now the Sensex and Nifty are down nearly 7%. Margin call is seen building up.

It has broken all technical and psychological levels. Both Sensex and Nifty has fallen 16% from their highs. Breadth has worsened and the advance decline ratio is over 1:50. According to analyst the scenario is similar to the May 2006 fall. There is pressure due to triggering of margin call. Nifty Futures is trading at 100 points discount.

Shashank Khade, VP – Portfolio Management Services, Kotak Securities feels that the value that is right now emerging is clearly in technology, in auto and in FMCG. Valuations are really cheap right now in these three sectors, he feels.

He said, “My sense is that the markets may tend to go ahead and rotate the sectors itself. The underperformance that you had seen in the last six to eight months may actually start looking good, because not only did they not participate on the way up, they have also participated on the way down, which clearly means that the valuations of these stocks have got much more interesting. Sectors, in this sort of space would include FMCG, auto, technology, which may actually become extremely cheap in terms of valuations. So, while the infrastructure stocks may continue their consolidation and correction, it could be that monies may actually get rotated into the other stocks, which haven’t participated at all.”

He adds that, “The value that is right now emerging is clearly in technology, in auto and in FMCG. It is a call as to how much of the negatives in these sectors per se have been factored into these prices. That is the biggest call here. In FMCG and auto, the growth has not been as strong and that is the reason why these stocks have been really down and under. But valuations are really cheap right now in these three sectors.”

Vibhav Kapoor of IL&FS said, “We like banking a lot. There is definitely value in banking, capital goods; infrastructure has been beaten down. But there is good value in some of those sectors. In fact we are basically avoiding cement, technology sector and global commodities, which are metals. Apart from these three sectors, we think there is a lot of value in many other sectors.

Stocks to pick: Reliance capital,Axis Bank, Moser Baer, Shree Cement

Stocks to pick: Reliance capital,Axis Bank, Moser Baer, Shree Cement

14 Jan, 2008,

Reliance Capital

Research: Macquarie

Rating: Outperform

CMP: Rs 2,768

Macquarie has initiated coverage on Reliance Capital with an ‘outperform’ rating and a target price of Rs 3,392, with a 23% potential upside. The company looks set to make a serious breakthrough into multiple segments of retail financial services. Macquarie believes the domestic financial services sector is in a period of high structural growth. The retail side of this is being driven by chronic under-penetration, which is being unlocked by changing demographics and greater availability and reach of products. The wholesale segment is being driven by significant acceleration in investment activity in the economy. Reliance Capital is entering a critical phase in most of its businesses, where it will start to grow aggressively and give a massive push to break into the top three.

It has already established its credentials by surging to the top spot in the mutual fund league tables, and is now starting to make an impact in insurance and broking/wealth management as well. Its core strengths remain its strong brand name, aggression in the market, deep pockets and execution capabilities. The stock looks expensive at >11x P/BV, even on a consolidated basis, but its holding-company-like structure makes it difficult to view it on traditional valuation parameters. Also, the market is factoring in its large unrealised gains on the equity portfolio, some of which include strategic holdings in other group companies.

Moser Baer

Research: JP Morgan

Rating: Underweight

CMP: Rs 289

JP Morgan retains its negative view on Moser Baer with a sum-of-the-parts based June ’08 price target of Rs 250. Risks to the target price include a sharp price increase in optical media. Monthly sales of Taiwanese optical media manufactures fell 15% month-on-month. December monthly sales also fell 36% year-on-year (YoY), indicating continued original equipment manufacturer (OEM) pricing pressure. Optical media sales fell 14% quarter-on-quarter (QoQ) and 30% YoY during the second quarter. JP Morgan expects subdued pricing to continue, especially in DVD-R, leading to weak margins. On January 4, ’08, Warner Brothers (WB) announced that it will exclusively support the Blu-ray format. This is a major positive for the Blu-ray format as WB has the largest market share (18-20%) in the US and earlier supported both formats. As greater clarity emerges on the next-generation DVD format, JP Morgan believes that adoption will accelerate, but expects significant volumes only in late ’09. The photo voltaic business may face significant margin pressure going forward, led by higher poly-silicon prices in the near term and rising competition in the long term once the supply tightness eases.

