Information – Oil Gas Future Energy

Iraq flares up on Reliance deal with Kurdish govt

Iraq flares up on Reliance deal with Kurdish govt

16 Nov, 2007, 0056 hrs IST,Rajeev Jayaswal, TNN

RIYADH: Iraq has threatened to bar Reliance Industries (RIL) from oil deals for signing oil block contracts in the Kurdish region. RIL recently executed two production-sharing contracts (PSC) with the Kurdistan Regional Government (KRG), covering petroleum exploration activities in the Rovi and Sarta blocks in the Kurdistan region of Iraq.

Iraqi oil minister Hussein Al-Shahristani said on Thursday that Iraq’s federal government does not recognise the deal. “The contracts have no standing with the Iraqi government. The companies that have signed the contracts with the Kurdish region may compromise chances of getting future contracts in Iraq,” he replied on the sidelines of the third Opec summit when asked about the RIL oil deals.

The oil deals seem to have angered Baghdad, which opposes a unilateral crude oil block selloff in the absence of a national oil law. The federal government of Iraq had urged the regional government of Kurdistan against signing an oil deal till the new national oil law was passed in Iraq Parliament.

Reacting to the development, RIL said its agreement with the autonomous KRG conformed to law. “The two exploration blocks in northern Iraq in Kurdistan region, for which we have signed the agreement, are within the legal framework,” RIL said in a statement issued here.

“RIL has always maintained highest cordial relationship with the government of Iraq and all other stakeholders in the countries where we operate. We will continue to do so in future,” the statement said.

Al-Shahristani said any independent deal with KRG would face difficulty in exporting oil from the region as Iraq would not allow its oil to be exported. Kurdistan lies in the north of Iraq and does not have a port for export of oil. Companies producing oil in the region have to necessarily go to southern ports that come under the administrative control of the federal government of Iraq.

On November 8, RIL announced it had executed two contracts with KRG covering petroleum exploration activities in the Rovi and Sarta blocks. Under the terms of the contract, Reliance Exploration & Production DMCC, a wholly-owned subsidiary of RIL, would serve as the operator. The blocks measuring 450-500 sq km are highly prospective and have almost 80% oil-bearing structure.

According to sources, RIL is likely to make a discovery soon. The company had paid a signing amount of $15.5-17.5 million for the blocks. While announcing the deal, RIL president (international operations) Atul Chandra had said, “We are pleased to reach an agreement with the KRG on the two PSCs.

We hope and believe this will be an investment that will provide long-term benefits to all the stakeholders.” RIL has established a local office in Erbil and has undertaken extensive geological work over the past year in the Kurdistan region.

RIL bags deepwater oil and gas block in Oman

RIL bags deepwater oil and gas block in Oman

PTI

NEW DELHI: Mukesh Ambani-run Reliance Industries Ltd has won a deepwater oil and gas block in Oman, a company source said.

Reliance Exploration and Production DMCC, a wholly-owned subsidiary of RIL, has signed contract for Block 41.

The block lies adjacent to Block 18 in Gulf of Oman, which the Government of Sultanate of Oman awarded to RIL in 2005.

Block 18 is situated in the offshore Gulf of Oman between Block 41 and the border with the Fujuriah offshore block. The two blocks comprises approximately 21,000 sq km of area each.

Reliance last week executed two production sharing contracts covering petroleum exploration activities in the Rovi and Sarta blocks in the Kurdistan region of Iraq.

The company has been actively pursuing petroleum exploration activities in the Middle East, particularly in Oman and Yemen, besides India, Asia Pacific Region and South America.

Atul Chandra, President of International Operations, RIL, said agreements for the two blocks were signed by Kurdistan Regional Government. He, however, said the reported figures of signature bonus paid for the two blocks were not correct.

Are Indian oil companies ‘bidding on the riskiest properties’ overseas?

Are Indian oil companies ‘bidding on the riskiest properties’ overseas?

If the world increased its energy efficiency by 3 per cent a year to 2100, the entire world could live at a European standard of living and use just half the fossil fuels we do today.

Oil price hit $84 a barrel a few days ago, amidst fears that the Kurdish rebel problem would lead to the snapping of Iraq’s supplies. And closer home, despite an appreciating rupee, we have been oscillating between ominous expectations of petrol and diesel price increases, to political assurances of ‘no hike now’ with short shelf life, though.

“An interesting and scary thing about high oil prices is that we realise how incredibly interconnected global economies are, and how little we understand the consequences of these connections,” observes Ms Lisa Margonelli, the author of ‘Oil on the Brain’, in the course of an exclusive interaction with Business Line.

“Despite the deep interconnections, we live very differently: after all, Americans continue to use this enormous amount of fuel per capita and that is simply not available to other consumers,” she adds.

A graduate of Yale University, Ms Margonelli is a California-based Fellow at the New America Foundation ( http://www.newamerica.net), an institute that relies on ‘a venture capital approach’ to invest in ‘outstanding individuals and policy solutions that transcend the conventional political spectrum’. Ms Margonelli’s book is an engaging tale of her journey from the neighbourhood gas station to the oil well.

Excerpts from the e-mail interview:

The US plays an important role in the oil economics. But with the shift now towards Asia significantly, do you think the Chinese as well as the Indian people and their automobiles hold the next piece in the oil puzzle?

Oh yes. Right now the power of the American consumer is that they have big wallets and a huge appetite. But it’s the world’s growing middle class in China and India who will really spur new demand for oil. I’ve heard that only 12 per cent of the world drives cars now — the big question is what will the other 88 per cent drive? (I would imagine they’re likely to buy a Cheri or one of these $2,500 Tatas rather than a Cadillac.) What kind of fuel will they use? (We need cars that don’t pollute or we’ll all have hard time breathing.)

In the near term, new consumers are playing a big role in driving oil demand, and creating an atmosphere where oil investors assume prices will keep rising. But in the long term, it’s these new consumers who will drive the development of new fuels and new vehicles. We’re in a funny time where the money and the future are in different places.

You have talked in your book about how a simple phone call from a warlord in Africa can change the price of oil in a matter of hours. Leaving alone the power of mobile communication, do you think Africa is going to play an even more important role in oil politics now?

Africa is already playing a role in oil politics — Nigeria, Libya, Algeria, Angola, Sudan, and Chad. As the politics of getting oil in the Middle East and Russia has gotten tougher, Africa has been seen as a place where the politics are different, but money still speaks. However, recently, that’s changed. Angola has joined OPEC. Chad has taken a more nationalistic stance on its oil reserves. In Sudan, Chad, and Nigeria, Chinese companies are making a lot of deals —which is also changing oil politics.

What is your take on the acquisition by Indian oil companies of oil assets in other countries?

I understand that Indian companies are buying oil assets for strategic reasons — to compete with China and the West. But they’re clearly bidding on the riskiest properties politically and geologically. As the world’s largest democracy, India has a complicated and growing leadership role in global politics. I’m not sure Indian companies will ultimately be comfortable with the risks they’ve taken on.

The contentious Iran-Pakistan-India pipeline… Iran, Pakistan, and India have some economic and geo-strategic issues in common and the so-called Peace Pipeline could be a way to cement those commonalities and begin to work through the differences. But, um, what’s the hold-up? I’m being flip, but the process of working through those differences to get the pipeline built will be a big step for the region, going beyond the symbolism of the pipeline and the importance of the energy it carries.

The US and its government have often come under the hammer for oil policies, be it with regard to Venezuela, Iran or Iraq. But is not the government doing the right thing by ensuring oil wells are there for its people? After all, oil is a commodity that can make or break a government. Nobody knows it better than George Bush who is known for working for his family’s oil businesses before making the unsuccessful run for US House of Representatives in 1978.

Americans DO use a quarter of the world’s oil production, so we are very dependent on other countries. So we’re in a bind, because our power in the world partly derives from both oil dependence and our sense of mission derives partly from the myth of independence. That doesn’t mean we have a right to other countries’ oil wells. That is a really un-American idea, I think. You are right that American politicians live and die by gas prices. That’s one of the reasons the US doesn’t have a forward thinking energy policy — our politicians work in four-year cycles, but a good energy policy needs 10 or 20 years, which is too long for a political payoff. Anyway, at the moment George W. Bush is too busy being buffeted by other problems to worry much about gas prices.

With limited amounts of crude and consumption set to go higher as more people buy cars and fewer drilling it out of the ground, is oil really heading for $100 per barrel? How far is oil price driven by demand and supply economics, as compared to speculative forces? Are speculators in commodity futures raking in profits at the cost of the less privileged, as some allege?