Axis Bank

Research: CLSA

Rating: Buy

CMP: Rs 1,167

Axis Bank can trade up to 25x 12-month forward P/E based on its strong growth trajectory, and reiterates ‘buy’ rating on the stock with a price target of Rs 1,300. Axis Bank’s Q3 FY08 profit grew 66% YoY to Rs 310 crore, ahead of estimates, led by strong growth in core operations and higher treasury gains. Despite moderation in sector loan growth, Axis Bank’s loan book grew 50% YoY led by corporate and agricultural credit. Retail loans as a percentage of total loans fell to 25% (29% in December ’06). Despite strong loan growth, asset quality improved, gross non-performing loans (NPLs) fell 5% YoY, while net NPLs declined 12% YoY. Gross NPLs are now at 0.8% of advances and coverage has improved to 50%. Net interest margins (NIMs) expanded 90 bps to 3.9%, of which, 30 bps was due to the bank’s recent capital-raising.

Cost of funds declined by 45 bps QoQ due to capital-raising and aggressive growth in low-cost demand deposits. Cost pressures for Axis Bank continue; while employee costs have increased 51% YoY, other operating costs have risen 75% YoY (partly due to rising rentals for new branches). Treasury gains also increased sharply due to a buoyant equity market and some reversal of mark-to-market hit on the bank’s bond portfolio. Axis Bank, with Tier-1 capital of 12.6%, is well-capitalised to leverage on rising credit demand.

Shree Cement

Research: Merrill Lynch

Rating: Neutral

CMP: Rs 1,325

Shree Cement’s operating performance in Q3 FY08 was a tad better than expectations due to lower-than-expected rise in costs. Q3 EBITDA/tonne was up 2% QoQ versus flattish forecast. Contrary to expectations, Shree’s power and fuel costs fell 8% QoQ in Q3 FY08. Shree stated that higher blending had offset the impact of rising pet-coke prices. Overall, operating cost per tonne was up 3% QoQ, in line with the improvement in cement prices. Reported net profit fell 66-67% YoY to Rs 35 crore, due to accelerated depreciation. For the industry, the window of opportunity to increase cement prices is short (1-2 quarters), as nearly 49 million tpa (mtpa) of new capacity is expected to be commissioned by March ’09. Merrill Lynch is also uncomfortable about the recent uptick in clinker inventory across the industry, including North India.

The upside to cement prices in the North may be capped in the near term due to recent large capacity expansions by both Binani and Shree Cement. Merrill Lynch expects Shree to post flattish earnings in FY09E. Despite likely strong volume growth of ~30% YoY, FY09-EBITDA growth may be modest at ~8% YoY due to forecast of a downturn in cement prices by end-CY08. Shree is evaluating greenfield capacity expansion in Madhya Pradesh as part of its long-term plans. This is unlikely to impact cash flows over the next year or so. In the next six months (by Q1 FY09E), Shree will commission further 1.5 mtpa expansion at Ras, thereby taking its composite capacity to 9 mtpa versus 7.5 mtpa currently.

Sensex flat after hitting record high

Sensex flat after hitting record high

Reuters Published: January 10, 2008, 00:55

Mumbai: Indian shares rose to a fifth record high of the new year yesterday but faltered to end little changed, as a bullish domestic outlook was weigh-ed down by losses in global markets and intensifying US downturn worries.

ICICI Bank and Reliance Industries, which account for more than a quarter of the main index, were among the losers as investors locked in profits in the two stocks that have gained 5-10 per cent this year.

The 30-share BSE index ended 0.02 per cent, or 3.55 points, lower at 20,869.78, with 18 of the components falling.

The benchmark had opened 0.14 per cent up, but quickly slipped into negative before rallying as much as 1.14 per cent to an all-time high of 21,113.13. It was the fourth record in a row and the fifth in 2008.

Volatility

“Volatility is mostly because of the [negative] global cues. Our markets are so resilient that they don’t want to go down,” said Neeraj Dewan, director at Quantum Securities.

“If the US stops falling, then may be you could see five-seven per cent jump from these levels,” Dewan said.

India’s domestic demand driven economy is expected to expand at about nine per cent in the fiscal year ending March, the fastest pace after China among major economies.

No 2 lender ICICI Bank ended 1.7 per cent down at Rs1,310.45, extending its 2.2 per cent fall on Tuesday. The stock had gained more than six per cent on Monday on market talk that it could list its broking subsidiary and is up 6.3 per cent this year.

Reliance Industries, India’s most-valuable listed firm, slipped 0.6 per cent to Rs3,031.95.

Public issue

Reliance Energy, the half-owner of Reliance Power which is aiming to raise up to $3 billion next week in India’s biggest public issue, rose 1.2 per cent to Rs2,565.45, while group firm Reliance Communications added 2.1 per cent to Rs820.80.

State-run utility NTPC Ltd gained 4.5 per cent to Rs277.15 on hopes of a re-rating after the Reliance Power IPO, traders said.

HDFC, which has said it would float part of its life insurance joint-venture, added 3.6 per cent to a record close of Rs3,174.25.

Software stocks were volatile ahead of bellwether Infosys Technologies’ quarterly results on Friday. Infosys ended 0.4 per cent down, while No 3 software exporter Wipro pared early gains to close 0.6 per cent higher.

End of Day Review – Wednesday, 09th January 2008

Sensex retreats from all-time high

9 Jan 2008, 1617 hrs IST,INDIATIMES NEWS NETWORK

MUMBAI: Volatility continued for second straight day on Wednesday as equities retraced from higher levels to close lower.

A weak opening in the European market dampened sentiment.

Bombay Stock Exchange’s Sensex ended at provisional 20,839.33, down 34 points or 0.16 per cent. Earlier, the benchmark hit an all-time high of 21,113.13 but soon gave in to profit booking. It touched a low of 20,701.49.

National Stock Exchange’s Nifty closed at provisional 6265.75, down 22 points or 0.35 per cent. It touched a high of 6,338.30 and low of 6,231.25.

Biggest Sensex gainers were NTPC (4.49%), HDFC (3.59%), Reliance Communications (2.05%), Hindalco Industries (1.7%), HDFC Bank (1.68%) and DLF (1.59%).

Mahindra & Mahindra (down 2.67%), BHEL (2.02%), ONGC (1.76%), ICICI Bank (1.73%), Ranbaxy Laboratories (1.65%) and ACC (1.52%) were the losers.

All sectoral indices, barring BSE IT Index and BSE Realty Index, ended in the red.

Market breadth remained negative on the BSE with 2130 declines outnumbering 763 advances.

European markets were witnessing selling pressure after UK’s clothing retailer Marks & Spencer, plunged over 15 percent.

UK’s FTSE 100 was down 1.22 per cent at 6,279.80, Germany’s DAX was at 7,789.29, down 0.77 per cent.

Last trading day: Wednesday, 9 January

4:22 PM – The market closed weak with Sensex swinging 400 points and Nifty 100 points in intra day trade. Sensex closed at 20869, down 3 points and Nifty at 6272, down 15 points from the previous close. The CNX Midcaps Index was down 0.4% and BSE Smallcaps Index was down 1%. The market breadth was bad with advances at 343 against declines of 881 on the NSE. Top Nifty gainers included NTPC, HDFC, Reliance Communications, Grasim and REL while losers included RPL, BPCL, M&M, Unitech and Maruti Suzuki.

4:19 PM – In the IT space, Aftek, KPIT Cummins, Roltas and Infosys still look good for the long term, says Anil Maghnani, technical analyst, on CNBC-TV18. He is bullish on metal, realty, banking and oil and gas sectors.

4:14 PM – India is a long-term investment story due to its domestic demand, says Richard Titherington of JP Morgan AMC, on CNBC TV19. JP Morgan is bullish on the infrastructure space, domestic goods, finance and power sectors, he adds.