I think oil will keep going higher until demand starts to fall off. Right now oil prices are like someone trying to figure out how deep a well is by using a stick. They keep making the stick longer to see if they can reach the bottom. Sooner or later people will stop buying, and then prices will fall.

Speculators — sure there are speculators. But until we find the bottom (or the top) for consumers, those speculators are just making good bets. There is no doubt that this is hurting the poor — in the world as well as in the US.

I really think that governments need to push energy efficiency — lots and lots of efficiency — to protect their economies, their poor, and the climate. Which brings me back to the Tata people’s car — what kind of fuel economy would it get? I think we should push for cars that get 100 km per gallon or more. In the 1980s I had a tiny Toyota that got about 90 km per gallon.

In your opinion, which fuel holds the most promise: hydrogen or electricity?

At the moment, barring a big jump in the technology to make and store hydrogen, I’m putting my money on electric cars. But electric cars can also be seen as precursors to hydrogen because the fuel cells act like a big battery.

I think it’s a staged process rather than either or. But I think that energy productivity needs to be a real priority, whichever fuel is used.

If the world increased its energy efficiency by three per cent a year to 2100, the entire world could live at a European standard of living and use just half the fossil fuels we do today.

That’s been called the “conservation bomb” and Art Rosenfeld and John Wilson wrote about it. If you take a programme like that, and then add renewable fuels to reduce the amount of fossil fuels we use, you’d be looking at a very different world — with a lot less smog. Of course, you’d still have a lot of traffic.

What’s your take on bio fuels? Are they a feasible option, something that could replace oil in the next century? Is there a risk that food may turn costlier owing to the diversion of harvest to the energy market?Bio fuels carry all kinds of risks — risks to farmers around the world, risks to food consumers, risks to investors since at the moment there’s no commercially feasible way to make cellulosic ethanol.

They also carry a lot of promise — but their success will be in their attention to details. I hope that we take in the lessons of the oil economy — that your economic future is only as secure as the environmental and social security of the people along your energy supply chain.

If bio fuels are going to work, they have to create prosperity all along that supply chain. They also have to be environmentally sustainable. People have to get a fair deal.

If people are starving in one place because of biofuel crops, then people in another place will attack those fuel crops and the whole market will pay for the impact. Politics may be local, but the effects are becoming global.

On your current research, and your next expedition…

I’m doing more research on the supply chains for alternative fuels and pursuing some stories about unexpected technology transfers. I’m also really interested in whether the fight against global climate change will bring new economic opportunities or not. Travel. Well, I’m trying to stay in one place for a little while.

D. MURALI

KUMAR SHANKAR ROY

for The Hindu Business Line

Opec set to raise output from Nov 1

Opec set to raise output from Nov 1

(Reuters) 25 October 2007 (Khaleej Times)

BEIJING — Opec Secretary-General Abdullah Al Badri yesterday said the group was implementing a decision taken in September to increase production by 500,000 barrels per day (bpd).

The Organisation of the Petroleum Exporting Countries agreed to increase oil output from November but the Petrologistics consultancy, which tracks tanker movements, said on Tuesday it was already raising oil supply this month in response to record high prices.

Asked on a visit to Beijing if Opec had already started increasing production by half a million bpd from October, Badri would only say: “We are implementing our decision we took in September, at the last conference, that are we going to increase production by 500,000bpd from November 1.”

Opec’s 10 members subject to output limits, all except Iraq and Angola, are set to pump 27.5 million bpd in October, up from a revised 27.2 million bpd in September, said Conrad Gerber of Petrologistics.

Overall output from the 12-member Opec is set to rise 500,000bpd to 31.4 million bpd as a result of higher shipments from Iraq and Angola, Petrologistics said.

The estimate indicates that Opec may be relaxing adherence to supply curbs, as oil prices hit a record of $90.07 a barrel on Friday, fuelling fears that higher energy bills could strangle global economic growth.

Crude prices fell below $85 yesterday on signs that Opec was already boosting production and on forecasts that US oil inventories likely rose again heading into the key winter demand season.

Opec formally agreed on September 11 to lift production from November 1.

No oil shortage: Javad Yarjani, head of Opec affairs at Iran’s Oil Ministry, told reporters there was no shortage of oil in the market and that prices were being driven up by fear rather than fundamentals.