Gold prices at all-time high

9 Jan 2008, 1916 hrs IST,PTI

NEW DELHI: Gold prices zoomed past the all-time high levels and touched Rs 11,350 per 10 gram on the bullion market here on Wednesday on brisk buying by stockists, following the metal rising to record levels in global markets.

Standard gold and ornaments remained in hectic demand and gained Rs 200 each at Rs 11,350 and Rs 11,200 per 10 gram respectively. Sovereign also jumped by Rs 100 at Rs 9,050 per piece of eight gram.

Silver ready also attracting persistent buying support from industrial units and spurted by Rs 540 to Rs 20,100 per kilo and weekly-based delivery by Rs 600 at Rs 20,500 per kilo on speculative buying.

Silver coins also gained Rs 100 at Rs 25,400 for buying and Rs 25,500 for selling of 100 coins in line with general trend.

The market sentiment here turned bullish after reports of gold prices surging to a new high in the global markets on softening of dollar against major currencies and rising crude oil prices.

In Asian markets, gold rose by 13.54 dollar to an all-time high of 891.70 dollar an ounce and silver advanced 1.9 percent at 15.97 dollar an ounce.

Market men said aggressive buying by stockists and jewellery makers, who were influenced by reports of the precious metal soaring to records in Asia, led to a rise.

TOP 5 GAINERS

Symbol Curr.Price % Change

HDIL 1,357.75 12.19

ADITYA BIR 2,314.30 8.56

I-FLEXSOLU 1,585.40 8.18

BANKOFINDI 400.45 7.42

PUNJABTRAC 338.30 6.28

TOP 5 LOSERS

Symbol Curr.Price % Change

PARSVNATH 505.75 -8.08

RPL 232.05 -5.90

BPCL 463.50 -5.63

H C L INFO 251.30 -5.19

ENGINEERS 1,207.90 -5.00

TOP 5 VALUE STOCK

Symbol Curr.Price Value (‘000)

RELINCECAP 2,859.60 3693168.80

RPL 232.05 3318512.95

RCOM 820.80 3085497.14

REL 2,565.45 2220695.03

RIL 3,031.95 1606131.47

WORLD INDICES

NIFTY 6,272.00 -0.25 %

SENSEX 20,869.78 -0.01 %

DOW 12,561.51 -0.22 %

NASDAQ 2,425.88 -0.60 %

FTSE 6,272.70 -1.32 %

NIKKEI 14,599.16 0.48 %

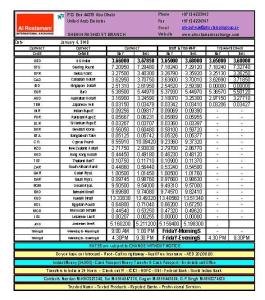

Daily Exchange Rates – Saturday, 5th January 2008

Brought to you by

Al Rostamani International Exchange

Abu Dhabi

Phone: +9712 6223003

http://www.alrostamaniexchange.com

Money Matters – End of Day Review – Friday, 4th January 2008

4:14 PM – The Indian market outperformed its global peers this week and today closed with new life highs. It was good gains and the weekly figures are: Sensex up 2.1%, Nifty 3%, CNX Midcaps 5.6% and BSE Smallcaps 7.6%, BSE Realty Index and BSE FMCG Index both up 5.9%, BSE Oil & Gas Index 5.4%, BSE Bankex 4.2%, BSE Capital Goods Index almost 2%, BSE Metal Index 1.8%, BSE Auto Index 1.7% and BSE Healthcare Index 1.3%. BSE IT index was down 5%.

4:06 PM – The market saw an excellent close with new all time highs for the Sensex at 20,762 and Nifty at 6300 in trade today. Sensex closed at 20686, up 341 points and Nifty at 6274, up 95 points from the previous close. The CNX Midcaps Index was up 0.3%, BSE Smallcaps Index was down 0.3%, BSE Oil&Gas Index was up 2%. The market breadth was negative with advances at 542 against declines of 690 on the NSE. Top Nifty gainers included Reliance Industries, Sterlite, L&T and RPL while losers included NTPC, Satyam, Cipla, Maruti and Tata Motors.