“As far as future consumption, and stocks (is concerned)… there is definitely no shortage of crude oil. You may see in some places, some shortage of products, but that is again because of lack of refining, or sometimes glitches at refineries,” he said.

“But don’t forget, according to IEA rules, member countries are required to keep 90 days of imports but now that figure is well above 110 days. That shows there is no shortage of crude oil,” said Yarjani.

Opec implementing September decision

Opec implementing September decision

Reuters Published: October 24, 2007, 23:44 (GULF NEWS)

Beijing: Opec Secretary-General Abdullah Al Badri said the group was implementing a decision taken in September to increase production by 500,000 barrels per day (bpd).

Opec countries agreed to increase oil output from November but the Petrologistics consultancy, which tracks tanker movements, said on Tuesday it was already raising oil supply this month in response to record high prices.

Asked on a visit to Beijing if Opec had already started increasing production by half a million bpd from October, Badri would only say: “We are implementing our decision we took in September, at the last conference, that are we going to increase production by 500,000 bpd from November 1.”

Opec’s 10 members subject to output limits, all except Iraq and Angola, are set to pump 27.5 million bpd in October, up from a revised 27.2 million bpd in September, said Conrad Gerber of Petrologistics.

Output from Opec is set to rise 500,000 bpd to 31.4 million bpd as a result of higher shipments from Iraq and Angola, it said.

The estimate indicates that Opec may be relaxing adherence to supply curbs, as oil prices hit a record of $90.07 a barrel on Friday, fuelling fears that higher energy bills could strangle global economic growth.

Crude prices fell below $85 yesterday on signs that Opec was boosting production and on forecasts that US oil inventories likely rose again heading into the key winter demand season.

Javad Yarjani, head of Opec affairs at Iran’s Oil Ministry, said there was no shortage of oil in the market and that prices were being driven up by fear rather than fundamentals. “As far as future consumption, and stocks [is concerned]… there is definitely no shortage of crude oil. You may see in some places, some shortage, but that is again because of lack of refining, or sometimes glitches at refineries,” he said.

OPINION

Output should rise by a further 500,000 bpd

Opec should raise oil output by a further 500,000 barrels per day to ensure sufficient supply in the fourth quarter when seasonal demand rises, an Opec delegate said yesterday.

The comments contrast with recent remarks from Opec officials that world oil markets have enough crude oil and that a surge in prices to record highs reflects factors beyond the group’s control.

“My personal view is I think we need to increase another 500,000 bpd in November,” said the source, one of the more senior delegates in Opec.

Leaders of Opec member countries gather on November 11-18 in Riyadh for their third heads of state summit. Opec oil ministers are expected to meet during the event.

Mittal-ONGC oil & gas JV runs out of steam

Mittal-ONGC oil & gas JV runs out of steam

Agencies Posted online: Friday , October 12, 2007 at 1434 hrs IST

New Delhi, October 12: Steel czar Lakshmi N Mittal’s joint venture with state-run ONGC for oil and gas trading has all but folded-up, with the India born billionaire absorbing the remaining two employees including the CEO into his group.

S K Sharma, the CEO of ONGC-Mittal Energy Services Ltd, along with the only other employee at OMESL, is joining the Mittal Investment Sarl, the Luxembourg-registered holding company of Mittal family, industry sources said.

OMESL, one of the two joint venture company Mittal had formed with ONGC in July 2005, is also shutting its Delhi office. “The company will only exist in paper,” a source said.

Mittal had never been happy with the progress at OMESL.

Apparently, ONGC, after the exit of flamboyant Chairman and Managing Director Subir Raha, was not keen on trading and shipping of oil and gas (including LNG).

The state-run firm had not even contributed its share of capital and the company survived all this while only on Mittal’s contribution.

In June last year, a government director on the board of ONGC blocked the exploration firm’s equity participation in OMESL as the ministry did not want the state-run firm to make huge financial outlays for non-core trading business.

Frustrated at the delays, Mittal first wrote to the Petroleum Ministry about the delays in shaping up of OMESL and later signed a preliminary pact with Total of France for cooperation in oil and gas business including trading.

Mittal Investment on its own has already taken 49 per cent stake in HPCL’s Bhatinda refinery and Russian oil firm Lukoil’s 50 per cent stake in Caspian Investments Resources for 980 million dollars.