39 PM – The market is likely to continue to see volatility next week and aggressive profit booking simply because of the sheer volume of profits made on many stocks in the last 2 months, says Sajiv Dhavan of JV Capital Securities, on CNBC TV18.

TOP 5 GAINERS

Symbol Curr.Price % Change

PUNJABTRAC 351.50 29.49

HINDUJA TM 844.10 13.51

PARSVNATH 529.10 9.15

EIH 235.00 8.70

BOMBAYDYEI 980.05 6.24

TOP 5 LOSERS

Symbol Curr.Price % Change

FDC 47.30 -4.54

D-LINKINDI 121.00 -4.12

APOLLO TYR 57.10 -4.11

RAMCOSYSTE 229.85 -3.85

IVR PRIME 434.75 -3.66

TOP 5 VOLUME STOCK

Symbol Curr.Price Volume

RPL 244.65 17780257

ISPATINDUS 77.10 14405399

ASHOKLEYLA 54.00 11110608

POWER GRID 150.90 6336527

SPICE TELE 63.65 5679160

TOP 5 VALUE STOCK

Symbol Curr.Price Value (‘000)

RPL 244.65 4349939.88

RIL 2,985.85 2725970.57

REL 2,510.35 2468663.13

PARSVNATH 529.10 1991645.10

RCOM 760.05 1568939.29

Top 5 Performers from high-risk, high-returns category

Company,Scheme,Class,Plan,Type,Returns (%)

Reliance Capital Asset Management Ltd.,+,Reliance Diversified Power Sector Fund,Equity – Sector Fund,Growth,Open Ended,127.13

Reliance Capital Asset Management Ltd.,+,Reliance Diversified Power Sector Fund,Equity – Sector Fund,Bonus,Open Ended,127.13

JM Financial Asset Management Pvt. Ltd.,+,JM Basic Fund,Equity – Sector Fund,Growth

Open Ended,115.83

Taurus Asset Management Co. Ltd.,+,Taurus Libra Taxshield,Equity – ELSS,Growth,Open Ended,114.56

Standard Chartered Asset Management Co. Pvt. Ltd.,+,Standard Chartered Premier,Equity Fund,Equity – Diversified,Growth,Open Ended,109.55

World Indices today

SENSEX 20686.89 341.69

NIFTY 6274.30 95.75

DJIA 13056.72 12.76

NASDAQ 2602.68 -6.95

RS/$ 39.45 0.02

Investment bloopers: How not to lose money in 2008

Investment bloopers: How not to lose money in 2008

You were pretty confident about the investments you made at the beginning of 2007. But when the year closed you made nothing much from them.

Be it stocks, mutual funds, real estate or insurance. All or many of your bets fell through.

You bought stocks but at a higher price. The price went up still higher but the uncle next door bought another stock and made stupendous returns on his investments. Or you bought a share on some tip passed on to you by your cousin’s uncle’s friend’s neighbour who got the same piece of information from a shady stock market operator. But the share price plummeted after you bought it.

Or are you the one who bought mutual funds just because your financial advisor promised you the moon? He told you about the past performance of a mutual fund scheme and you bought his logic that mutual fund unit prices move only one way: up, up, up.

Or maybe your insurance agent pushed one policy after another, of companies and various products like ULIPs, money back and endowment plans but forgot to mention the term insurance plan.

Here’s the story of our reader Ashish Nagpal, 27, a Delhi-based software consultant, who bought a ULIP policy instead of buying a term insurance as he later realised.

I got married in the summer of 2005. By January 2007 we were blessed with a baby girl and were also able to purchase a 2 bed room flat on the outskirts of Delhi. Since I had taken a loan and had dependants now I wanted to buy an insurance policy that would take care of my family in case of any unfortunate event.

I called up my insurance agent and asked him to come out with the best option that would take care of my requirement. He visited my house two days later and advised me to buy a unit linked insurance programme, ULIP. He told me how ULIPs will help me invest as well as take care of my insurance needs.