Abu Dhabi’s Sour Gas Project to Use Sulfur Pipeline (Update1)

Abu Dhabi’s Sour Gas Project to Use Sulfur Pipeline (Update1)

By Ayesha Daya for Bloomberg

Oct. 10 (Bloomberg) — Abu Dhabi National Oil Co. is proceeding with a $10 billion project to develop high-sulfur gas reserves in the United Arab Emirates, choosing a pipeline to carry away sulfur even before selecting an international partner.

International companies Exxon Mobil Corp., Royal Dutch Shell Plc, ConocoPhillips and Occidental Petroleum Corp. are vying to join Adnoc in the project and become the first foreign company to gain access to the country’s gas reserves, among the world’s largest.

“Abu Dhabi holds the fifth-largest gas reserves in the world, but it is importing gas to meet its domestic energy needs,” said Dalton Garis, an energy analyst at the U.A.E.-based Petroleum Institute. “Abu Dhabi wants to double its population by 2010 as well as build gas-intensive industries such as aluminum smelters, so it needs to increase its supply of natural gas.”

Adnoc, meantime, has decided that sulfur produced as a byproduct with the gas will be transported by pipeline from the field to a processing facility 120 kilometers (75 miles) away. The state-run company debated using trucks or a purpose-built railroad to carry the sulfur, before deciding to use a pipeline, said an Adnoc official who declined to be identified by name.

Abu Dhabi, home to more than 90 percent of the U.A.E.’s oil and gas reserves, is under pressure to develop its “sour,” or high-sulfur, gas reserves to meet the growing energy requirements of its burgeoning economy.

“There is potentially in excess of 30 trillion cubic feet of undeveloped sour gas reservoirs in the initial two onshore fields scheduled for development,” said Stuart Lewis, a Middle East analyst at oil and gas consultancy IHS Energy. “Reserves of this magnitude would be difficult for any company to overlook, particularly in an economy as vibrant as that of the U.A.E.”

Molten Sulfur

The state-run company will use heated water to maintain high temperatures inside the sulfur pipeline, to prevent the material from solidifying and getting stuck, the ADNOC official said. Sulfur must be kept at a temperature of above 115 degrees Celsius (239 degrees Fahrenheit) to remain in liquid form.

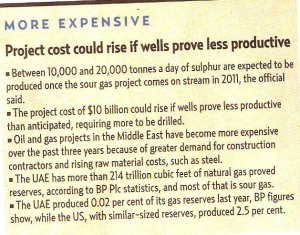

Between 10,000 and 20,000 tons a day of sulfur is expected to be produced once the sour gas project comes on stream in 2011, the official said. It will use gas from the Shah field while another field, Bab, will be developed in a second phase because it is more complex and has a higher sulfur content.

The project cost of $10 billion could rise if wells prove less productive than anticipated, requiring more to be drilled. Oil and gas projects in the Middle East have become more expensive over the past three years because of greater demand for construction contractors and rising raw material costs, such as steel.

`National Imperative’

The primary motivation for developing U.A.E. gas reserves is political, rather than financial, said Lewis. “Although technically challenging, the development of non-associated gas might be regarded as a national imperative in terms of energy security.”

Adnoc already extracts some sour gas, producing about 6,000 tons of sulfur a day at a gas processing facility at Habshan, which is then loaded into 150 trucks daily and carried 120 kilometers to a sulfur-handling terminal at Ruwais.

The U.A.E. has more than 214 trillion cubic feet of natural gas proved reserves, according to BP Plc statistics, and most of that is sour gas. The country extracts only a tiny fraction of its reserves each year partly because of the technical challenge and dangers associated with producing highly sulfuric gas.

The U.A.E. produced 0.02 percent of its gas reserves last year, BP figures show, while the U.S., with similar-sized reserves, produced 2.5 percent.

This year, the U.A.E. began importing gas from Qatar through the Dolphin pipeline to supply its power and water plants. Dolphin Energy Ltd. is a joint venture between the Abu Dhabi government, Total SA and Occidental.

To contact the reporter on this story: Ayesha Daya in Dubai adaya1@bloomberg.net

Last Updated: October 10, 2007 10:58 EDT

Facing skills shortage

Facing skills shortage

By Andrew England, Financial Times Published: October 08, 2007, 23:16

Rising drilling and riggings costs, combined with shortages of skilled personnel and equipment, are affecting hydrocarbon projects throughout the Middle East, with some being delayed and other contracts being renegotiated. Producers in the region, from Libya to Saudi Arabia, have embarked on ambitious plans to increase production and capacity to meet growing global demand and take advantage of record oil prices.

But many will struggle to meet their schedules, experts say, and can expect to pay exorbitant prices if they are to ensure they have the material and personnel in a market suffering severe constraints.

“It’s having an impact and that impact is going to increase over the next few years. We are seeing projects being delayed simply because they can’t get the equipment delivered on the timescale they used to,” says Candida Scott, an analyst at Cambridge Energy Research Associates (Cera).

Experts say a critical bottleneck is the shortage of skilled staff, with an industry workforce dominated by people close to retirement and inexperienced graduates.

The issues affect producers worldwide, with the Middle East and Libya accounting for 20 per cent of world projects adding productive capacity between 2007 and 2011, according to Cera.

Significantly, it is also the region requiring the most manpower for design and project management over the same period, with 35 per cent of the world’s projected total, the institute says.

One of the most high-profile examples of a project affected is in Algeria where Sonatrach, the state oil company, cancelled the contract of Repsol YPF and Gas Natural to develop the 5tcf (trillion cubic feet) Gassi Touil project citing development delays and cost overruns. When the consortium won the contract in 2004 the deal’s economics were “marginal”, according to Wood Mackenzie analysis.

Since then, rising upstream costs and the increasing cost of setting up liquefaction plants raised the project’s overall costs by 127 per cent from $3 billion to $6.8 billion, according to the energy consultants.

“A lot of people have suggested Sonatrach’s decision to cancel the project was nationalism, but we would disagree with that; the fact is it was based on simple economics,” says Craig McMahon, at Wood Mackenzie.

At best, the project will start producing in mid-2012, at least two and half years later than expected, he adds.

In Abu Dhabi, which produces around 95 per cent of the UAE’s hydrocarbons, the completion of some larger projects is being put back by between nine and 12 months, an industry source said.

Development of the onshore Bab field has also been delayed mainly because of the scarcity of specialised equipment needed for the sour gas project. The lead time for some equipment is 18 months to two years, experts say.

Officials had put the development of the Bab and Shah fields out to a joint tender, hoping the two would eventually produce 3bcf (billion cubic feet) per day. However, given the technical challenges of the sour gas fields and market difficulties the authorities later elected to re-tender just for Shah, which is less complex and has higher liquid yields, analysts say.

Abu Dhabi is also taking a more “stringent” approach in terms of its commercial deals than others, such as Saudi Arabia, the industry source says. “My understanding is they are taking a more liberal view of the market, they will pay top dollar to secure resources, while here we are more prudent and not willing to be bullied by the market,” the source says. Saudi Arabia maintains the world’s largest crude oil production capacity, estimated to be 10.5 million to 11 million barrels per day.

In 2006 Aramco, the state oil company, announced an $18 billion plan to increase capacity to 12.5 million barrels per day by 2009 and 15 million barrels per day by 2020, according to the US’s Energy Information Administration. Experts say the kingdom seems on track, but will pay high prices.

“The Saudis have been fairly adept at ordering equipment and rigs; their project management skills are fairly honed – getting access to the equipment they need. But in doing that they are paying much more than they would have five years,” says David Fyfe, at the International Energy Agency. There are about 270 rigs operating in the Middle East, compared to 158 in September 2000, according to Baker Hughes, the oil services company, with Saudi Arabia estimated to be employing around 130.

Four or five years ago, the kingdom would have been using 30 or 40, says Gene Shiels at Baker Hughes. But even as costs rise, Saudi Arabia has the advantage of scale, says Colin Lothian, a Gulf specialist at Wood Mackenzie.

“While the projects in Saudi Arabia are highly capital intensive, when you look at the unit cost of bringing that production on stream it’s low in global terms, just because of the size and scale of these assets,” he says. For smaller producers it means having to compete with large producers who can offer longer contracts and pay top rates.

The issues can be exacerbated by difficult operating environments. In Libya, for example, there are clear attractions for international oil companies given the nation’s unexplored status and its proximity to Europe. But one expert says there has already been a decline in oil majors’ interest in the North African state. “If there were no shortage globally the Libyan programme would be challenging simply because of the time taken to get permission to get the necessary people and equipment into Libya, which raises costs significantly [and] slows everything down,” the expert says.