He explained all the benefits of investing in ULIPs — the option of not paying annual premiums after three years without any impact on my sum assured, my premiums getting invested into the share market and buying units for me etc. I gave in to his persistent pitch without thinking too much about the pros and cons of such a policy.

Though the stock market has gained stratospheric heights my units are still not fetching me enough returns. This is because the premiums in the first three years that you pay towards your ULIP policy goes towards a bevy of charges like administration costs, mortality charges and lot other things, my insurance agent said like a sage.

He told me that as time goes by these charges will decrease and more of ULIP premiums will go towards investments in the share market thereby increasing my returns. Also, the sum assured on my ULIP policy is Rs 25,00,000 for which I am paying an annual premium of Rs 30,000.

A friend of mine told me that a term insurance plan would have got me the same sum assured at a much lower annual premium. He told me that I could get a sum assured of Rs 25,00,000 by buying a term insurance at an annual premium of not more than Rs 10,000. He told me I could myself invest the remaining amount — Rs 15,000 I will save if I switched from the ULIP plan to term insurance — in diversified equity mutual funds and get better returns than ULIPs over a time horizon of 15 years.

When I hired a professional financial consultant he too agreed with my friend and has asked me to stop paying ULIP premiums after three years and buy a term insurance policy immediately.

Now that I have realised my investment/insurance blooper I bought a term insurance plan and feel much happy that I could insure myself at a fraction of a cost and invest the rest of my money into mutual funds.

Moral of the story:

~ Don’t take your insurance agent at face value; cross-check whatever s/he says with a couple of professionals before you make a decision.

~ Always seek professional help for making important financial/investment decisions in your life.

~ Study all the advice — even if it comes from your professional financial advisor — before you put your hard earned money.

~ Never make any investment be it in stocks, mutual funds, real estate or insurance unless you are pretty certain about what you are doing.

~ And once you board the ship expect the best and be prepared for the worst.

Money Matters – End of Day Review – Thursday, 3rd January 2008

Money Matters – End of Day Review – Thursday, 3rd January 2008

Global jitters shy away investors; Sensex loses 120 pts

3 Jan, 2008, 1805 hrs IST,Crystal Barretto, INDIATIMES NEWS NETWORK

MUMBAI: After soaring to all time highs, indices pared gains as weak global cues and sky rocketing oil prices got the better of investors.

Weak manufacturing data released late on Wednesday in the US further triggered fears of a recession. To add to that, crude oil zoomed to $100, mounting inflationary concerns and lessening the hopes of an interest rate cut by the US Federal Reserve.

Key indices across the globe slumped, and India was no exception. Mid-caps were fairly stable, but frontline shares bore the brunt, possibly on account of foreigners selling.

After setting a record high of 6230.15, the National Stock Exchange’s Nifty finally settled near the previous day’s close at 6178.55.

The Bombay Stock Exchange’s Sensex finished at 20,345.20, down 120.10 points or 0.59 per cent. The 30-share index charted a high of 20,519.70 and low of 20,293.87 intra day.

Major index gainers included NTPC (up 7.56%), Reliance Energy (6.42%), Hindustan Unilever (3.51%), ONGC (2.88%), Reliance Industries (1.44%) and DLF (0.24%).

Sensex losers comprised Grasim Industries (down 4.03%), ICICI Bank (3.03%), Wipro (3.03%), ITC (3.01%), TCS (2.95%) and Mahindra & Mahindra (2.83%).

“Weak international markets weighed down sentiment, and the hike in fuel prices only dampened the situation. But the outlook in the mid-cap space is still bullish. With global markets subdued, investors become wary of the large-cap space and don’t feel there’s much room for immediate upside. Also, with results season around the corner, investors are waiting for some cues before taking fresh positions,” said Viral Doshi, independent technical and derivatives strategist.

“Going by the discount in January Nifty futures, it appears traders are jittery at higher levels. One should refrain from going long in index futures till the 20,600 mark is breached on a closing basis in Sensex with substantial volumes. On the lower end, support comes at 20,250,” Doshi added.

Nifty January futures ended at 3-point discount to the spot, with 3.74 crore shares in open interest.

The BSE Mid-cap Index ended flat at 10,056.87 while the CNX Mid-cap Index was down 11 points at 9581.80.

Power shares posted smart gains. Torrent Power gained 20 per cent, NTPC climbed 7.56 per cent, Reliance Energy added 6.42 per cent and Tata Power was up 4.38 per cent.

Shares of cement companies took a beating with the Tamil Nadu government threatening to nationalise the units in the state if manufacturers fail to bring down prices to affordable levels. Grasim Industries, down 4.03 per cent per cent, was the biggest loser. Chettinad Cements followed with a fall of 2.2 per cent, Ambuja Cements slipped 1.82 per cent, ACC declined 1.64 per cent and Madras Cement was down 0.76 per cent.

TOP 5 GAINERS

Symbol, Curr.Price, % Change

GUJ INDS P, 173.90, 19.97

MOSER BAER, 337.85, 11.41

NTPC, 276.70, 7.56

HPCL, 399.45, 6.75

NEYVELILIG, 267.70, 6.67

TOP 5 LOSERS

Symbol, Curr.Price, % Change

INDO RAMA, 73.05, -5.56

SPICE TELE, 63.20, -5.46

FDC, 49.55, -4.99

MIRC ELTRN, 36.10, -4.87

CASTROLIND, 330.60, -4.75

TOP 5 VOLUME STOCK

Symbol, Curr.Price, Volume

RPL, 232.30, 13440701

ISPATINDUS, 76.90, 10951013

SPICE TELE, 63.20, 9226388

ASHOKLEYLA, 52.45, 7094260

POWER GRID, 151.70, 6830921

TOP 5 VALUE STOCK

Symbol, Curr.Price,Value (‘000)

REL, 2,517.40, 3953950.10

RPL, 232.30, 3136875.23

JAIPRAK AS, 473.35, 2030158.89

RIL, 2,902.90, 1782409.33

NTPC, 276.70, 1762653.97

3:34 PM – The market closes a bit quiet. Sensex closed at 20337, down 128 points (provisional) and Nifty at 6178, down 1 point (provisional) from the previous close. The CNX Midcaps Index and BSE Smallcaps Index both closed in the negative. But BSE Power Index closed up 3%. The market breadth was negative with advances at 522 against declines of 708 on the NSE.

4:13 PM – The market was volatile in late trade but closed a bit quiet. Sensex closed at 20345, down 120 points and Nifty closed at 6178, flat from the previous close. The CNX Midcaps Index and BSE Smallcaps Index both closed in the negative today. BSE Power Index closed up 3% and BSE PSU Index closed up 2.2%. The market breadth was negative with advances at 523 against declines of 709 on the NSE. Top Nifty gainers included NTPC, REL, Cairn India and Tata Power while losers included VSNL, TCS, SAIL and Unitech.

Top Performers from high-risk, high-returns category

Company ,Scheme ,Class ,Plan,Type

Reliance Diversified Power Sector Fund,Equity-Sector Fund,Growth,Open Ended,127.13

Reliance Diversified Power Sector Fund,Equity-Sector Fund,Bonus,Open Ended,127.13

JM Basic Fund,Equity-Sector Fund,Growth,Open Ended,115.83

Taurus Libra Taxshield,Equity-ELSS,Growth,Open Ended,114.56

Standard Chartered Premier Equity Fund,Equity-Diversified,Growth,Open Ended,109.55

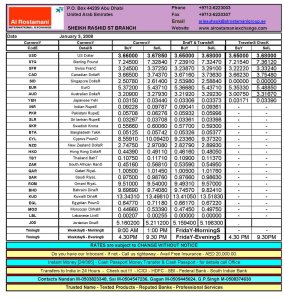

Daily Exchange Rates – Thursday, 03 January 2008

Brought to you by

Al Rostamani International Exchange

Abu Dhabi

Phone: +9712 6223003

http://www.alrostamaniexchange.com

You must be logged in to post a comment.