“And everybody who has got kit and people has got lots of other places they can deploy, so why on earth should I go through all the time and trouble.”

Politics hurts Kuwait’s progress to 2020 output goal

Politics hurts Kuwait’s progress to 2020 output goal

Reuters Published: October 05, 2007, 00:21

Kuwait City: A political standoff in Kuwait has delayed progress on projects to boost oil output and left the world’s seventh-largest oil exporter struggling to meet its 2020 output target of 4 million barrels per day (bpd).

The Opec member’s oil production capacity now stands at around 2.8 million bpd and is unlikely to be much more by the end of the next decade, analysts said.

“We are very pessimistic about their chances of hitting the 4 million bpd target – largely because political issues that have long dogged projects are going to continue to be major factors,” said David Kirsch, manager of market intelligence at Washington-based consultancy PFC Energy.

Kirsch expects Kuwait’s capacity to be just shy of 3 million bpd by 2017.

A key obstacle to expansion plans is winning approval from parliament for international oil companies to take a role in an $8.5 billion scheme to boost output from the country’s northern oilfields, known as Project Kuwait.

Despite having debated the plan for more than a decade, Project Kuwait has never gone beyond the committee stage to the floor of the house as some parliamentarians oppose the involvement of foreign companies.

Even with Project Kuwait, the 2020 target looks out of reach, said Colin Lothian, senior analyst for the Middle East at global consultancy Wood Mackenzie.

“They’d struggle even if the project went ahead,” he said. “To get to 4 million bpd from where they are now is an awfully big jump.”

Political standoff

Kuwait’s parliament has a history of challenging the government.

One of the latest victims of the political standoff between parliament and the government was Oil Minister Shaikh Ali Al Jarrah al-Sabah, who resigned in June and has yet to be replaced. He held the position for less than a year.

Lack of continuity in the post was impeding expansion plans, an official at a state oil firm said. “We need stability at the top of the oil sector,” the official said. “Nothing moves forward, a new minister always has to go back to the start. And the government fears any confrontation with parliament.”

Acting Oil Minister Mohammad Al Olaim, who is also in charge of the water and electricity ministry, has made few public comments about Kuwait’s oil policy.

During the summer, Olaim was kept busy averting blackouts as Kuwait’s power system ran close to maximum capacity.

Kuwaiti newspapers have reported that Finance Minister Badr Al Humadhi is most likely to become the new oil minister. No decision is expected until after Ramadan.

More trouble may lie ahead in parliament for a new minister as some deputies have submitted a motion to tie oil production to the country’s reserves in a bid to force the government to disclose reserves on a regular basis.

Doubts about the size of Kuwait’s proven oil reserves have persisted since industry newsletter Petro-leum Intelligence Weekly reported last year that it had seen internal records showing reserves were about 48 billion barrels, about half what was officially stated.

Olaim said in July the reserves stood at 100 billion barrels but did not say if these were proven or unproven reserves.

Both Kirsch and Lothian believe reserves are closer to the level that PIW reported.

Lower reserves would reduce how long Kuwait could sustain future output boosts.

Lothian forecast Kuwait’s output capacity at 2.8 million bpd in 2016, and to decline thereafter.

Pumping more of the country’s heavy oil was also key to boosting capacity, but for that, as for Project Kuwait, it would need the experience and technology of international oil firms, said Karmel Al Harmi, an independent Kuwaiti oil analyst.

Kuwait has said it wants to boost heavy oil output to 700,000 bpd by 2020.

Tehran to shut Bandar Abbas crude units

Tehran to shut Bandar Abbas crude units

Reuters Published: October 05, 2007, 00:21

Tehran: Iran will shut a crude unit at its Bandar Abbas refinery in January and a second in May to boost capacity by 40 per cent, part of its multi-billion dollar move to cut dependence on gasoline imports, a National Iranian Oil Co source said yesterday.

The source said the shutdowns at the 110,000 barrels per day (bpd) units, set to last for about 30 days each, would allow the state-run firm to boost the refinery’s capacity to 320,000 bpd.

“In January we will shut down one CDU to raise the capacity to 160,000 barrels per day, this one will last about a month and the refinery will be in full operation after,” the source said.

A second crude unit, of similar size, will be shut in May for the same operation, the source added.

You must be logged in to post a comment.